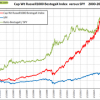

- The iM-BestogaX Index of the Russell1000 holds the so called “Vice” stocks (excluding Gaming stocks), plus the stocks from the GICS-sub-industries: Restaurants, Soft Drinks, and Internet Retail.

- The number of stocks in this index varied from a minimum of 23 to a maximum of 32 since Jan-2000.

- This capitalization weighted index outperformed SPY by about 4.5-times from Jan-2000 to Mar-2016.

- Over down-market periods the iM-BestogaX Index lost on average 87% less than SPY, and over up-market periods gained on average 24% more than SPY.

- An equal weighted investment in all available BestogaX stocks of the Index from the beginning of Jan-2000 to the middle Mar-2016 would have produced an annualized return of 17.2%.

- Trading systems which periodically select a small number of highest ranked stocks from the Index produced simulated annualized return as high as 34.4% with maximum drawdowns of about -20%.

In five separate articles (listed below) we describe the universe and its index, two trading models, and a combination of them to make a robust and low turnover system, the iM-BetogaX5-System, which will be updated weekly (Gold membership required).

The BestogaX Universe of the Russell1000 consists of the so called “Vice” stocks (excluding Gaming stocks), plus the stocks from the GICS-sub-industries: Restaurants, Soft Drinks, and Internet Retail.

The BestogaX Universe of the Russell1000 consists of the so called “Vice” stocks (excluding Gaming stocks), plus the stocks from the GICS-sub-industries: Restaurants, Soft Drinks, and Internet Retail.

Many of the BestogaX companies have affordable products, familiar name brands, and worldwide distribution networks, providing them with reliable revenue growth also during adverse economic climates.

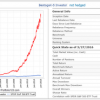

The iM-BestogaX5-Investor model periodically selects only five of the highest ranked stocks from the Russell1000 BestogaX universe, and holds them for at least one year.

The iM-BestogaX5-Investor model periodically selects only five of the highest ranked stocks from the Russell1000 BestogaX universe, and holds them for at least one year.

There is no market timing in the buy- and sell rules. The model is rebalanced weekly, resulting in small weight adjustments, and dividends are re-invested when available.

The iM-BestogaX5-Investor, with partial hedging, shows a simulated annualized return of 29.06% from January 2000 to March 2016, and maximum drawdown would have been -17% in 2003.

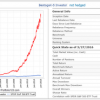

The iM-BestogaX5-Trader model periodically selects only five of the highest ranked stocks from the Russell1000 BestogaX universe, and holds them for at least three months.

The iM-BestogaX5-Trader model periodically selects only five of the highest ranked stocks from the Russell1000 BestogaX universe, and holds them for at least three months.

There is no market timing in the buy- and sell rules. The model is rebalanced weekly, resulting in small weight adjustments, and dividends are re-invested when available.

The iM-BestogaX5-Trader, with partial hedging, shows a simulated annualized return of 38.8% from January 2000 to March 2016, and maximum drawdown would have been about -22% in 2000 and 2009.

The iM-BestogaX5-System is a combination of the partially hedged (short SSO) BestogaX-5 Investor and Trader models, each of which periodically select five of the highest ranked stocks from the Russell1000 BestogaX universe.

The iM-BestogaX5-System is a combination of the partially hedged (short SSO) BestogaX-5 Investor and Trader models, each of which periodically select five of the highest ranked stocks from the Russell1000 BestogaX universe.

This combination model shows a simulated annualized return of 34.4% from January 2000 to March 2016, and maximum drawdowns would have been -18% in the year 2000.

The iM-BestogaX5-System(SDS) is a combination of the partially hedged (long SDS) BestogaX-5 Investor and Trader models, each of which periodically select five of the highest ranked stocks from the Russell1000 BestogaX universe.

The iM-BestogaX5-System(SDS) is a combination of the partially hedged (long SDS) BestogaX-5 Investor and Trader models, each of which periodically select five of the highest ranked stocks from the Russell1000 BestogaX universe.

This combination model shows a simulated annualized return of 32.4% from January 2000 to April 2016, and maximum drawdowns would have been -16.9% in the year 2000.

Georg,

Your iM-BestogaX5-System looks very interesting.

Can you please explain how you came up with the collection of stocks for the BestogaX universe of the Russell 1000? Is this cherry-picking?

Thank you,

Paul

The reason why investing in the BestogaX stocks should also be profitable in the future, is that these companies exhibit many desirable characteristics which are not likely to change any time soon:

1. Reliable and consistent revenue growth.

2. Steady and predictable operating margins.

3. Steady EPS growth (higher than the S&P500 EPS growth).

4. Good debt management and low borrowing costs.

5. Large financial resources to weather litigation.

6. Recognizable name brands.

7. Pricing power and growing markets, leading to growing, sustainable profits.

8. Established, worldwide distribution networks.

9. Operating also in emerging markets with large and growing populations.

10. Affordable products, desired (needed) by many.

Thanks Georg, this model looks like a robust addition to the collection.

I have two quick questions for you:

1) Why was WYNN (or other gambling stocks) excluded from this model, but not BESTOGA3?

2) How strong is the correlation between the BestogaX5-System and the BESTOGA3 model?

Thanks!

1)Bestoga3 uses the Vice stocks from the S&P500. There was only one gaming stock in the S&P500, whereas the Russell1000 holds three. The gaming stocks showed large drawdowns during the financial crisis and do not fit the profile of the Bestoga-type stocks. (see my previous comment on desired characteristics.)

2)About 65%.

Georg,

Great work identifying this list of 32 Vice stocks and the related BESTOGAX systems.

Can you go into more detail on why these 32 make your cut? i see your list above of 10 characteristics. is this your version of Piotroski F-Score?

great theory and screening here, love these systems, great job.

There are currently only 32 stocks in the Russell 1000 which make the cut. They are not all “Vice” stocks. Casinos & Gaming is not included.

BF.B — Brown-Forman Corp

CCE — Coca-Cola European Partners Plc

DPS — Dr Pepper Snapple Group Inc

KO — Coca-Cola Co (The)

MNST — Monster Beverage Corp

PEP — PepsiCo Inc

STZ — Constellation Brands Inc

TAP — Molson Coors Brewing Co

ARMK — Aramark

CBRL — Cracker Barrel Old Country Store Inc

CMG — Chipotle Mexican Grill Inc

DNKN — Dunkin’ Brands Group Inc

DPZ — Domino’s Pizza Inc

DRI — Darden Restaurants Inc.

JACK — Jack in the Box Inc.

MCD — McDonald’s Corp

PNRA — Panera Bread Co

SBUX — Starbucks Corp

TXRH — Texas Roadhouse Inc

WEN — Wendy’s Co

YUM — YUM! Brands Inc.

AMZN — Amazon.com Inc

EXPE — Expedia Inc

LVNTA — Liberty Ventures

NFLX — Netflix Inc

PCLN — Priceline Group Inc (The)

QVCA — Liberty Interactive Corp QVC Group

TRIP — TripAdvisor Inc

W — Wayfair Inc

MO — Altria Group Inc

PM — Philip Morris International Inc

RAI — Reynolds American Inc