Market Signals Summary:

Both MAC-US and the 3-mo Hi-Lo Index have switched back into the market. The bond market model avoids high beta (long) bonds, and the yield curve is steepening. The Gold Coppock remains in gold but the iM-Gold Timer is in cash. The Silver Coppock model is invested in silver.

The iM-GT Timer, based on Google Search Trends volume is invested in the the markets since 7/1/2020.

Stock-markets:

The MAC-US model switched back into the markets..

The MAC-US model switched back into the markets..

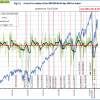

The 3-mo Hi-Lo Index Index of the S&P500 at +8.46% is above last week’s +7.70%, and switched back into the market beginning June 2020

The 3-mo Hi-Lo Index Index of the S&P500 at +8.46% is above last week’s +7.70%, and switched back into the market beginning June 2020

The Coppock indicator for the S&P500 entered the market on 5/9/2019 and is invested. This indicator is described here.

The Coppock indicator for the S&P500 entered the market on 5/9/2019 and is invested. This indicator is described here.

The MAC-AU model switch out of the markets on 3/27/2020. The buy-spread (green line) is rising is just below the zero line and will signal a buy on Monday 7/13/2020.

The MAC-AU model switch out of the markets on 3/27/2020. The buy-spread (green line) is rising is just below the zero line and will signal a buy on Monday 7/13/2020.

This model and its application is described in MAC-Australia: A Moving Average Crossover System for Superannuation Asset Allocations.

Recession:

BCIg Temporarily withdrawn

BCIg Temporarily withdrawn

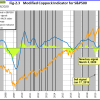

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) is above last week’s level.

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) is above last week’s level.

A description of this indicator can be found here.

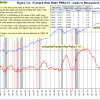

The iM-Low Frequency Timer switched into the markets on 6/15/2020.

The iM-Low Frequency Timer switched into the markets on 6/15/2020.

A description of this indicator can be found here.

Leave a Reply

You must be logged in to post a comment.