|

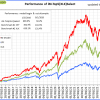

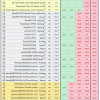

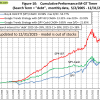

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

iM-Inflation Attuned Multi-Model Market Timer: The model’s out of sample performance YTD is 1.8%, and for the last 12 months is 20.2%. Over the same period the benchmark SPY performance was 0.7% and 16.9% respectively. Over the previous week the market value of the iM-Inflation Attuned Multi-Model Market Timer gained 1.16% at a time when SPY gained 0.58%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $155,929,347 which includes $294,502 cash and excludes $3,953,990 spent on fees and slippage. |

|

|

iM-Conference Board LEIg Timer: The model’s performance YTD is 14.3%, and for the last 12 months is 7.3%. Over the same period the benchmark SPY performance was 20.1% and 9.4% respectively. Over the previous week the market value of the iM-Conference Board LEIg Timer gained 0.91% at a time when SPY gained 0.58%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $706,532 which includes $25,403 cash and excludes $763 spent on fees and slippage. |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 2.1%, and for the last 12 months is 4.8%. Over the same period the benchmark E60B40 performance was 1.0% and 12.8% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.58% at a time when SPY gained 0.30%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $183,170 which includes -$11 cash and excludes $5,611 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 2.2%, and for the last 12 months is 4.4%. Over the same period the benchmark E60B40 performance was 1.0% and 12.8% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 0.63% at a time when SPY gained 0.30%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $190,875 which includes -$90 cash and excludes $5,884 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 2.2%, and for the last 12 months is 4.1%. Over the same period the benchmark E60B40 performance was 1.0% and 12.8% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.68% at a time when SPY gained 0.30%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $198,500 which includes -$155 cash and excludes $6,148 spent on fees and slippage. |

|

|

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 839.13% while the benchmark SPY gained 297.24% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 5.29% at a time when SPY gained 0.58%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $228,920 which includes $16,192 cash and excludes $3,182 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 643.18% while the benchmark SPY gained 297.24% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 3.89% at a time when SPY gained 0.58%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $185,796 which includes $149 cash and excludes $1,951 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 1587.37% while the benchmark SPY gained 297.24% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 1.82% at a time when SPY gained 0.58%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $1,687,367 which includes -$6,698 cash and excludes $25,728 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 295.22% while the benchmark SPY gained 297.24% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 1.99% at a time when SPY gained 0.58%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $395,222 which includes -$3,785 cash and excludes $17,524 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 496.51% while the benchmark SPY gained 297.24% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 0.70% at a time when SPY gained 0.58%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $596,513 which includes $1,540 cash and excludes $8,921 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 698.87% while the benchmark SPY gained 297.24% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 1.83% at a time when SPY gained 0.58%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $798,872 which includes $4,213 cash and excludes $3,071 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 276.14% while the benchmark SPY gained 297.24% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -1.67% at a time when SPY gained 0.58%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $376,139 which includes $2,580 cash and excludes $3,099 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 423.18% while the benchmark SPY gained 297.24% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 2.13% at a time when SPY gained 0.58%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $523,179 which includes $1,800 cash and excludes $19,968 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 245.89% while the benchmark SPY gained 297.24% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 0.19% at a time when SPY gained 0.58%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $345,892 which includes -$920 cash and excludes $18,372 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 384.56% while the benchmark SPY gained 297.24% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -1.04% at a time when SPY gained 0.58%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $484,562 which includes -$196 cash and excludes $7,844 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 129.72% while the benchmark SPY gained 106.21% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 0.96% at a time when SPY gained 0.58%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $229,715 which includes $0 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 9.5%, and for the last 12 months is 17.1%. Over the same period the benchmark SPY performance was 0.7% and 16.9% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 1.40% at a time when SPY gained 0.58%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $583,043 which includes $1,475 cash and excludes $14,626 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 42.2%, and for the last 12 months is 396.5%. Over the same period the benchmark SPY performance was 0.7% and 16.9% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 5.89% at a time when SPY gained 0.58%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $9,359 which includes $188,159 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 1.9%, and for the last 12 months is 17.7%. Over the same period the benchmark SPY performance was 0.7% and 16.9% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.58% at a time when SPY gained 0.58%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $390,391 which includes $4,646 cash and excludes $2,335 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 0.6%, and for the last 12 months is -4.9%. Over the same period the benchmark SPY performance was 0.7% and 16.9% respectively.. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $69,399 which includes $761 cash and excludes $2,818 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 0.8%, and for the last 12 months is -7.1%. Over the same period the benchmark SPY performance was 0.7% and 16.9% respectively. Over the previous week the market value of iM-Combo3.R1 gained 0.03% at a time when SPY gained 0.58%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $196,926 which includes $8,163 cash and excludes $8,524 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -7.8%, and for the last 12 months is -5.9%. Over the same period the benchmark SPY performance was 0.7% and 16.9% respectively. Since inception, on 7/1/2014, the model gained 243.34% while the benchmark SPY gained 326.42% and VDIGX gained 50.63% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 2.25% at a time when SPY gained 0.58%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $343,340 which includes $845 cash and excludes $5,695 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 20.3%, and for the last 12 months is 14.9%. Over the same period the benchmark SPY performance was 0.7% and 16.9% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 2.97% at a time when SPY gained 0.58%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $309,016 which includes $900 cash and excludes $4,455 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 6.5%, and for the last 12 months is 25.4%. Over the same period the benchmark SPY performance was 0.7% and 16.9% respectively. Since inception, on 6/30/2014, the model gained 354.89% while the benchmark SPY gained 326.42% and the ETF USMV gained 224.68% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 2.38% at a time when SPY gained 0.58%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $454,886 which includes $885 cash and excludes $8,774 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 0.4%, and for the last 12 months is 18.5%. Over the same period the benchmark SPY performance was 0.7% and 16.9% respectively. Since inception, on 1/3/2013, the model gained 1095.29% while the benchmark SPY gained 488.63% and the ETF USMV gained 488.63% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -0.02% at a time when SPY gained 0.58%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $1,195,287 which includes -$565 cash and excludes $15,356 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 1.3%, and for the last 12 months is 4.2%. Over the same period the benchmark BND performance was 1.4% and 5.7% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -0.32% at a time when BND gained -0.14%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $150,969 which includes $1,119 cash and excludes $2,916 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 1.9%, and for the last 12 months is 17.7%. Over the same period the benchmark SPY performance was 0.7% and 16.9% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.58% at a time when SPY gained 0.58%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $390,391 which includes $4,646 cash and excludes $2,335 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 8.9%, and for the last 12 months is 9.5%. Over the same period the benchmark SPY performance was 0.7% and 16.9% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 0.83% at a time when SPY gained 0.58%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $204,952 which includes $52 cash and excludes $5,775 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 8.3%, and for the last 12 months is 10.4%. Over the same period the benchmark SPY performance was 0.7% and 16.9% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.49% at a time when SPY gained 0.58%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $198,147 which includes $4,311 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 1.9%, and for the last 12 months is 1.1%. Over the same period the benchmark SPY performance was 0.7% and 16.9% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 0.58% at a time when SPY gained 0.58%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $220,690 which includes $362 cash and excludes $8,651 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 23.7%, and for the last 12 months is 86.2%. Over the same period the benchmark SPY performance was 0.7% and 16.9% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 1.82% at a time when SPY gained 0.58%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $499,304 which includes $36 cash and excludes $9,190 spent on fees and slippage. |

We offer three categories of membership – bronze, silver and gold at $20, $40 and $80 per month respectively, or discounted on a per year basis. The table to the left (just click on it) lists what you can access depending on the membership level you choose. All information not listed will remain free, however selected key articles could in future be restricted to a paid membership category.

We offer three categories of membership – bronze, silver and gold at $20, $40 and $80 per month respectively, or discounted on a per year basis. The table to the left (just click on it) lists what you can access depending on the membership level you choose. All information not listed will remain free, however selected key articles could in future be restricted to a paid membership category. The MAC-US model is invested since mid June 2025,

The MAC-US model is invested since mid June 2025,

The MAC-AU model is dis-invested from the Australian stock market sine end April 2025.

The MAC-AU model is dis-invested from the Australian stock market sine end April 2025.

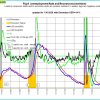

BCIg is not signaling a recession.

BCIg is not signaling a recession.

The growth of the Conference Board’s Leading Economic Indicator does not signal a recession, yet

The growth of the Conference Board’s Leading Economic Indicator does not signal a recession, yet

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) is no longer inverted and the curve is steepening.

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) is no longer inverted and the curve is steepening.

The iM-Low Frequency Timer switched to bonds on 9/26/2022.

The iM-Low Frequency Timer switched to bonds on 9/26/2022.

Performance comparison of the iM-Best models hosted on P123 and on iMarketSignals.

Performance comparison of the iM-Best models hosted on P123 and on iMarketSignals.

Performance graphs for iM-FlipSavers

Performance graphs for iM-FlipSavers

Performance graphs for iM-3mo-SuperTimer(SPY-IEF)

Performance graphs for iM-3mo-SuperTimer(SPY-IEF)

Performance graphs for iM-1mo-SuperTimer(SPY-IEF)

Performance graphs for iM-1mo-SuperTimer(SPY-IEF)

Performance graphs for iM-1wk-SuperTimer(SPY-IEF)

Performance graphs for iM-1wk-SuperTimer(SPY-IEF)

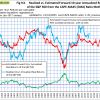

Fig 9a depicts the CAPE-Cycle-ID and the year-on-year rate-of-change of the Shiller CAPE; the level switched from -2 to 0 end of June 2023 generating a buy signal. This indicator now invested in the markets. This indicator is described here.

Fig 9a depicts the CAPE-Cycle-ID and the year-on-year rate-of-change of the Shiller CAPE; the level switched from -2 to 0 end of June 2023 generating a buy signal. This indicator now invested in the markets. This indicator is described here.

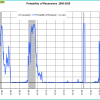

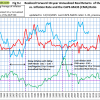

The estimated forward 10‐year annualized real return is 4.3% (previous month 4.4%) with a 95% confidence interval 2.8% to 5.8% (2.9% to 5.9%). Also refer to the Realized Forward 10-Year Returns vs. Inflation Rate

The estimated forward 10‐year annualized real return is 4.3% (previous month 4.4%) with a 95% confidence interval 2.8% to 5.8% (2.9% to 5.9%). Also refer to the Realized Forward 10-Year Returns vs. Inflation Rate  We may be in a rising inflation period with a falling CAPE-MA35 ratio similar to 1964-1973. This implies very low or negative 10 year forward annualized real returns, much lower than the returns indicated by regression analysis shown in the Estimated Forward 10-Year Returns.

We may be in a rising inflation period with a falling CAPE-MA35 ratio similar to 1964-1973. This implies very low or negative 10 year forward annualized real returns, much lower than the returns indicated by regression analysis shown in the Estimated Forward 10-Year Returns.

The iM-GT Timer, based on Google Search Trends volume indicator is invested in the stock markets since beginning November 2025. This indicator is described here.

The iM-GT Timer, based on Google Search Trends volume indicator is invested in the stock markets since beginning November 2025. This indicator is described here. Will be updated later, the weekly FRED data series we used was discontinued and replacement series is daily and runs from 2015. We need to adapt our software and graphics first.

Will be updated later, the weekly FRED data series we used was discontinued and replacement series is daily and runs from 2015. We need to adapt our software and graphics first.

The 1-year rolling return is =2.8% (previous month 2.8%) and is invested in the TIAA Real Estate Account since beginning May 2025.

The 1-year rolling return is =2.8% (previous month 2.8%) and is invested in the TIAA Real Estate Account since beginning May 2025.