Market Signals Summary:

The MAC-US model, iM-Low Frequency Timer, and the S&P500 Coppock are invested in the markets, as is the “3-mo Hi-Lo Index of the S&P500” which entered the market on 10/22/2018. The MAC-AU is also invested in the markets. The recession indicators iM-LLI and iM-BCIg do not signal a recession. The bond market model avoids high beta (long) bonds, and the yield curve is flattening. The Gold Coppock and iM-Gold Timer remains invested in gold, however the silver model is in cash.

Stock-markets:

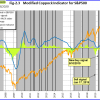

The MAC-US model switched into the markets on 2/26/2019. The sell-spread (red line) is above last week’s value and needs to move below zero to generate a sell signal.

The MAC-US model switched into the markets on 2/26/2019. The sell-spread (red line) is above last week’s value and needs to move below zero to generate a sell signal.

The 3-mo Hi-Lo Index Index of the S&P500 is above last week’s level at 14.01% (last 14.28%), and is invested in the stock market since 10/22/2019.

The 3-mo Hi-Lo Index Index of the S&P500 is above last week’s level at 14.01% (last 14.28%), and is invested in the stock market since 10/22/2019.

The Coppock indicator for the S&P500 entered the market on 5/9/2019 and is invested. This indicator is described here.

The Coppock indicator for the S&P500 entered the market on 5/9/2019 and is invested. This indicator is described here.

The MAC-AU model is invested in the markets. The sell-spread (red line) is above last week’s value and needs to move below zero to generate a sell signal.

The MAC-AU model is invested in the markets. The sell-spread (red line) is above last week’s value and needs to move below zero to generate a sell signal.

This model and its application is described in MAC-Australia: A Moving Average Crossover System for Superannuation Asset Allocations.

Recession:

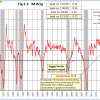

The current level of iM-LLI is plus 3.61 and is below last week’s 3.76, hence this indicator signals that a recession is unlikely to begin during the next 8 months.

The current level of iM-LLI is plus 3.61 and is below last week’s 3.76, hence this indicator signals that a recession is unlikely to begin during the next 8 months.

Figure 3.1 shows the recession indicator iM-BCIg up from last week’s level. An imminent recession is not signaled .

Figure 3.1 shows the recession indicator iM-BCIg up from last week’s level. An imminent recession is not signaled .

Please also refer to the BCI page

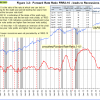

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) remains near last week’s level and is not signaling a recession.

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) remains near last week’s level and is not signaling a recession.

A description of this indicator can be found here.

The iM-Low Frequency Timer is back in the markets since 1/22/2019.

The iM-Low Frequency Timer is back in the markets since 1/22/2019.

A description of this indicator can be found here.

Leave a Reply

You must be logged in to post a comment.