- An interest rate environment in which long-term debt instruments have a lower yield than short-term debt instruments of the same credit quality is considered to be a predictor of recessions.

- Prior to recession it is advisable to exit the stock market and invest in U.S. Treasuries instead; in this strategy using as proxies ETFs (SPY) and (IEF), respectively.

- This model uses the 2-year and 10-year U.S. Treasury yields as measures of short-term and long-term rates, respectively, and calculates the Forward Rate Ratio (FRR2-10) between the two rates.

- FRR2-10 is the ratio of the rate at which one can lock in borrowing for the eight year period starting two years from now and the current ten-year rate itself.

- Currently the FRR2-10 is near 1.0 signifying that US economic activity is near the end of the expansion phase of this business cycle.

In this previous article it was demonstrated that an almost risk-free investment is to buy 2-year Treasury bonds when the FRR2-10 is close to 1.0 and to sell when the Federal Funds Rate (FRR) is at its lowest after recessions. A reader critiqued the article and asked “[B]ut how do we know that we reached a low FFR for the exit until after the fact? For example 12/30/2008. Wasn’t it possible the rate could have gone lower?”

In response to that critique, we show that it is possible to design a mathematical model using a smoothed FRR2-10 to signal investment in IEF and a moving average of the FFR for sell signals.

Buy Rule

- The FRR2-10 is calculated using as input smoothed 2-year and 10-year U.S. Treasury yield rates. When the FRR2-10 is less or equal to 1.02 the model buys IEF, otherwise SPY.

Sell Rule

- The model sells IEF when the 10-day moving average of FFR divided by the 50-day moving average of FFR is greater than 1.05, otherwise SPY, provided a position has been held for a minimum of 90 days.

Performance Backtest from Jan-2000

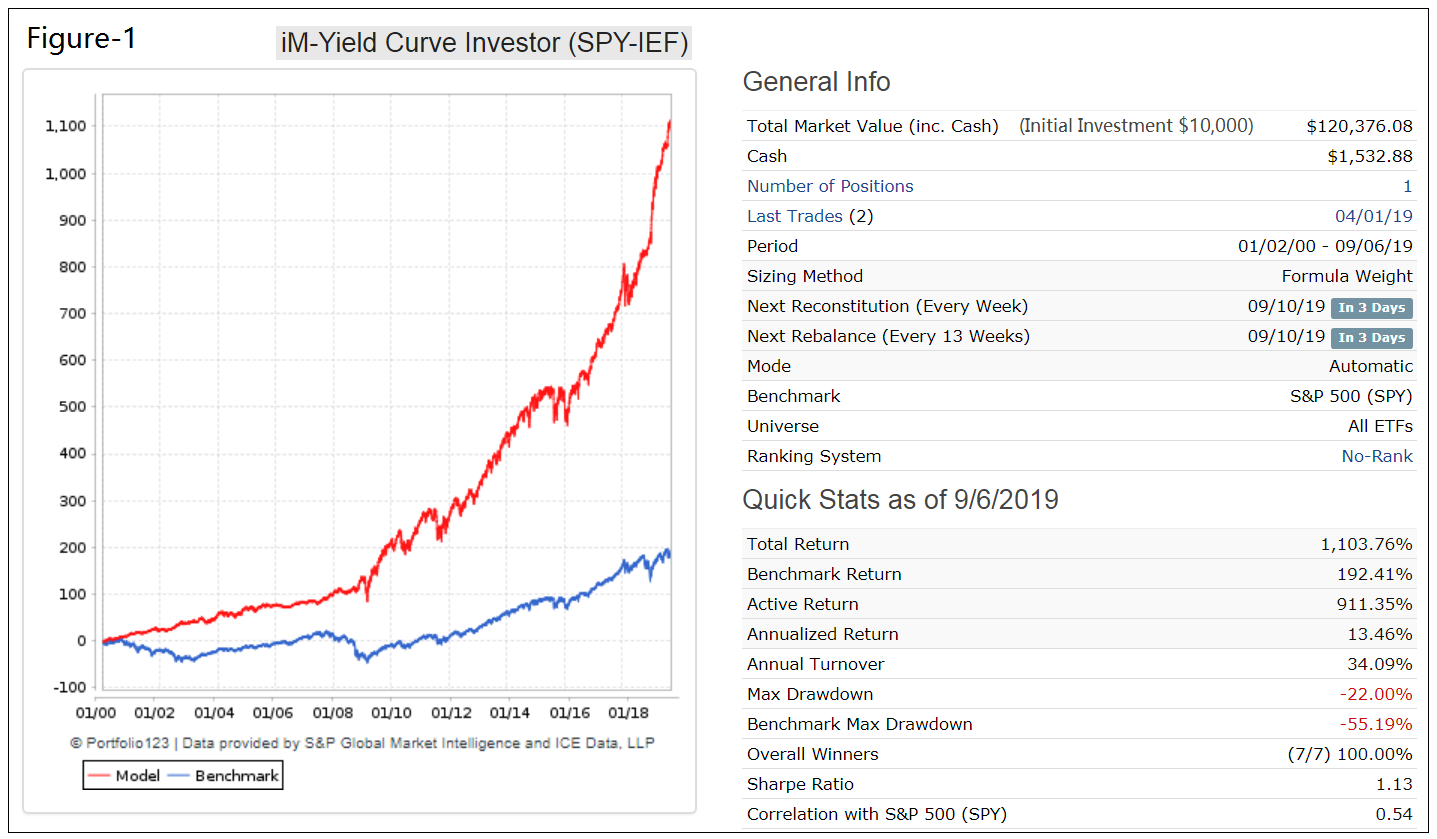

A backtest from Jan-2000 to Sep-2019 was performed on the online simulation platform Portfolio 123 with transaction costs and slippage taken into account and compared with the returns of a buy-and-hold investment in SPY.

Performance over almost 20 years is shown in Figure-1. For the model the Total Return and Annualized Return would have been 1100% and 13.5%, respectively, with a Maximum Drawdown of -22%.

Over the same period the benchmark (SPY) had a Total Return and Annualized Return of 192% and 5.6%, respectively, with a Maximum Drawdown of -55%.

Since Jan-2000 there were only six realized trades, and the current holding since 4/1/2019 is IEF, all of them winners.

Conclusion

From the analysis it appears that fairly satisfactory returns can be had by investing in 10-yr Treasury bond funds as indicated by the FRR2-10, and switching back to equity according to signals from the Federal Funds Rate.

The model can be followed live at imarketsignals.com.

Appendix

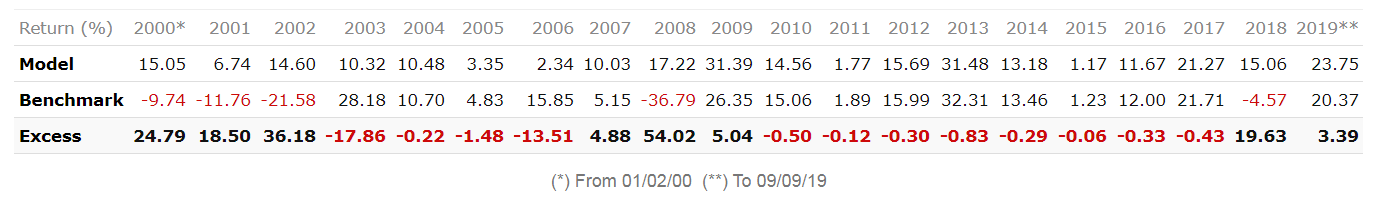

Calendar Year Performance

The model would have had only positive calendar year returns, and significantly underperformed the benchmark in 2003 and 2006. (The indicated underperformance in the years 2004 to 2005, and 2010 to 2017, is a result in differences how dividends are reinvested in the benchmark and the model.)

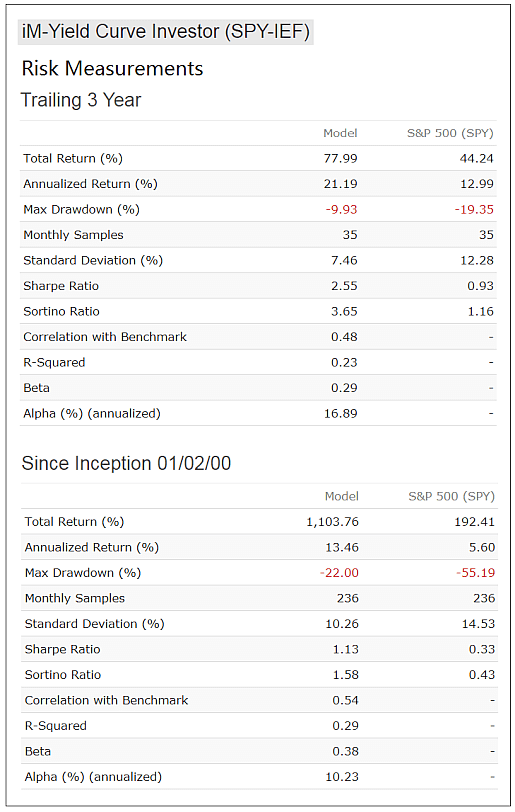

Risk Measurements

Realized Trades

| Ticker | Open | Close | Days | Pct Gain |

| IEF | 1/3/2000 | 8/18/2003 | 1323 | 32.90% |

| SPY | 8/18/2003 | 9/12/2005 | 756 | 24.20% |

| IEF | 9/12/2005 | 1/26/2009 | 1232 | 12.10% |

| SPY | 1/26/2009 | 9/24/2018 | 3528 | 199.40% |

| IEF | 9/24/2018 | 12/31/2018 | 98 | 3.10% |

| SPY | 12/31/2018 | 4/1/2019 | 91 | 14.60% |

| IEF | 4/1/2019 | Holding | 5.20% (as of 9/13/2019) |

Georg,

Can you explain the exit calc at 1/26/2009? My understanding was that the FFR was flat for 8 years at its lowest (0.25%) after financial crisis, so how could the 10 day avg / 50 day avg be anything but flat for most of that period? Am I looking at the right rate (or missing something else obvious)?

Thanks much.

Tom C

And one more follow-up: is this the effective Fed Funds rate, or the target Fed Funds Rate like you use in the iM Best2 MC-Score System’s Aggregate Spread calculation?

Any thoughts on the comments above?

Thanks

Tom C

hi, when will this be available as a weekly signal? thanks

also, looks like a good candidate to be a component of the super timer