Market Signals Summary:

The 3-mo Hi-Lo Index is out of the market since 3/5/2020 and the MAC US and the MAC AU are out of the markets since 3/26/2020. The bond market model avoids high beta (long) bonds, and the yield curve is steepening and signaled a buy STPP. The Gold Coppock remains in gold but the iM-Gold Timer is in cash. The Silver Coppock model is invested in silver.

The BCIg, the BCIp and the iM-Unemployment models all signal a recession

The iM-GT Timer, based on Google Search Trends volume switched out of the markets on 3/5/2020.

Stock-markets:

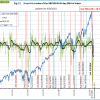

The MAC-US model switched out of the markets on 3/26/2020. The buy-spread (green line) is below last week’s value.

The MAC-US model switched out of the markets on 3/26/2020. The buy-spread (green line) is below last week’s value.

The 3-mo Hi-Lo Index Index of the S&P500 at -19.70% is below last week’s -18.02%, and is out of the stock market since 3/5/2020.

The 3-mo Hi-Lo Index Index of the S&P500 at -19.70% is below last week’s -18.02%, and is out of the stock market since 3/5/2020.

The Coppock indicator for the S&P500 entered the market on 5/9/2019 and is invested. This indicator is described here.

The Coppock indicator for the S&P500 entered the market on 5/9/2019 and is invested. This indicator is described here.

The MAC-AU model switch out of the markets on 3/27/2020. The buy-spread (green line) is below last week’s value.

The MAC-AU model switch out of the markets on 3/27/2020. The buy-spread (green line) is below last week’s value.

This model and its application is described in MAC-Australia: A Moving Average Crossover System for Superannuation Asset Allocations.

Recession:

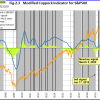

This iM-LLI reflects mainly data for February 2020, except for the BCI.

This iM-LLI reflects mainly data for February 2020, except for the BCI.

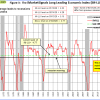

Figure 3.1 shows the recession indicator iM-BCIg below last week’s level and just below the recession trigger level thus also signaling a recession warning.

Figure 3.1 shows the recession indicator iM-BCIg below last week’s level and just below the recession trigger level thus also signaling a recession warning.

Please also refer to the BCI page

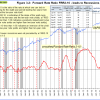

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) is above last week’s level. It is rising steeply, typically seen at a start of a recession.

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) is above last week’s level. It is rising steeply, typically seen at a start of a recession.

A description of this indicator can be found here.

The iM-Low Frequency Timer is back in the markets since 1/22/2019.

The iM-Low Frequency Timer is back in the markets since 1/22/2019.

A description of this indicator can be found here.

Leave a Reply

You must be logged in to post a comment.