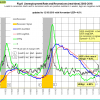

Unemployment

The unemployment rate recession model (article link), has been updated with the November UER of 4.6%. Based on the historic patterns of the unemployment rate indicators prior to recessions one can reasonably conclude that the U.S. economy is not likely to go into recession anytime soon. The growth rate UERg decreased to -4.82% (previous at -3.15%) and EMA spread of the UER widened to -0.21% (previous at -0.10)

The unemployment rate recession model (article link), has been updated with the November UER of 4.6%. Based on the historic patterns of the unemployment rate indicators prior to recessions one can reasonably conclude that the U.S. economy is not likely to go into recession anytime soon. The growth rate UERg decreased to -4.82% (previous at -3.15%) and EMA spread of the UER widened to -0.21% (previous at -0.10)

Here is the link to the full update.

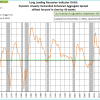

The Dynamic Linearly Detrended Enhanced Aggregate Spread:

.Long leading indicator DAGS at 11 (last month 9), a level from which it has never recovered in the past. Should this downward trend continue then, according to this indicator, a recession could be expected to begin after September-2017.

.Long leading indicator DAGS at 11 (last month 9), a level from which it has never recovered in the past. Should this downward trend continue then, according to this indicator, a recession could be expected to begin after September-2017.

CAPE-Cycle-ID

Fig 9a depicts the CAPE-Cycle-ID and the year-on-year rate-of-change of the Shiller CAPE. A model using this indicator invests in the market when the Cycle-ID is +2 or 0, and when the Cycle-ID equals -2 the model is in cash. This indicator is described here.

Fig 9a depicts the CAPE-Cycle-ID and the year-on-year rate-of-change of the Shiller CAPE. A model using this indicator invests in the market when the Cycle-ID is +2 or 0, and when the Cycle-ID equals -2 the model is in cash. This indicator is described here.

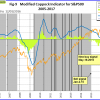

Coppock Indicator for the S&P500

The Coppock indicator for the S&P500 generated a buy signal on May 19, 2016. This model is now in the market. This indicator is described here.

The Coppock indicator for the S&P500 generated a buy signal on May 19, 2016. This model is now in the market. This indicator is described here.

Trade Weighted USD

The TW$ value has again risen and the 6 month moving average is increasing too.

The TW$ value has again risen and the 6 month moving average is increasing too.

TIAA Real Estate Account

The 1-year rolling return for the end of last month is 4.82%. A sell signal is not imminent.

The 1-year rolling return for the end of last month is 4.82%. A sell signal is not imminent.

Leave a Reply

You must be logged in to post a comment.