Market Signals Summary:

The iM-HiLo exited the stock market 1/20/22. The other indicators, the MAC US, iM-GT Timer, and S&P 500 Coppock Indicator are invested in the stock markets. The bond market model avoids high beta (long) bonds. The Gold Coppock is in cash after a sell signal on 9/30/2021, however the iM-Gold Timer remains invested in Gold. The Silver Coppock model is also invested in silver.

Stock-markets:

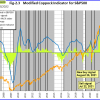

The MAC-US model is invested in the stock market.

The MAC-US model is invested in the stock market.

The 3-mo Hi-Lo Index Index of the S&P500 is at +3.33% (last week +3.77%), and has exited the stock market on 1/20/22.

The 3-mo Hi-Lo Index Index of the S&P500 is at +3.33% (last week +3.77%), and has exited the stock market on 1/20/22.

The Coppock indicator for the S&P500 generated a buy signal end August 2021 and is invested in stocks. This indicator is described here.

The Coppock indicator for the S&P500 generated a buy signal end August 2021 and is invested in stocks. This indicator is described here.

The MAC-AU model is invested in the Australian stock market since mid July 2020.

The MAC-AU model is invested in the Australian stock market since mid July 2020.

This model and its application is described in MAC-Australia: A Moving Average Crossover System for Superannuation Asset Allocations.

Recession:

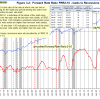

BCIg signals economic recovery.

BCIg signals economic recovery.

The growth of the Conference Board’s Leading Economic Indicator signals economic recovery.

The growth of the Conference Board’s Leading Economic Indicator signals economic recovery.

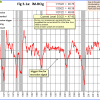

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) is below last week’s level.

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) is below last week’s level.

A description of this indicator can be found here.

The iM-Low Frequency Timer switched into stocks on 6/15/2020.

The iM-Low Frequency Timer switched into stocks on 6/15/2020.

A description of this indicator can be found here.