The IBH stock market model is out of the market. The MAC stock market model is invested, the bond market model avoids high beta (long) bonds, the yield curve is steepening, the gold model is not invested, but the silver model is invested. The recession indicator COMP is higher from last week’s level, and iM-BCIg is lower from last week’s level. MAC-AU is invested.

Blog Archives

Best(SPY-SH) 12-16-13

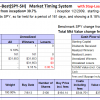

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 161 days, and showing 9.18% return to 12/16/2013

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 161 days, and showing 9.18% return to 12/16/2013

Read more >

iM Update 12-13-13

The IBH stock market model is out of the market. The MAC stock market model is invested, the bond market model avoids high beta (long) bonds, the yield curve is steepening, the gold model is not invested, but the silver model is invested. The recession indicator COMP is lower from last week’s level, and iM-BCIg is higher from last week’s level. MAC-AU is invested.

Best(SPY-SH) 12-9-13

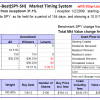

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 154 days, and showing 10.51% return to 12/9/2013

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 154 days, and showing 10.51% return to 12/9/2013

Read more >

Best10 12-2-13

Currently the portfolio holds 10 stocks, 6 of them winners, so far held for an average period of 28 days, and showing combined 3.60% average return to 12/2/2013

Currently the portfolio holds 10 stocks, 6 of them winners, so far held for an average period of 28 days, and showing combined 3.60% average return to 12/2/2013

Read more >

iM Update 12-6-13

The IBH stock market model is out of the market. The MAC stock market model is invested, the bond market model avoids high beta (long) bonds, the yield curve is steepening, the gold model is not invested, but the silver model is invested. The recession indicator COMP is higher from last week’s level, and iM-BCIg also higher from last weeks revised level. MAC-AU is invested.

Read more >

Best(SPY-SH) 12-2-13

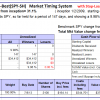

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 147 days, and showing 9.98% return to 12/2/2013

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 147 days, and showing 9.98% return to 12/2/2013

Read more >

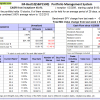

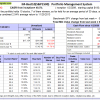

iM-Best9(Russell 1000) – Large-Cap Portfolio Management System

This model invests in highly liquid large-cap stocks selected from those making up the Russell 1000 Index which represents the large-cap segment of the U.S. equity universe. When adverse stock market conditions exist the model reduces the size of the stock holdings by 50% and buys the -1x leveraged ProShares Short S&P500 ETF (SH). It produced a simulated survivorship bias free average annual return of about 53% from Jan-2000 to end of Nov-2013.

Best10 11-25-13

Currently the portfolio holds 10 stocks, 7 of them winners, so far held for an average period of 30 days, and showing combined 2.54% average return to 11/25/2013

Currently the portfolio holds 10 stocks, 7 of them winners, so far held for an average period of 30 days, and showing combined 2.54% average return to 11/25/2013

Read more >