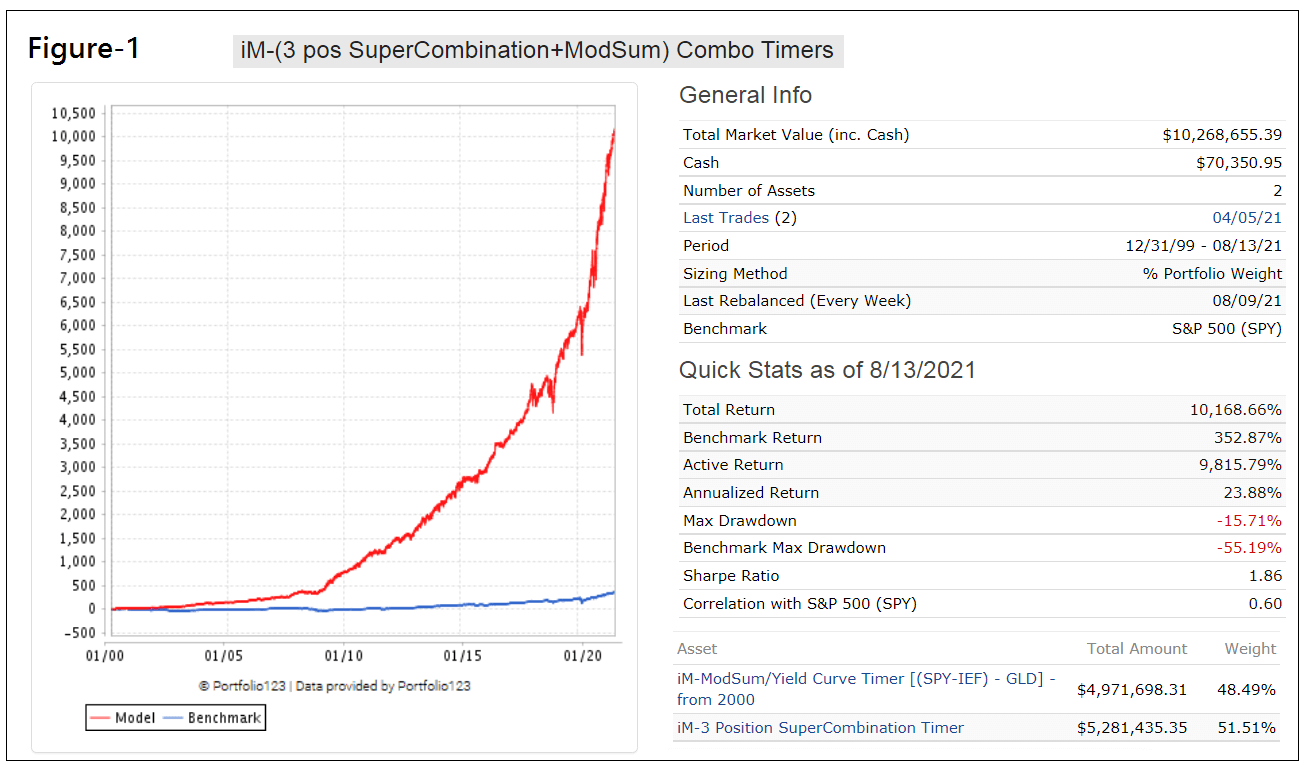

- This strategy combines the iM-3 Position SuperCombination Timer and the iM-ModSum/YieldCurve [(SPY-IEF) – GLD] Timer models equally weighted.

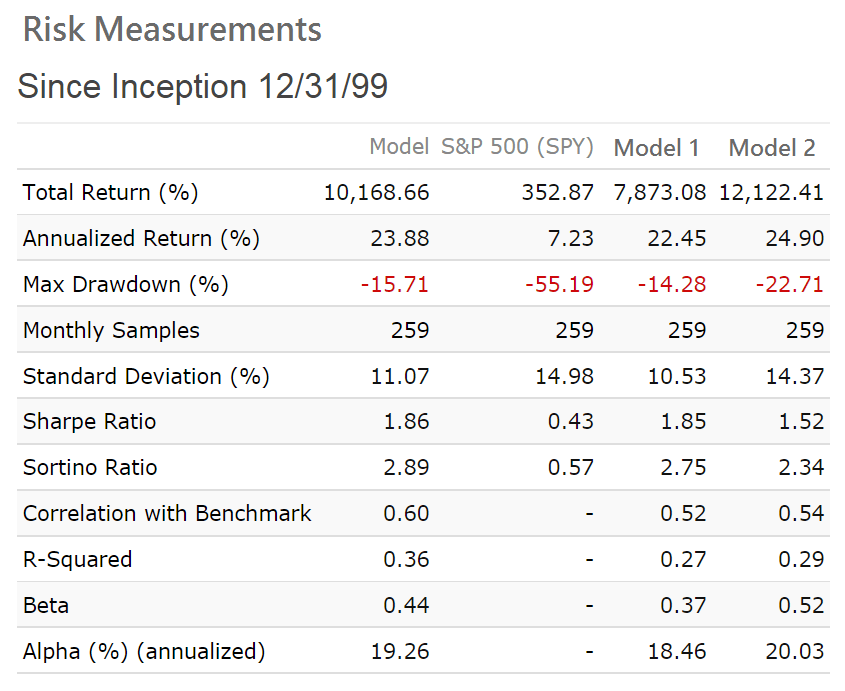

- A 2000-2021 backtest shows that this combination strategy would have outperformed the SPDR S&P 500 ETF Trust (SPY), showing an annualized return of 23.9% versus 7.2% and with a maximum drawdown of 15.7% versus 55.2% for SPY, respectively.

- The backtest also shows that this combination would have since 2000 produced only positive calendar year returns and would also have outperformed SPY over each calendar year.

The Component Models

- Model 1: iM-ModSum/YieldCurve [(SPY-IEF) – GLD] Timer.

- Model 2: iM-3 Position SuperCombination Timer

Performance from 2000 to 2021

The analysis was performed on the online portfolio simulation platform Portfolio 123 which provides historic financial data for stocks, bonds and ETFs.

Figure-1 shows the simulated performance from 1/2/2000 to 8/13/2021 for a strategy which holds 50% of each model. The annualized return would have been 23.9% with a maximum drawdown of -15.7%. For SPY the corresponding figures are 7.2% and -55%.

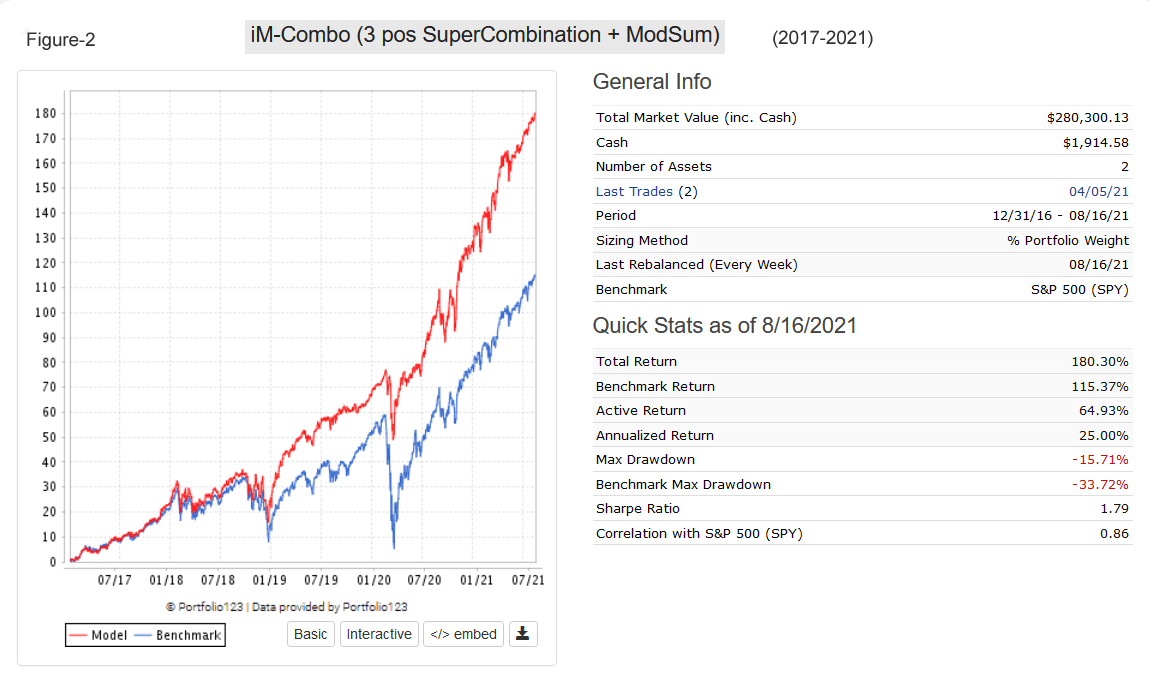

See Appendix for performance from 2017, and we note the maximum model drawdown was in March 2020 during the COVID-19 recession.

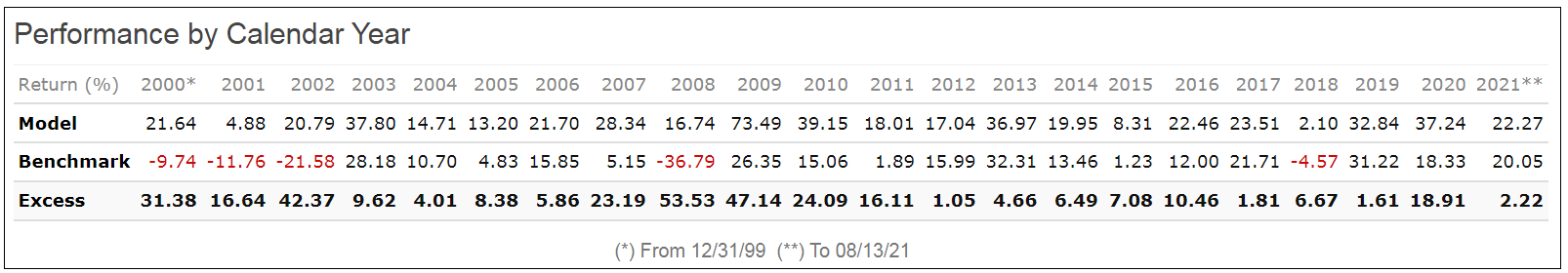

Investment Risk

The risk statistics from 2000 to 2021 for the model and its two component models relative to the benchmark S&P 500 (SPY) are shown below.

NOTE: Portfolio123 uses the industry standard (calendar monthly returns) for these statistics.

Conclusion

This model can be followed at imarketsignals.com where the performance is updated weekly. The current holdings as of 8/17/2021 are:

| Current holdings |

3 Pos Super Combination | ModSum | ||

| SSO | QQQ | XLU | IEF | |

| Weights | 16.67% | 16.67% | 16.67% | 50% |

Disclaimer:

Results shown are hypothetical and the result of backtesting over the period 2000 to 2021. No claim is made about future performance.

Hi Georg,

good work and great model, as usual.

How would the model perform without IEF ?

I just started trial. I would be interested in the 3 POS Super combo + Mod Sum.

Can it work for me with the $40 per month subscription? Aslo, do you have a phone number so I can talk with someone about this. Much more efficient. There is a lot to this. I little overwhelming.

Where is the performance for 3-pos + Mod Sum ?

I like this model. Can you show the results if using leverage (SPY/SSO) in Mod Sum? Overall stats as well as yearly results. Thank you.