- In 2008/9 the US Government bailed out the financial and automotive sectors.

- The energy sector is in a recession — the energy industry has filed negative earnings for four consecutive quarters.

- Negative earnings and Debt-to-EBITDA (earnings before interest, taxes, depreciation and amortization) ratio at historic highs, and no respite in sight.

- In 2015 the US produced 75% of its energy needs at home.

- The US government should not let this strategic industry fail and arrange a bailout program.

- According to our analysis the energy ETFs (XLE, VDE, XOP, etc) and energy stocks remain strong sells.

The post great-recession recovery was partly driven by the US oil industry. Technological developments enabled the US to advance to the world largest oil producer. It is not a secret that the traditional oil producer, who was dethroned from the number one position, wants to see the US oil industry fail. We think this could occur fairly soon .

Negative earnings for the past four quarters – that is a recession!

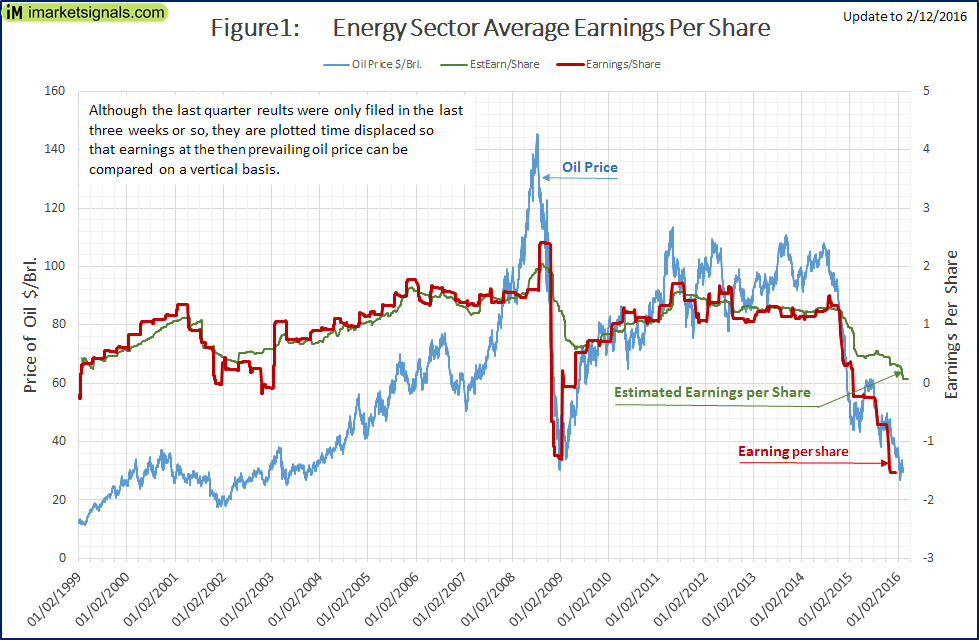

Figure-1 plots the average reported earnings per share for the last quarter alongside the crude oil price.

Prior to the great recession the worst reports were for Q4-1998, Q4-2001 and Q4-2002 when near zero earnings were reported. At the height of the great recession negative earnings bottomed at minus $1.35 per share in Q4-2008, however this was preceded by a quarter of record earnings of $2.40 per share.

During up-stock-market-periods the earnings per share exceed $1 per share, but since the decline of the oil price have dropped to negative $1.45, and earnings have been in negative territory now for 12 months. The oil industry is in a deep recession.

Swimming in Debts.

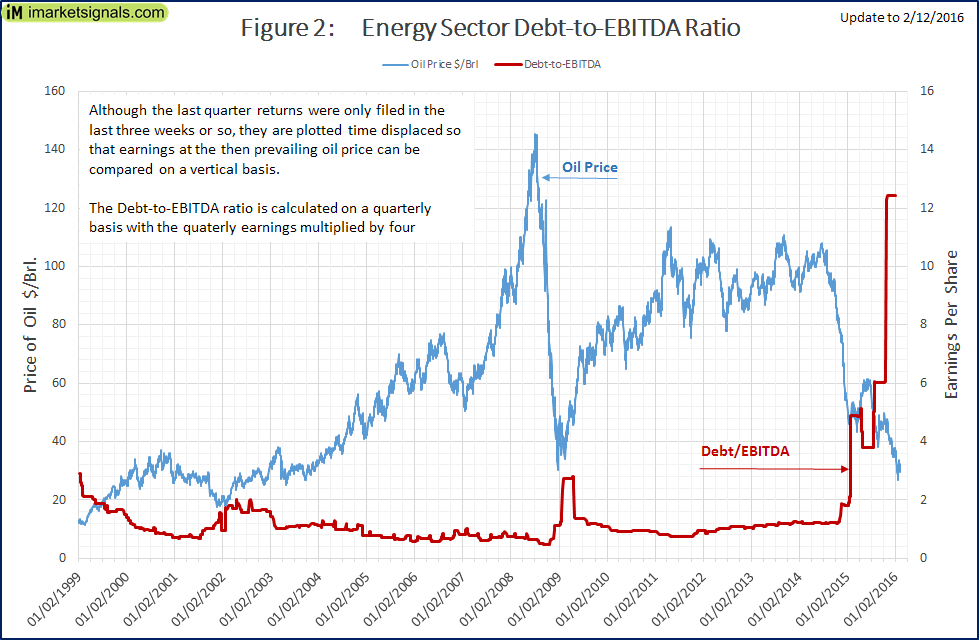

Increased borrowings financed the efforts to leverage oil production and returns. The total debt of companies representing the S&P500 energy sector doubled in the last 6 years from $205.9B to $402.8 (compared to a 1.46 increase of debt by the other industries excluding finance.) These loans are the sword of Damocles hanging over the US oil companies.

The Debt-to-EBITDA ratio relates the debts of a company to its cash flow by ignoring non-cash expenses. Entities in a normal financial state show Debt-to-EBITDA ratio less than 3, indeed the average Debt-to-EBITDA ratio of the S&P 500 companies (excluding oil and financials) is 2.3. Ratios higher than 4 usually set off alarms because they indicate that a company is likely to face difficulties in handling its debt burden.

Figure 2 charts the average Debt-to-EBITDA ratio, clearly showing an unprecedented rise in the debt/EBITDA ratio, reaching levels only seen in the financial sector and never seen in any of the other eight main CIGS sectors in the evaluation period 1999 to 2016. The current Debt-to-EBITDA ratio based on quarterly result exceeds 12, and the average for the 2015 financial year being 6.2.

Is there any respite?

Currently the analysts estimate earnings for Q2 and Q3-2016 are at $0.08 and $0.16 respectively. Also in Fig-1 the estimate earnings per share, as forecast by industry analysts, is plotted and can be compared to the actual earnings for that quarter. This clearly suggests that the estimates currently are very optimistic. This would suggest that the oil industry will not recover in the next two quarters and will continue posting negative earnings.

Also, Fig-1 suggest a breakeven oil price of $60; thus an oil price of $80 and above is required before the US energy sector has any relieve from the crisis it is in.

Bailout?

It is time for the politicians to step in and save the strategic US energy industry; they did it for the automotive industry why not for the oil industry?

“Too big to fail” is the same as “Too many to fail.“

Appendix

Average earnings per share is calculated, using the quarterly returns, as the (sum of earnings in the industry sector) divided by (the sum of shares in the industry sector).

Similar, the average Debt-to-EBITDA ratio is calculated, using quarterly returns, as the (sum of total debt in the industry sector) divided by (four times the sum of earnings before interest, taxes, depreciation and amortization for the quarter)

Very interesting. Not being an energy insider, but would like to understand if there are lingering issues with long term refinancing options when so much debt has been incurred and yet worldwide oil reserves are increasing. Would growth give into lowering the debt to EBITDA ratio through consolidation, increasing effective production measures, etc?

Clearly a grim picture for the oil industry. But lets not compound our policy mistakes by taking handing taxpayer money to yet another private industry. Let the free markets (what’s left of them) take care of this.