iM Fund Rating System

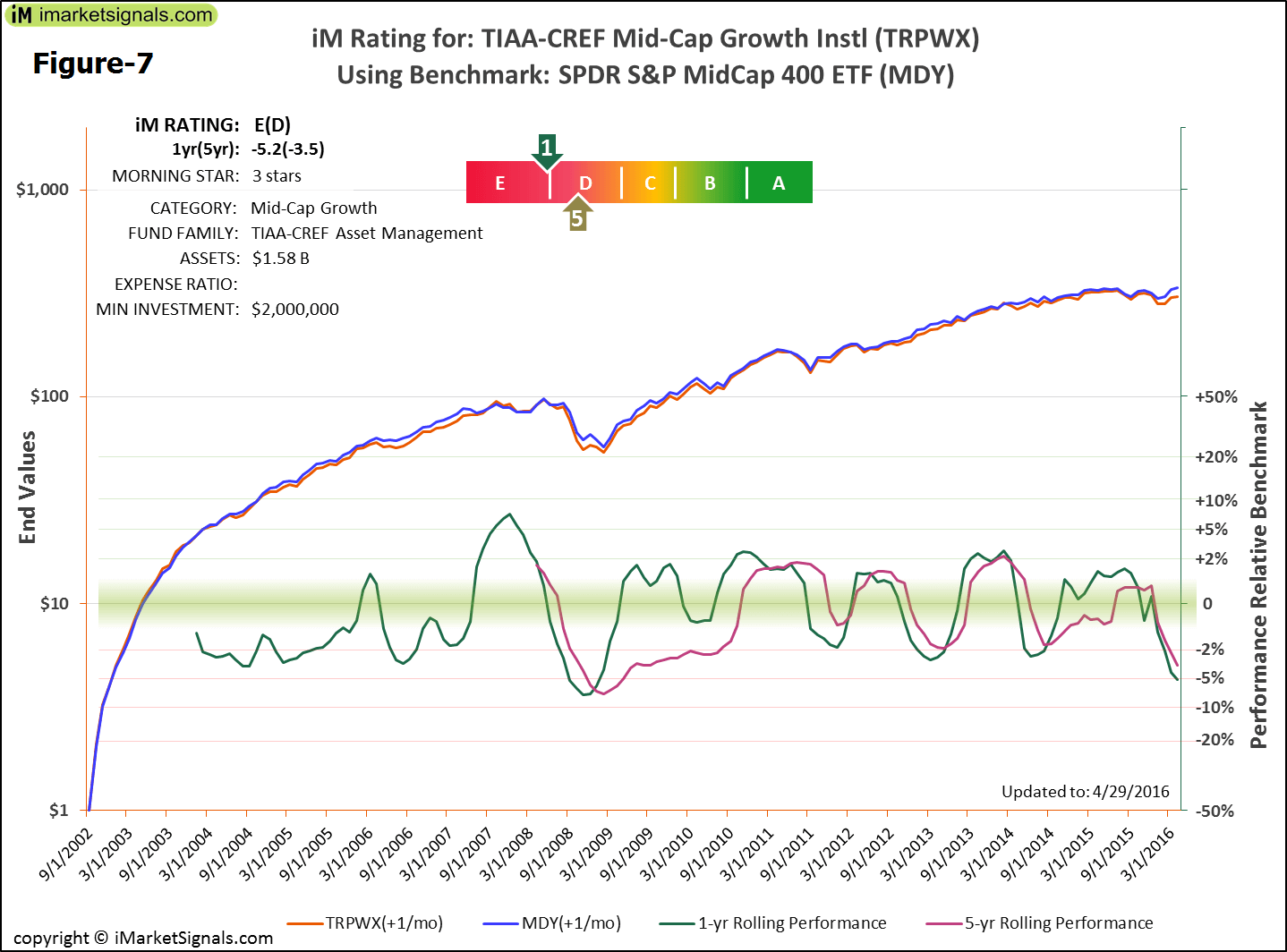

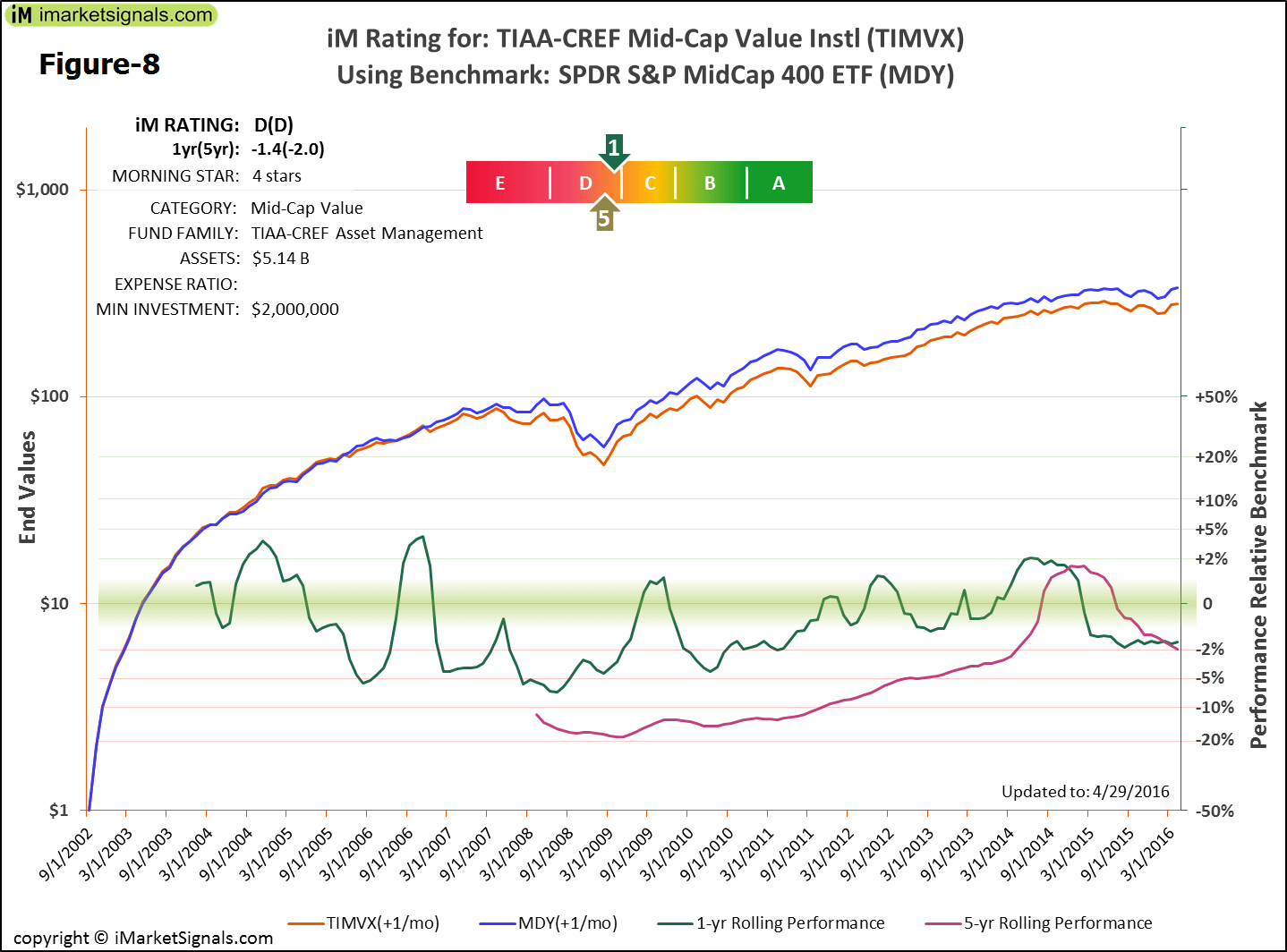

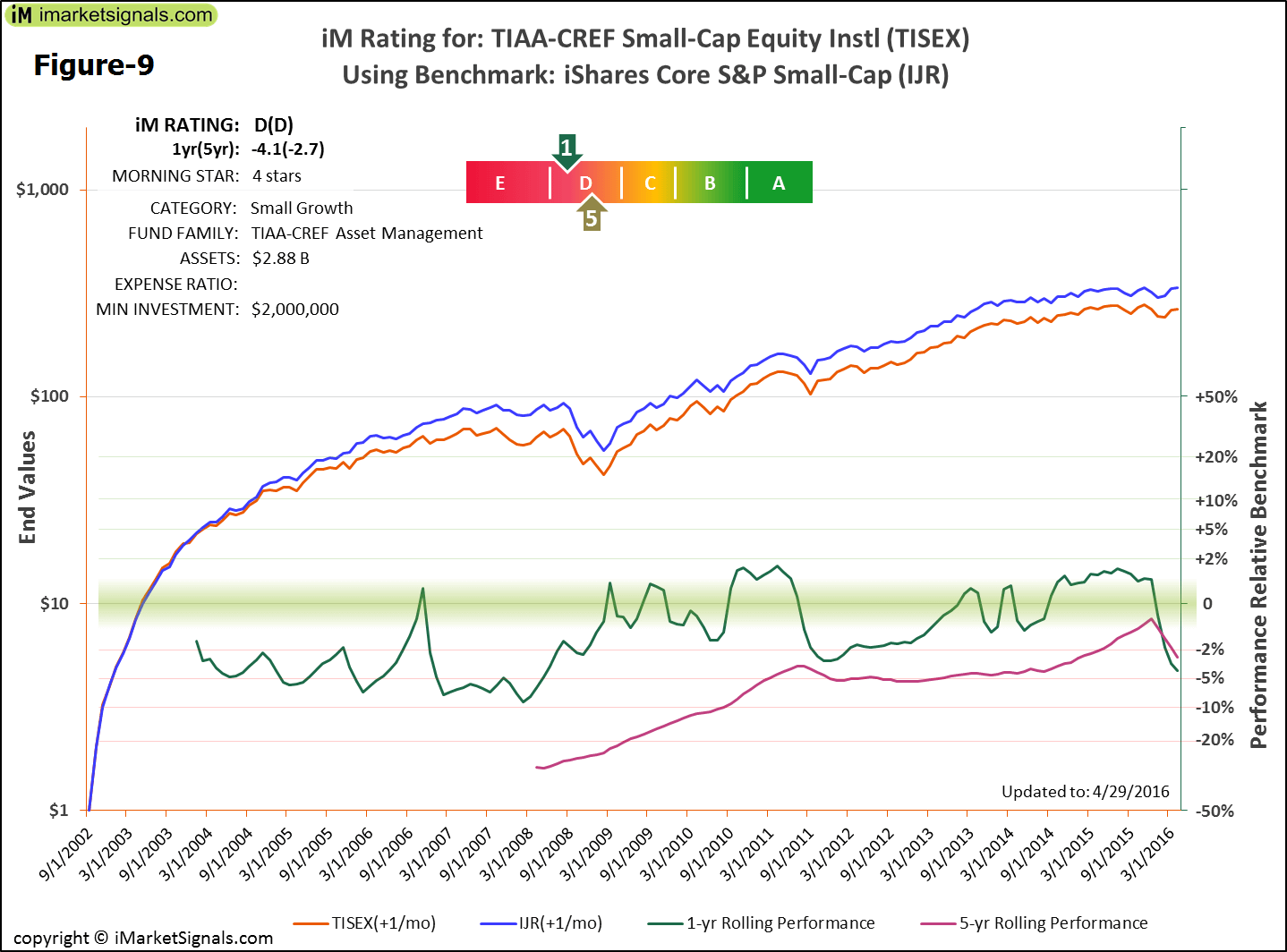

The iM Fund Rating System rates a fund’s return relative to a benchmark fund by comparing the terminal values from periodic $1.00 monthly contributions to both funds over the same period. Ratings can range from a grossly underperforming ‘E’ to a good outperforming ‘A’. The ratings are derived from the most recent past 1-yr and 5-yr Rolling Performances, shown as ‘1yr(5yr)’ e.g. A((B)).

TIAA-CREF’s actively managed equity funds and accounts

Only funds for which data is available for at least 12 years were investigated. These were compared to a representative benchmark, as follows:

1. Vanguard’s total stock market index (VTSMX) as benchmark for the CREF Accounts (QCSTRX), (QCGLRX) and (QCGRRX) and TIAA-CREF mutual funds (TIIEX), (TIGRX) and (TRLIX).

2. SPDR S&P Mid-Cap 400 ETF (MDY) as benchmark for TIAA-CREF mutual funds (TRPWX) and (TIMVX).

3. iShares Core S&P Small Cap ETF (IJR) as benchmark for TIAA-CREF mutual fund (TISEX).

Table-1 list the accounts and funds analyzed. It lists the iM-Ratings, the Annual Alphas from the Fama-French three-factor and four-factor analysis over the last five years, and also Morningstar ratings.

None of the accounts or funds had concurrently a rating of ‘C’ (or better) for both the 1-yr and 5-yr rating, such as C((C)). Also the Fama-French Factor Analysis produced only negative Annual Alphas for the mutual funds.

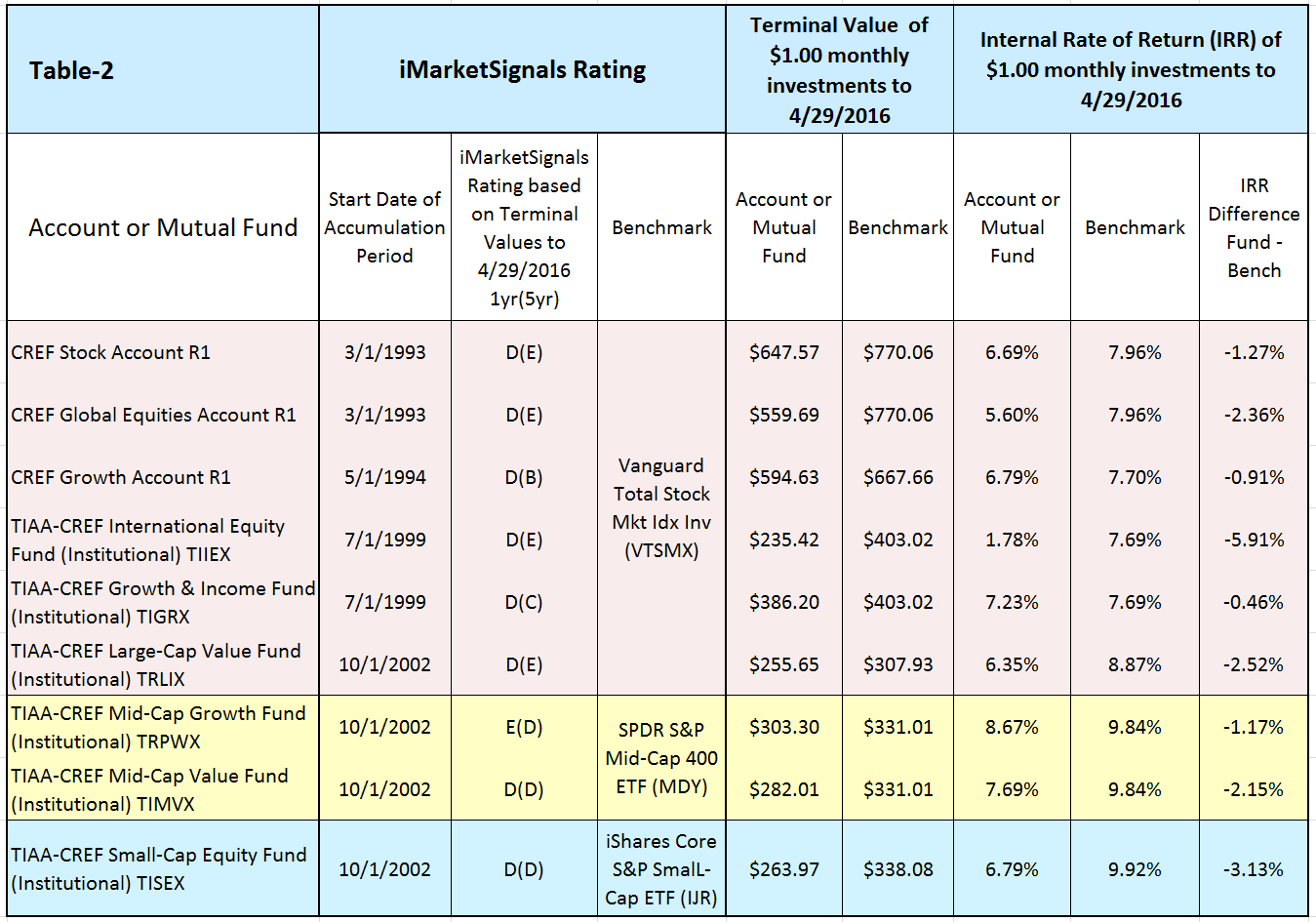

The results of an analysis of the internal rate of return obtained from investing $1.00 every month in the funds and the benchmarks over the full accumulation periods is shown in Table-2.

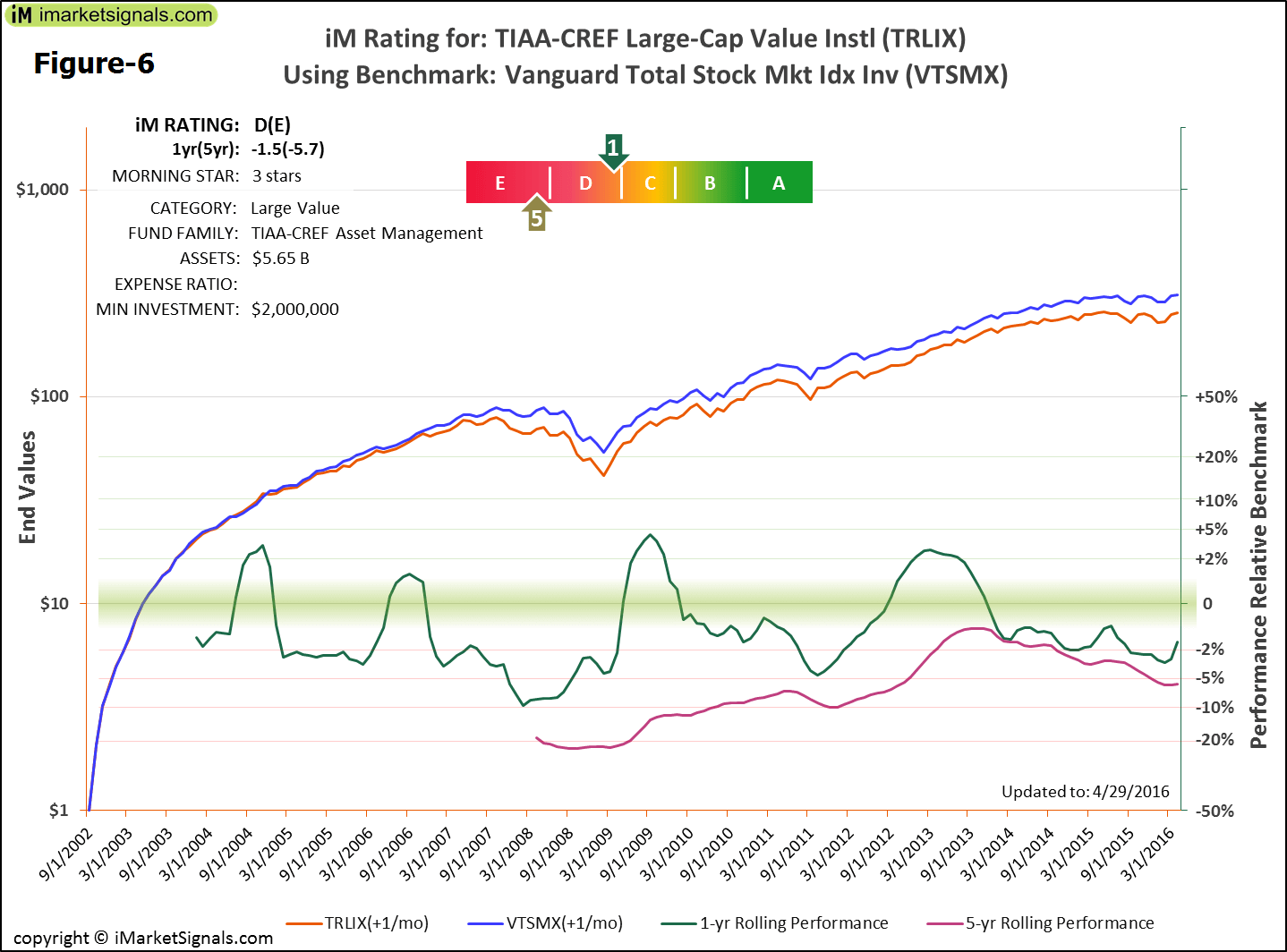

All of the accounts and funds produced lower terminal values and internal rates of return [IRR] than their respective benchmarks from the start of their accumulation periods to end of April 2016.

The CREF Growth Account performed relatively well, because its 5-yr rating of ‘B’ indicates a better performance over the last five years than that of the benchmark fund, but over the whole accumulation period the IRR was still 0.91% less than for the benchmark fund.

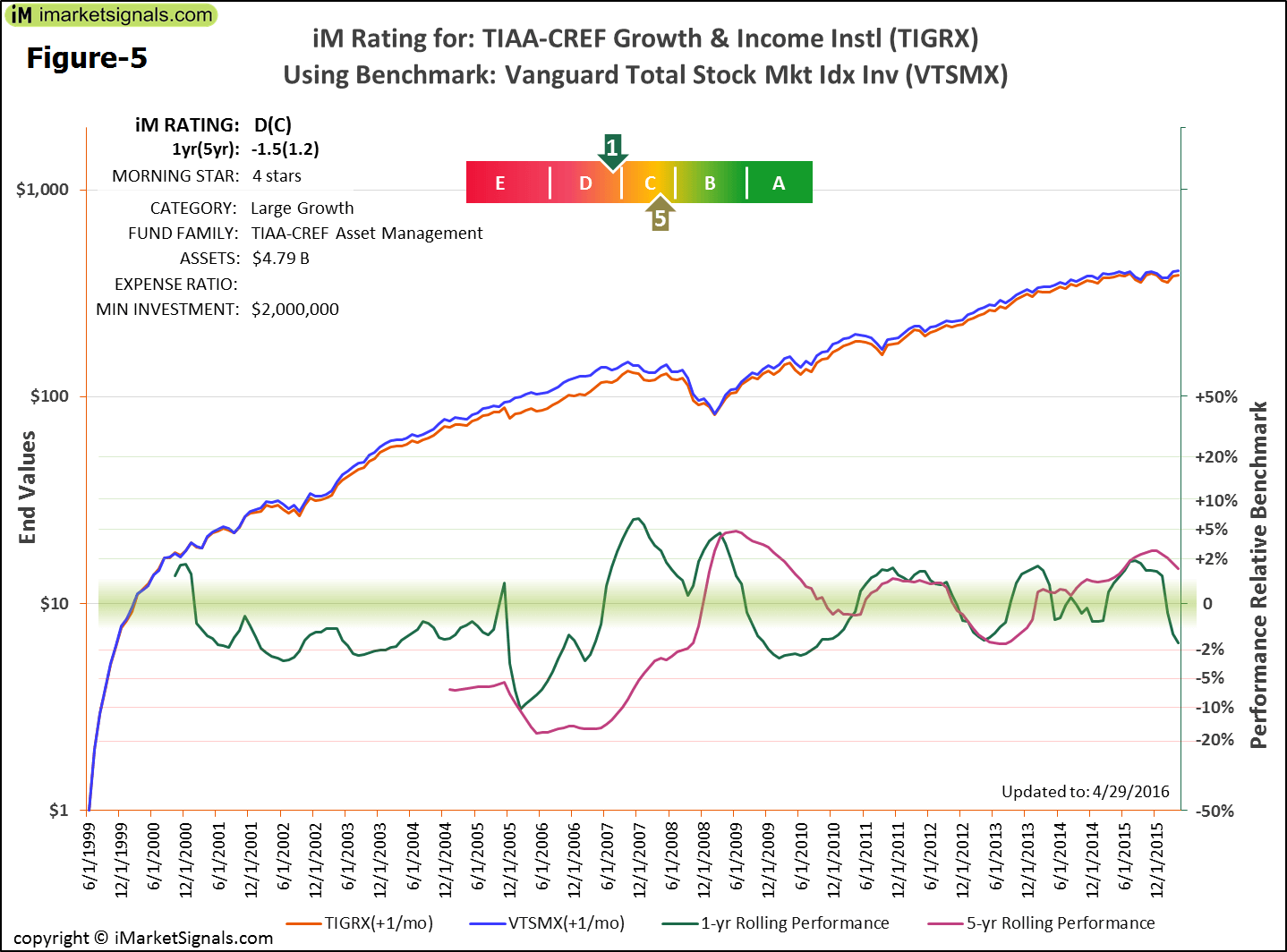

TIGRX has a 5-yr rating of ‘C’ indicating that this fund matched the performance of the benchmark over the last five years, but over the whole accumulation period the IRR was still 0.46% less than for the benchmark fund.

It is obvious from the analysis that the TIAA-CREF actively managed equity fund did not add value for investors relative to representative index funds. Investors would have done better to place their retirement funds in a suitable index fund.

Appendix

iM Rating Charts and how to interpret them.

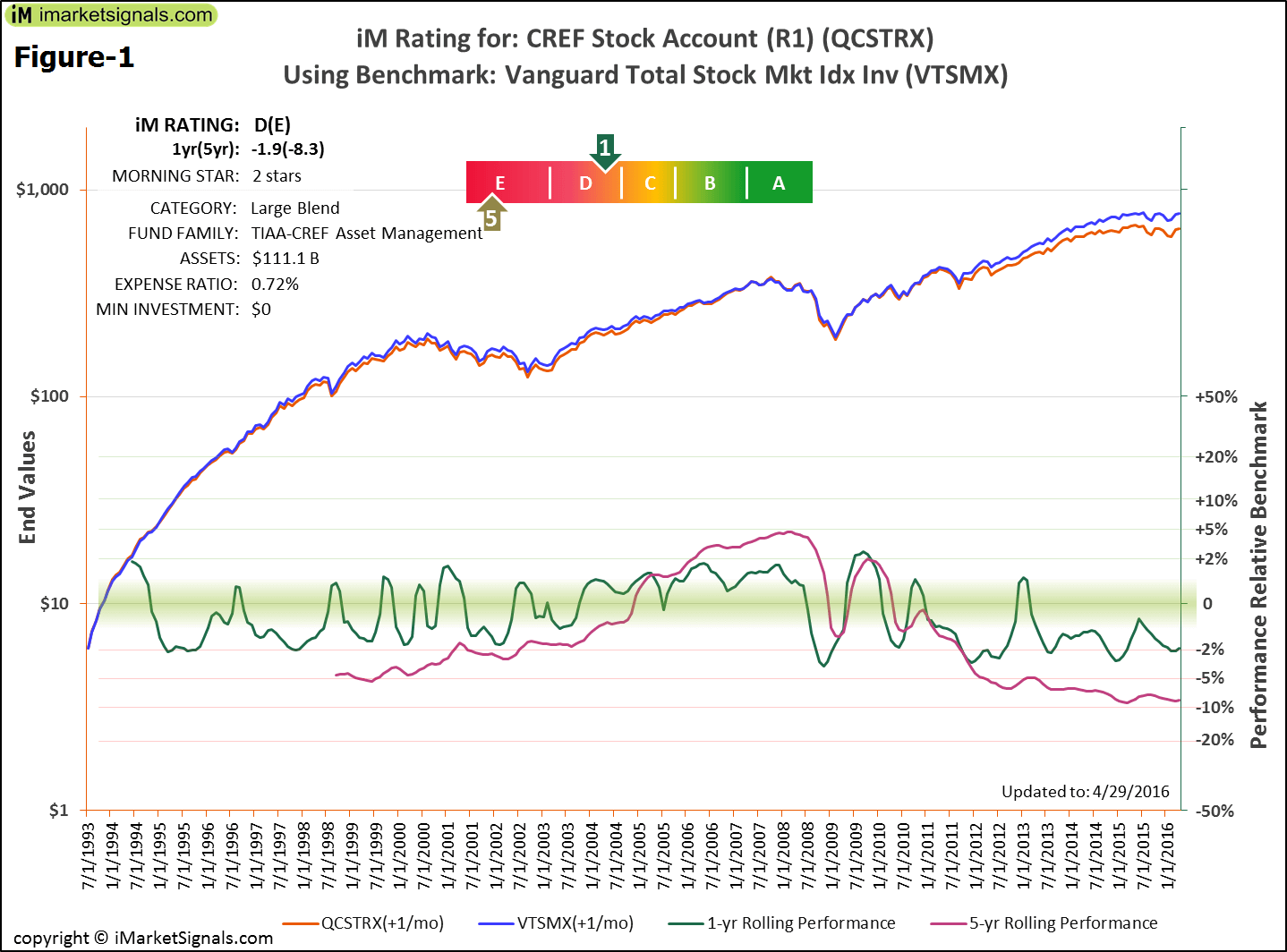

Figure-1 compares the CREF Stock Account (R1) (QCSTRX) to the Vanguard Total Stock Market Index. Figures 2 to 9 at end of article, compare the other mentioned TIAA-CREF funds to their respective benchmarks.

The upper two graphs in the charts show the actual terminal values obtained from investing $1.00 every month in the fund and the benchmark. These are the sums of all contributions including all gains and losses to the end of April 2016, and indicate the total savings over time. A desirable fund would continuously have produced a higher terminal value than those for the benchmark.

The lower two graphs in the charts are the 1-yr and 5-yr Rolling Performances. The 5-yr Rolling Performance should preferably be continuously positive, which would indicate that an investor would always have done better investing in the fund than in the benchmark over a five year period.

For future fund performance to be better than the benchmark would require the 1-yr and 5-yr Rolling Performance graphs near the end to be positive and to have upward (positive) slopes as well. Positive 1-yr and 5-yr Rolling Performances show that a fund performed better than the benchmark over the last year and the last five years, respectively. Upward slopes of the Rolling Performance graphs would indicate that fund performance had constantly gained over the benchmark while the slopes were positive and should also signal further excess gains for the fund over the benchmark in the near-term future. None of the TIAA-CREF actively managed equity accounts and funds exhibit those positive characteristics.

Leave a Reply

You must be logged in to post a comment.