- This study presents a rules-based ETF allocation model that uses the CAPE-MA35 ratio—the Shiller CAPE divided by its 35-year moving average—to identify distinct market phases and dynamically adjust portfolio exposure.

- The model defines four primary phases—Growth, Defensive, Uptrend, and Downtrend—based on the trend and relative valuation of CAPE-MA35. ETF allocations are adjusted monthly in response to these phases.

1. Concept and Methodology

1.1 The Shiller CAPE and Its Limitations

The Shiller CAPE (Cyclically Adjusted Price-to-Earnings ratio), or P/E10, measures market valuation by dividing the inflation-adjusted price of the S&P 500 by its average inflation-adjusted earnings over the prior ten years. While CAPE is useful for estimating long-term expected returns, it performs poorly as a short- or medium-term market-timing tool due to its slow mean-reversion and structural changes in markets over time.

1.2 The CAPE-MA35 Ratio

Introduced by us in 2019, the CAPE-MA35 improves upon traditional CAPE analysis by normalizing CAPE relative to its own 35-year moving average. This adjustment allows the ratio to adapt to evolving macroeconomic conditions—such as changing interest rate regimes, globalization effects, and technological shifts—thereby offering a valuation metric that better reflects current structural dynamics rather than a fixed historical mean. However, CAPE-MA35 alone is not suitable for market timing; it requires a framework that integrates both valuation level and trend behavior.

2. Market-Timing Model Using CAPE-MA35

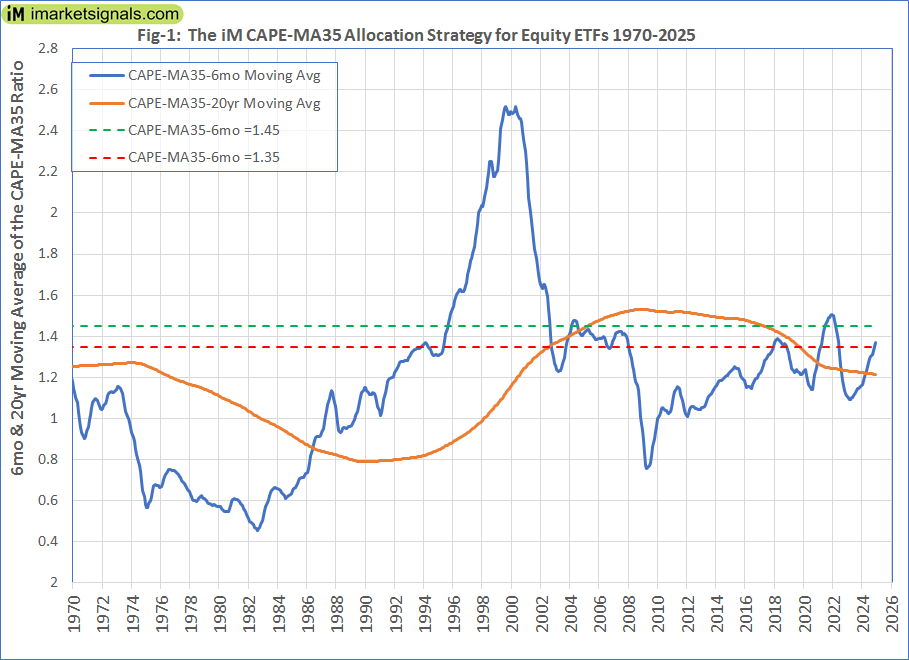

The model uses monthly S&P 500 CAPE data (point-in-time) to calculate CAPE-MA35. Two moving averages are computed: a 6-month average to identify short-term valuation trends and a 20-year (240-month) average to represent the long-term structural baseline. Two horizontal thresholds at 1.35 and 1.45 further classify valuation regimes. (Figure-1)

3. Defining Market Phases

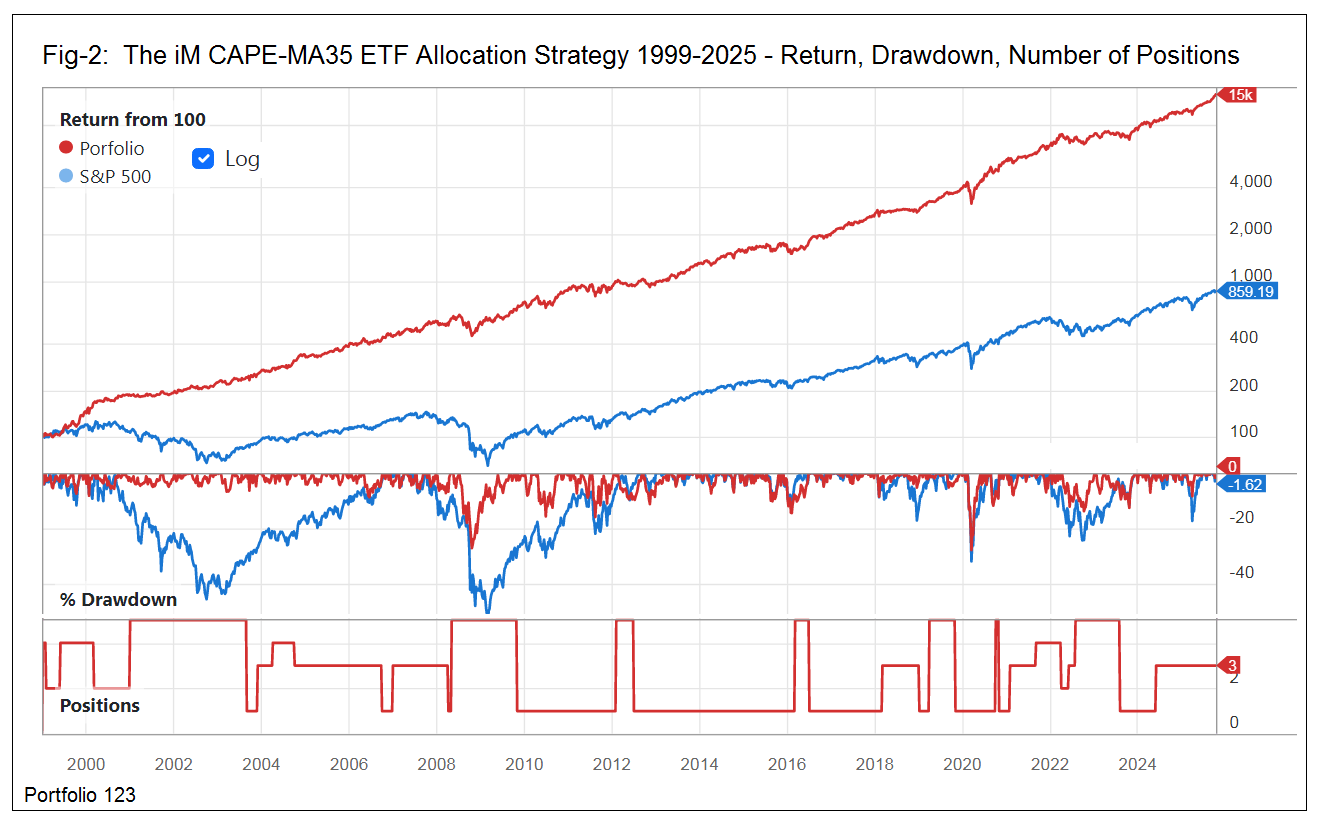

A linear regression trend (10-month window) is applied to the 6-month moving average of CAPE-MA35. The regression slope defines the trend direction: Slope > +0.01 indicates an Uptrend, and Slope < –0.01 indicates a Downtrend. Based on this slope and the relative position of CAPE-MA35, the market is classified into one of five phases (see bottom of Figure-2 for phases depicted by the number of positions pecified for the respective phases):

Phase |

Description |

ETF Allocations |

| 1. General Downtrend | Declining CAPE-MA35-6mo: Slope < –0.01 |

GLD, IAU, SLV, TLT, IEF (5 positions) |

| 2. Uptrend (Booming Growth) | Rising CAPE-MA35-6mo: Slope > +0.01, above long-term average, and CAPE-MA35-6mo > 1.45. |

QQQ, XLK, XLE, USO (4 positions) |

| 3.a Growth | Low valuation (CAPE-MA35-6mo < 1.35), and below long-term average |

QQQ (1 position) |

| 3.b Defensive | Very high valuation (CAPE-MA35-6mo ≥ 1.45), and above long-term average |

XLU, GLD (2 positions) |

| 3.c Growth + Defensive | (CAPE-MA35-6mo > 1.35) and below long-term average, or (CAPE-MA35-6mo < 1.45) and above long-term average |

QQQ, XLU, GLD (3 positions) |

4. Portfolio123 Implementation Logic

The model is implemented in Portfolio123 using nested eval() functions. In plain language, the allocation logic is:

- If the CAPE-MA35 6-month SMA trend slope < –0.01 → Downtrend portfolio, otherwise

- if the CAPE-MA35 6-month SMA > its 20-year average, and >1.45, and slope > +0.01 → Uptrend portfolio, otherwise

- if the CAPE-MA35 6-month SMA is below its 20-year average: and <1.35 → Growth portfolio; otherwise → (Growth + Defensive) portfolio. If it is not below its 20-year average: and <1.45 → (Growth + Defensive) portfolio; otherwise if ≥1.45 → Defensive portfolio.

5. Backtest and Results (1999–2025)

Backtesting from January 1999 through October 2025 was conducted on Portfolio123, which also provides extended ETF proxies for pre-inception data. A transaction cost of 0.1% per trade was applied.

Results Summary:

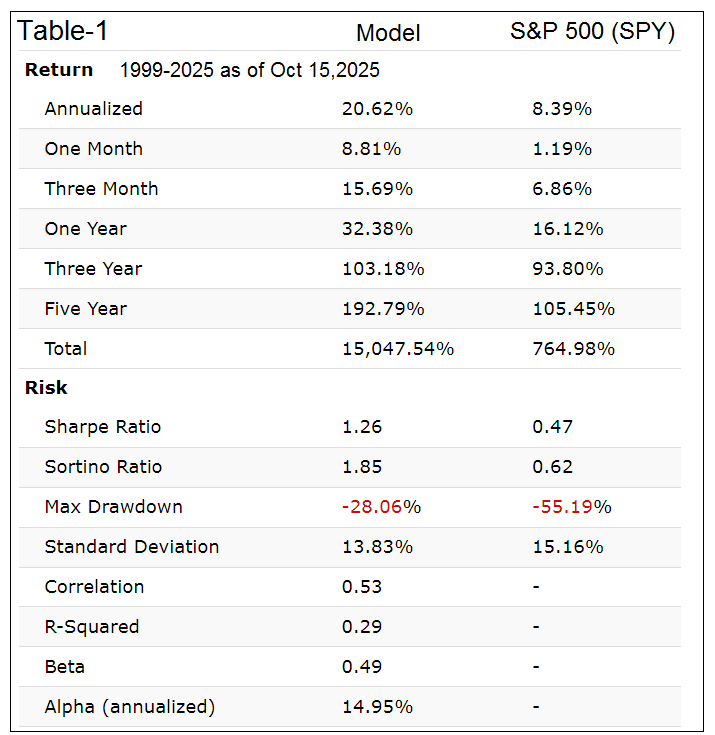

• Annualized return: 20.6%

• Maximum drawdown: –28%

• Total realized trades: 70 (51 profitable)

• Shortest holding period: 28 days

• Average annual turnover: ≈100%

Compared with SPY, the model demonstrates lower volatility and drawdown, approximately 20× higher cumulative return, and consistent long-term performance with low trading activity. (Figure-2 and Table-1)

6. Discussion

The CAPE-MA35 framework integrates long-term valuation awareness with short-term trend analysis to enhance tactical allocation decisions. Unlike static CAPE-based valuation strategies, it adjusts dynamically to market structure changes and macroeconomic evolution. Although based solely on publicly available CAPE data, its combination with systematic ETF rotation achieves high risk-adjusted performance and a stable allocation regime.

7. Conclusion

The Dynamic ETF Allocation using CAPE-MA35 provides a practical market-timing approach that bridges long-term valuation context and medium-term trend signals. Its performance since 1999 demonstrates that valuation-informed, trend-adaptive strategies can outperform passive benchmarks while managing downside risk and turnover efficiently.

This model can easily be replicated with the information provided. For convenience, this model is also available at iMarketSignals to subscribers with somewhat different ETFs to simplify trading.

Which model does this correspond to – I don’t see it in the list of models from your archive?

We are in the process of incorporating this model (but with only 4 ETFs) on our website. Coming soon.