- The 34th occurrence (since 1950) of the 50-day moving average of the S&P 500 crossing its 200-day moving average to the downside is imminent.

- The Death Cross is inevitable, and will occur early December.

- The looming Death Cross could indicate the potential for a major selloff.

In our article The S&P 500 Death Cross – Time To Panic?, we analyzed the markets after a Death Cross, that is when the 50-day moving average of the S&P 500 crosses its 200-day moving average. We now face the 34th Death Cross in the first or second week of December.

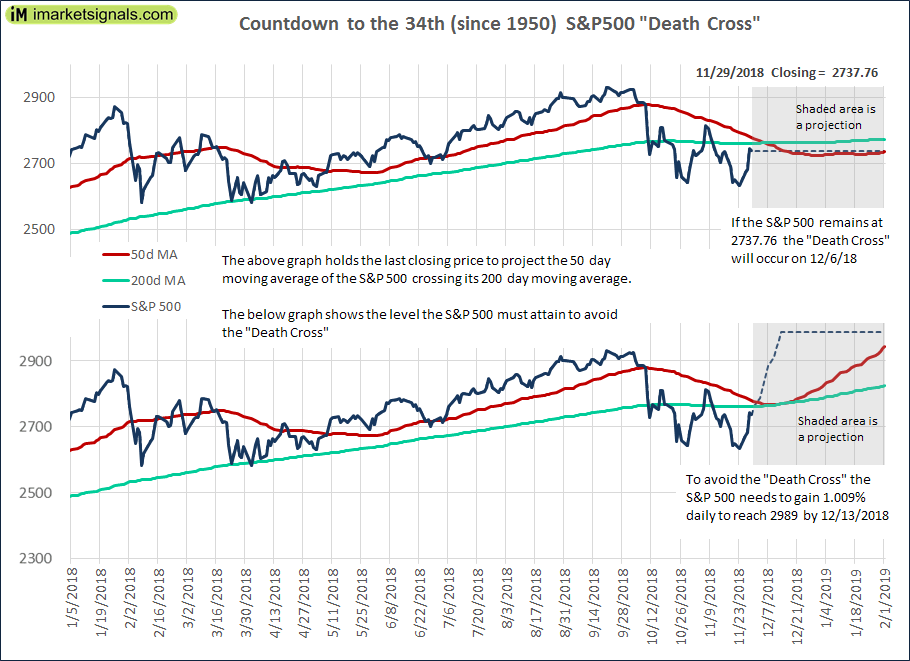

The Death Cross is inevitable, and will occur before December 13, 2018. We base this prediction on the strength of following two simulations, the results shown in the figure below.

- The future simulated S&P 500 remains at the 11/298 close of 2737.76 for the coming days. Then, the Death Cross is on Thursday, December 6.

- The future simulated S&P 500 gains 1.009% on its previous day, to close at 2989 on December 13. The Death Cross would then be avoided with the difference of 50-day and 200-day moving average equal zero on that day, a highly unlikely scenario.

Asset Allocation after a Death Cross

Based on past history of the performance of the S&P 500, there is no need to panic. A Death Cross does not always result in major market losses, as can be seen from the analysis. However, it would appear that one should avoid being invested in the stock market during the first two months after a DC, as there were many losses during this period, whereas the historic maximum gain was only about 13% in this period after any of the 32 DCs.

It is prudent for asset allocation to be in accordance with prevailing market conditions. More aggressive investments can be used during up-market periods, while more conservative investments are applicable during down-market periods. It would appear that good market timing models, such as our Composite Market Timer could provide guidance after Death Cross events.

Leave a Reply

You must be logged in to post a comment.