Market Signals Summary:

The Hi-Lo Index of the S&P 500, the MAC US, the iM-Google Trend Timer as well as the S&P 500 Coppock Indicator are disinvested from the markets. The bond market model begins to favor high beta (long) bonds. The Forward Rate Ratio between the 2 and 10 year rates inverted beginning August thus signalling a recession. Also the growth of the Conference Board’s Leading Economic Indicator is sinalling a recession. The Gold Coppock is invested in gold, so is the iM-Gold Timer. The Silver Coppock model is dis-invested in silver.

Stock-markets:

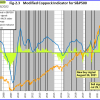

The MAC-US model exited the US stock markets end April 2022.

The MAC-US model exited the US stock markets end April 2022.

The 3-mo Hi-Lo Index Index of the S&P500 is at -7.06% (last week -9.39%), and has exited the stock markets.

The 3-mo Hi-Lo Index Index of the S&P500 is at -7.06% (last week -9.39%), and has exited the stock markets.

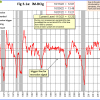

The Coppock indicator for the S&P500 generated a sell signal end July 2022 and is dis-invested in stocks. This indicator is described here.

The Coppock indicator for the S&P500 generated a sell signal end July 2022 and is dis-invested in stocks. This indicator is described here.

The MAC-AU model generated a buy signal end August 2022, and is invested the Australian stock market.

The MAC-AU model generated a buy signal end August 2022, and is invested the Australian stock market.

This model and its application is described in MAC-Australia: A Moving Average Crossover System for Superannuation Asset Allocations.

Recession:

BCIg does not signal a recession.

BCIg does not signal a recession.

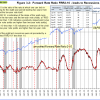

The growth of the Conference Board’s Leading Economic Indicator after the August 18 update signals a recession.

The growth of the Conference Board’s Leading Economic Indicator after the August 18 update signals a recession.

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) inverted begining August 2022 and is signalling a recession — the average lead time of this signal is 14 months.

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) inverted begining August 2022 and is signalling a recession — the average lead time of this signal is 14 months.

A description of this indicator can be found here.

The iM-Low Frequency Timer switched into stocks on 6/15/2020.

The iM-Low Frequency Timer switched into stocks on 6/15/2020.

A description of this indicator can be found here.