Market Signals Summary:

Both MAC-US and the 3-mo Hi-Lo Index are invested in the stock market, but simulations show that the 3-mo Hi-Lo index will drop below the 5% threshold in next week. The bond market model avoids high beta (long) bonds, and the yield curve is unchanged.

The Gold Coppock , iM-Gold Timer remain in gold. The Silver Coppock model is also invested in silver

The iM-GT Timer, based on Google Search Trends volume is invested in the the markets since 7/1/2020.

Stock-markets:

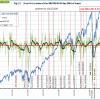

The MAC-US model is invested in the markets..

The MAC-US model is invested in the markets..

The 3-mo Hi-Lo Index Index of the S&P500 at +5.15% is below last week’s +6.3%, and is invested in the market beginning June 2020. Simulations show that the 3-mo Hi-Lo index will drop below the 5% threshold in next week.

The 3-mo Hi-Lo Index Index of the S&P500 at +5.15% is below last week’s +6.3%, and is invested in the market beginning June 2020. Simulations show that the 3-mo Hi-Lo index will drop below the 5% threshold in next week.

The Coppock indicator for the S&P500 entered the market on 5/9/2019 and is invested and generated a new buy signal 8/20/20. This indicator is described here.

The Coppock indicator for the S&P500 entered the market on 5/9/2019 and is invested and generated a new buy signal 8/20/20. This indicator is described here.

The MAC-AU model is invested in the markets since mid July 2020.

The MAC-AU model is invested in the markets since mid July 2020.

This model and its application is described in MAC-Australia: A Moving Average Crossover System for Superannuation Asset Allocations.

Recession:

BCIg Temporarily withdrawn

BCIg Temporarily withdrawn

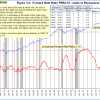

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) is above last week’s level.

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) is above last week’s level.

A description of this indicator can be found here.

The iM-Low Frequency Timer switched into the markets on 6/15/2020.

The iM-Low Frequency Timer switched into the markets on 6/15/2020.

A description of this indicator can be found here.

Leave a Reply

You must be logged in to post a comment.