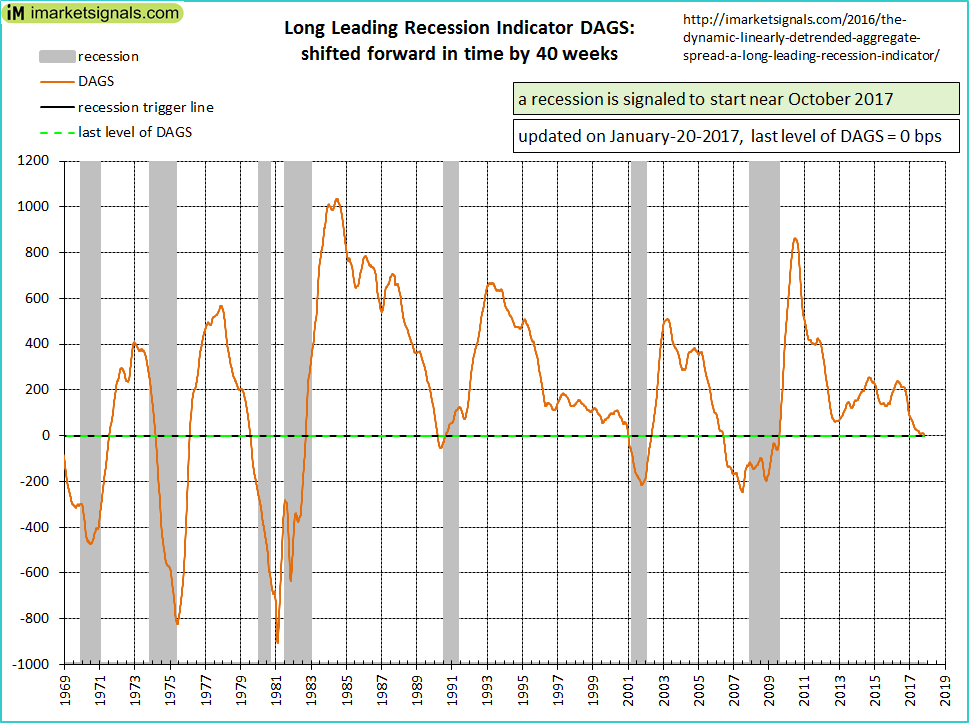

On January 20, 2017, our long leading recession indicator DAGS (Dynamic Linearly Detrended Aggregate Spread) signaled an oncoming recession.

Based on past history a recession could start at the earliest in 6 months (July-2017), but not later than 28 months from now (May-2019). The average lead time to previous recessions provided by DAGS would have been 15 months.

Being such a long leading indicator, the lag between the signals (when the DAGS moves from above to zero and lower) and the subsequent recession start is highly variable. It is now time to shift our attention to the other indicators which have historically had much shorter lead periods, such as our COMP, BCI, and Unemployment Rate models.

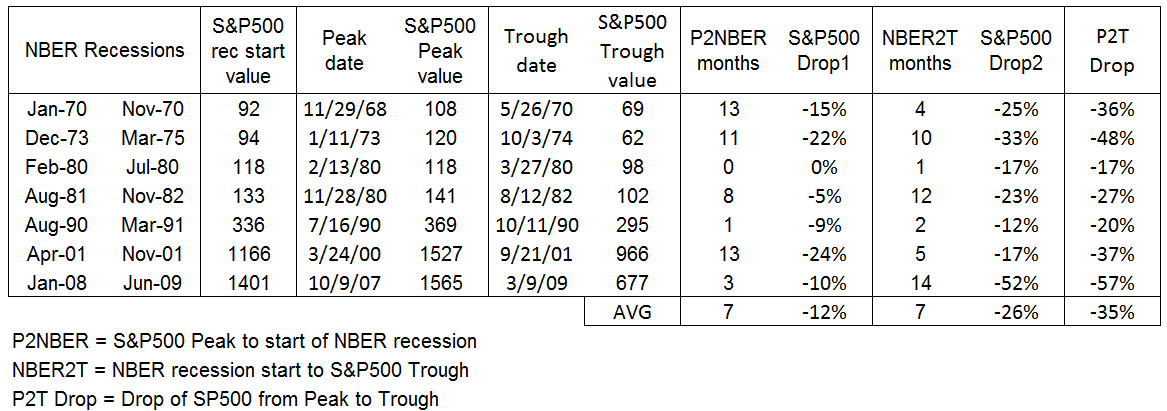

It is also counter-productive to exit the stock market long before a recession starts; the optimum exit time appears to be on average about 7 months before recessions. This is shown in the P2NBER column of the tale below which also shows that the average loss from the S&P500 peak prior to recessions to recession start is only about 12% (Drop1).

However, it is not advisable to remain in stocks once a recession begins; the average loss of the S&P500 from recession starts to the S&P500 recession trough is about 26% (Drop2).

According to Franz Lischka we are probably in the last intra-cycle uptick of this expansion. Considering the way the economy is now accelerating the cycle would call for a recession around 2019. This timing is also much more likely given the stage of the Fed’s interest rate cycle. US recessions have only occurred once the yield curve inverted. Given the likely path of Fed rate hikes, this is unlikely to happen before late 2018.

is there a way to get regular updates on the DAGS?

The DAGS is updated monthly on our logged in homepage: https://imarketsignals.com/#monthly

missed it! thanks

As opposed to ‘rule of thumb’ sector rotation, it would be interesting to see an analysis of which sub sectors of the economy do better after the DAGs goes through zero.

Hi Geov,

isn’t that indicator now below 0 and therefore in “Recession Warning” territory?

Thanks.

Thank you for the new indicator, LLI. Why was DAGS discontinued?