- Portfolios of the 12 top ranked stocks of the iShares MSCI USA Minimum Volatility ETF provided much higher 1-year returns than the ETF.

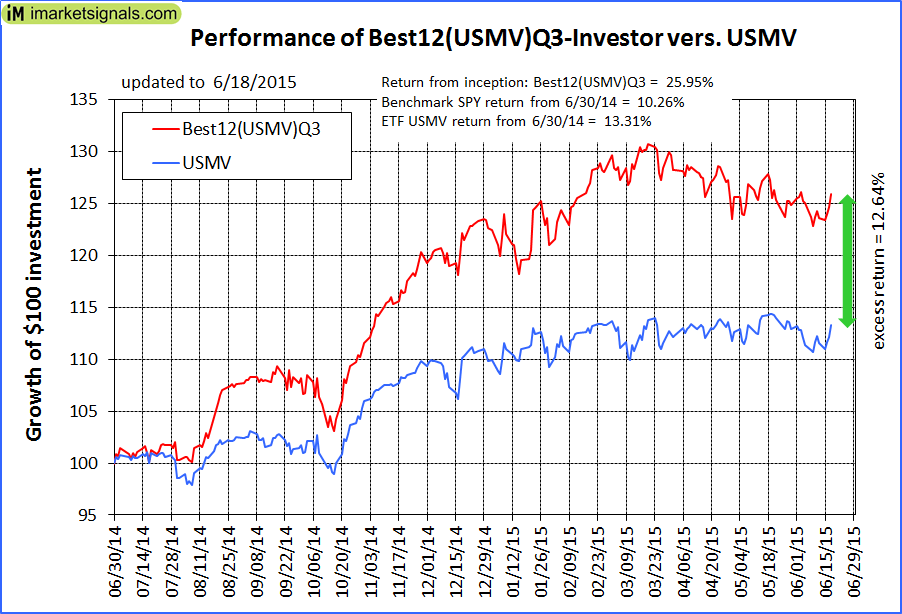

- For the period 6/30/14 to 6/18/15, our Best12(USMV)Q3-Investor, a 1-year buy&hold portfolio, returned 26.0%,

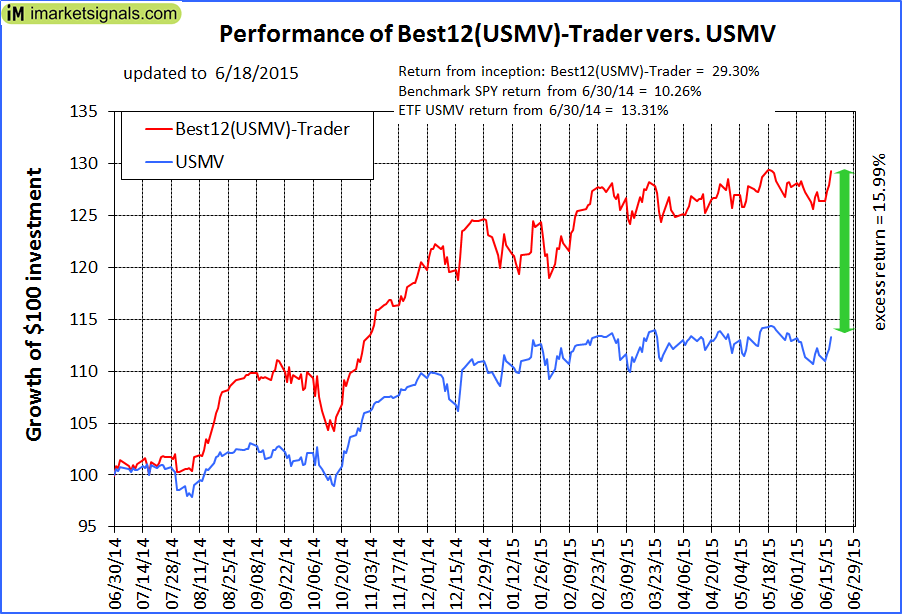

- The Best12(USMV)-Trader, re-balanced every 2 weeks, returned 29.3%,

- iShares MSCI USA Minimum Volatility ETF USMV returned 13.3% for the same period.

Minimum volatility stocks should provide exposure to the stock market with potentially less risk, seeking to benefit from what is known as the low-volatility anomaly. Consequently, they should show reduced losses during declining markets, but should also show lower gains during rising markets. However, our backtests show that better returns than the broader market can be obtained under all market conditions by selecting 12 of the highest ranked stocks of a universe made up from minimum volatility stocks of the iShares MSCI USA Minimum Volatility ETF USMV.

To test these findings we launched the Best12(USMV)Q3-Investor and Best12(USMV)Trader on Jun-30-2014 and provided weekly reports of holdings and performance for the two portfolios on our website. The performances for almost one year are depicted in the figures below.

One notes that performance of the Investor model relative to USMV diminished from end of March 2015, whereas the Trader’s performance was marginally better than USMV over this period. This could be due to the Investor still holding 10 of the original stocks from inception onwards (353 days), while the Trader’s stock holdings were periodically renewed. The Investor model will be rebalanced for the first time at the end of the first week of July 2015 and should have the majority of its current holdings replaced by higher ranked stocks.

Disclaimer: Although the performance of the two models have been considerably better than that of USMV, one should not commit capital in the expectation that strategies that worked well for one year are therefore also bound to do well in the future.

It seems that many of the imarketsignals stock selections strategies are limited to the USMV universe of stocks. No problem with that but have you considered offering strategies using the MSCI USA Momentum universe of stocks (ETF: MTUM)? If min vol stocks generally fall into the value category then it would be good to have some strategies that have momentum so a portfolio of your stock selection strategies would not be limited to a value bet. Min Vol and Momentum seem to be the two anomalies that can deliver righer risk adjusted returns.

Steve W

Steve, thank you for the suggestion. This is another ETF we can use. Inception of this ETF was Apr-16-2013.

CAGR from inception for MTUM = 17.3%

Neglecting survivorship bias when using the current holdings of MTUM as our universe from which the highest ranked stocks are selected, then

CAGR from inception for Best10(MTUM)-Trader= 54.0%

max drawdown= -9.1%

Sharpe ratio= 4.03.

However this fund has an annual turnover of 123%, which is high. Therefore, current holdings would almost certainly not been the holdings at inception.

I guess we could add this model to our ETF Traders.

Hi Georg,

I’m curious if you’ve continued to track this Best10(MTUM)-Trader model over the past year since this comment was posted? Are the CAGR, max drawdown and Sharpe ratio stats still impressive after the corrections in August and February? How does it compare to the Best12(USMV)-Trader model in returns?

Thanks!

To me the critical question is not when the ETF started to trade but when MSCI started to publish the underlying index. The important thing to consider is if many of your min vol strategies are heavily tilted toward value stocks and whether it would be good to have a strategy that is tilted toward growth. The opportunity is to be able to develop a strategy that takes advantage of market anomalies in the value universe (min vol) and the growth universe (momentum).

Steve