- This rating system identifies funds which may provide better returns than a benchmark index-fund by measuring fund performance from the perspective of savers who make regular monthly contributions to funds.

- It compares the terminal value from periodic $1.00 monthly contributions to a fund with the terminal value from the same contributions to a benchmark index-fund over the same time period.

- Specifically, the system calculates 1-year and 5-year rolling terminal values from $1.00 monthly contributions to the fund and the benchmark index-fund.

- Predictive information comes from the relationship between the fund and the benchmark rolling terminal values, allowing an estimate of future fund performance relative to the benchmark index-fund.

The Terminal Value Rating System

Since most investors aim to save an adequate amount for retirement it is appropriate to calculate the terminal value from monthly contributions to a particular fund and compare this to the terminal value if the same contributions had been made to a benchmark index-fund instead. (In this analysis SPY, the ETF tracking the S&P500, is used as the benchmark index-fund, hereinafter referred to as benchmark.)

This method provides a better picture of fund performance for savers as it measures the end value from periodic investments to a fund, rather than performance over standard fixed time periods. (Fund prices adjusted for dividends are mainly from Yahoo Finance. Also the system only applies to funds with no front load fees.)

An evaluation of the relationship between the 1-year and 5-year rolling terminal values for investments in a fund, and the corresponding rolling terminal values for investments in the benchmark, can provide a good estimate of future fund performance relative to the benchmark. The relationship is termed “Rolling Performance” and is defined in the Appendix.

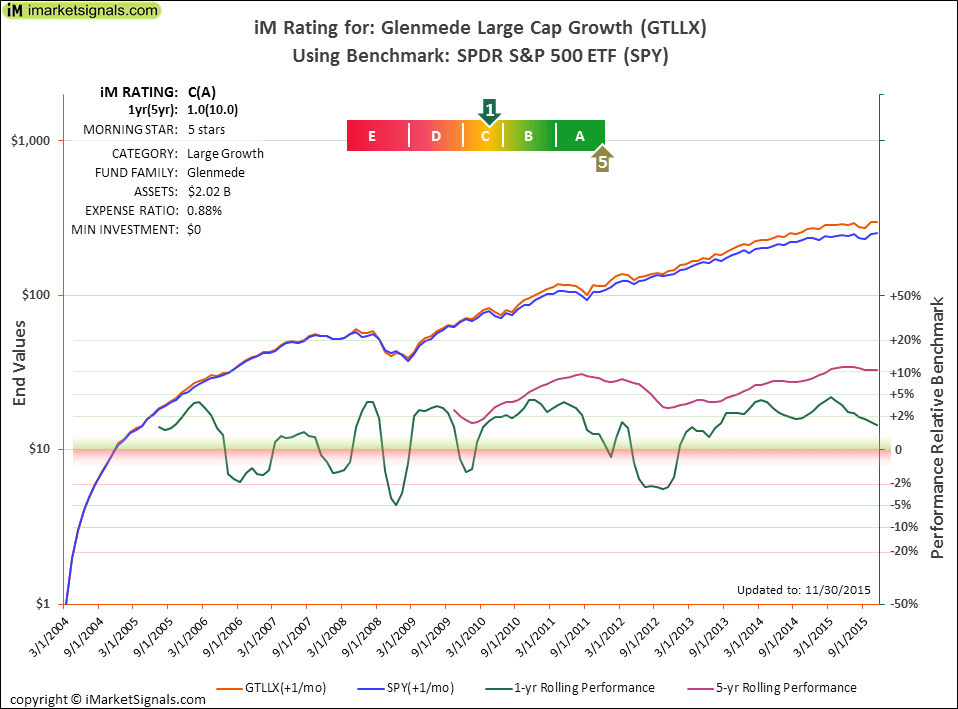

The ratings derived from this analysis range from a grossly underperforming ‘E’ to a good outperforming ‘A’. In the charts the ratings are based on the most recent past 1-yr and 5-yr Rolling Performances, shown as “iM RATING: 1yr(5yr)”. Desirable funds should have a 1yr rating of ‘C’ or better, and a 5yr rating of ‘B’ or better. (See the Appendix for Rating Criteria)

Over and above the simple 5-bin rating, charts are produced to visualize, and substantiate, the fund’s rating.

How to interpret the charts

The upper two graphs in the charts show the actual terminal values obtained from investing $1.00 every month in the fund and the benchmark. These are the sums of all contributions including all gains and losses to the end of November 2015, and indicate the total savings over time. A desirable fund would continuously have had higher terminal values than those for the benchmark.

The lower two graphs in the charts are the 1-yr and 5-yr Rolling Performances. The 5-yr Rolling Performance should preferably be continuously positive, which would indicate that an investor would always have done better investing in the fund than in the benchmark over a five year period.

For future fund performance to be better than the benchmark would require the 1-yr and 5-yr Rolling Performance graphs near the end to be positive and to have upward (positive) slopes as well. Positive 1-yr and 5-yr Rolling Performances show that a fund performed better than the benchmark over the last year and the last five years, respectively. Upward slopes of the Rolling Performance graphs would indicate that fund performance had constantly gained over the benchmark while the slopes were positive and should also signal further excess gains for the fund over the benchmark in the near-term future.

Example of a fund likely to outperform SPY

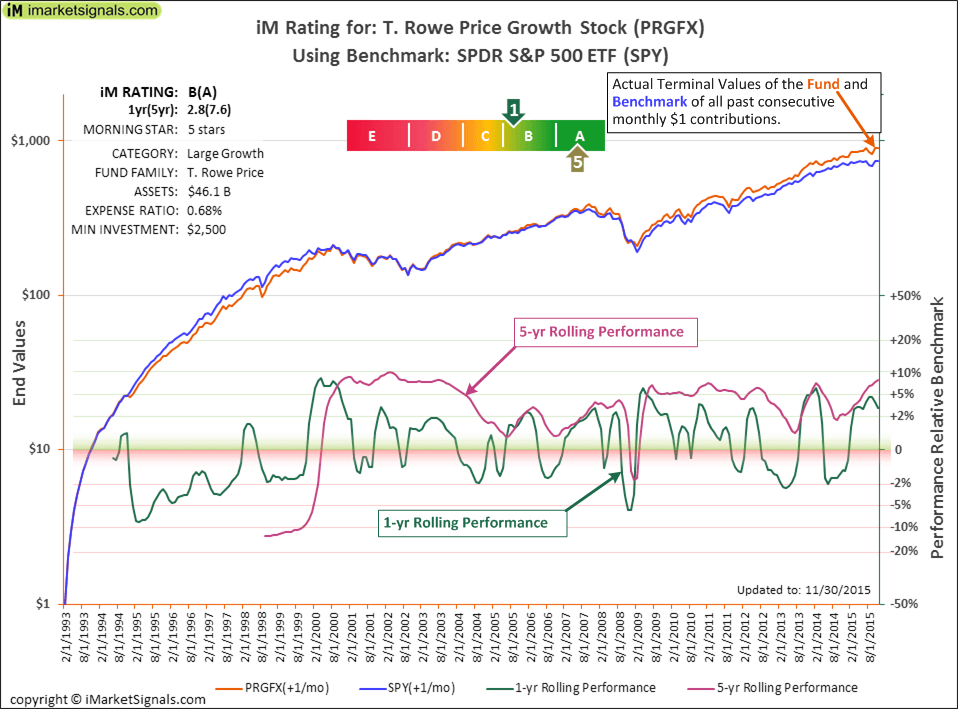

An example of a fund that should continue to provide better performance than the benchmark is T. Rowe Price Growth Stock (PRGFX) with an iM-Rating of B(A).

Had one invested $1.00 each month starting on the last day of February 1993, one would have contributed a total of $274 including the last contribution at the end of November 2015. The terminal value, that is the sum of all contributions including all gains and losses to November 2015, would have been $893. Had one made the same contributions to SPY then the terminal value would have been $746. A saver would have had 19.7% more money at the end from investing in PRGFX than from investing in SPY. The upper pair of graphs in the chart which are plotted to a semi-log scale shows the performances over time.

The terminal value rating system is especially useful to determine the likely future performance trend for a fund. The 1-yr and 5-yr Rolling Performances are shown by the green and purple graphs, respectively, at the bottom of the chart. One can see that since May-2000 for most of the time PRGFX provided better returns over five years for savers than SPY.

As of 11/30/2015 the value of the 5-yr Rolling Performance is +7.6%, and the 1-yr Rolling Performance is +2.8%. This indicates that over the last five years and one year a $1.00 per month investor would have had, respectively, 7.6% and 2.8% more savings from PRGFX than from SPY.

Both Rolling Performance values are positive and the slope of the 5-yr Rolling Performance graph since Aug-2014 is also positive, which is a good indication that performance of this fund relative to SPY should be higher also for the near-term future.

Example of a fund likely to underperform SPY

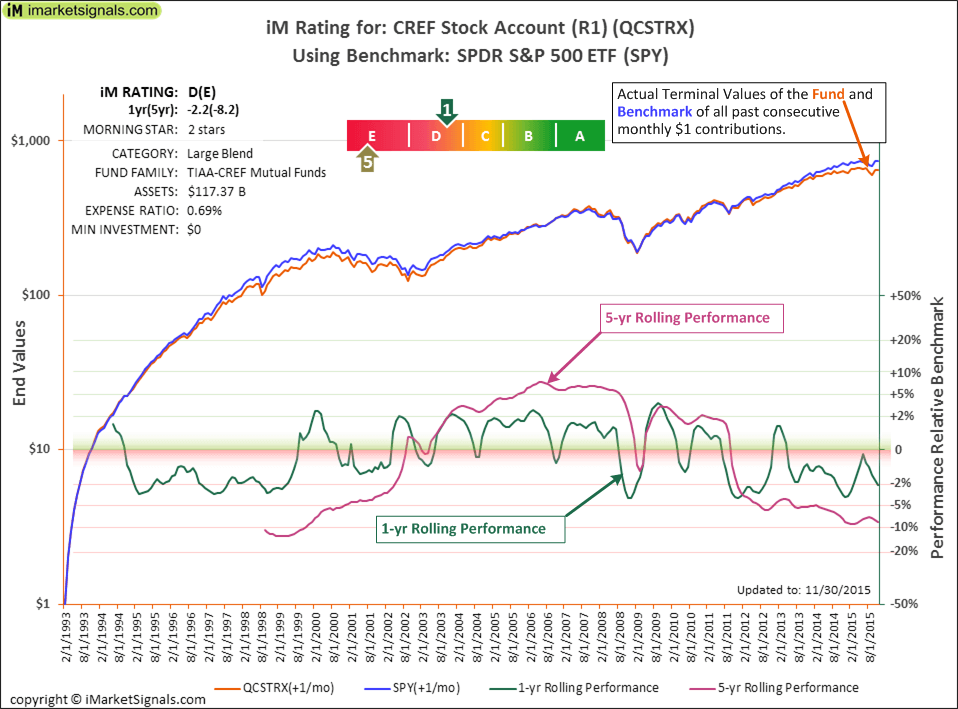

An example of a fund that will likely continue to underperform the index-fund is the CREF Stock Account (QCSTRX) with an iM-Rating of D(E). This is one of the oldest and largest actively managed stock funds in the U.S. with about $117-billion in assets, representing about 13.5% of total assets under management at TIAA-CREF.

Had one invested $1.00 each month starting on the last day of February 1993, one would have contributed a total of $274 including the last payment at the end of November 2015. The terminal value, that is the sum of all contributions including all gains and losses to November 2015, would have been $651. Had one made the same contributions to SPY then the terminal value would have been $746. A saver would have had 14.6% more money at the end from investing in SPY than investing in the CREF Stock Account. The upper pair of graphs in the chart which are plotted to a semi-log scale depicts the performances over time.

The fund versus benchmark 1-yr and 5-yr Rolling Performances are shown by the green and purple graphs, respectively, at the bottom of the chart. One can see that QCSTRX provided worse 5-yr returns for savers than SPY from 1998 to 2002 and then again from 2011 to 2015.

The latest value of the 5-yr Rolling Performance for QCSTRX is -8.2%, meaning that over the last five years a $1.00 per month investor would have had 8.2% less savings from the CREF Stock Account than from SPY.

Similarly, the 1-yr Rolling Performance for QCSTRX is -2.2%, meaning that over the last year a $1.00 per month investor would have had 2.2% less savings from the CREF Stock Account than from SPY.

Both Rolling Performance values are negative, and at the end the trajectories of both Rolling Performance graphs also point lower. This indicates that this fund is likely to provide lower returns for investors than SPY in the foreseeable future as well.

Conclusion

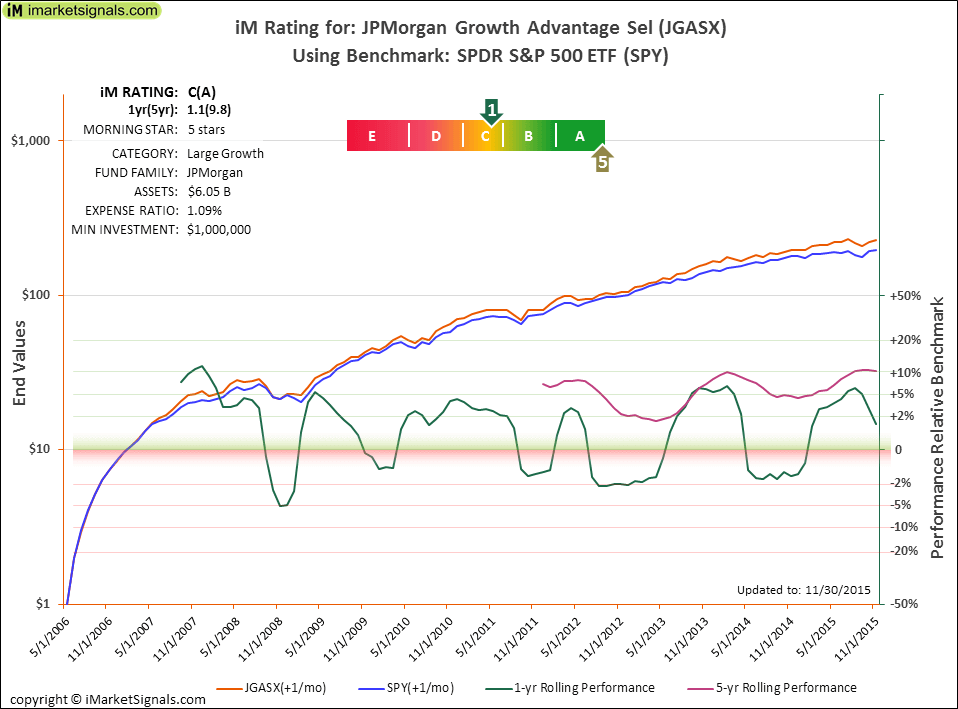

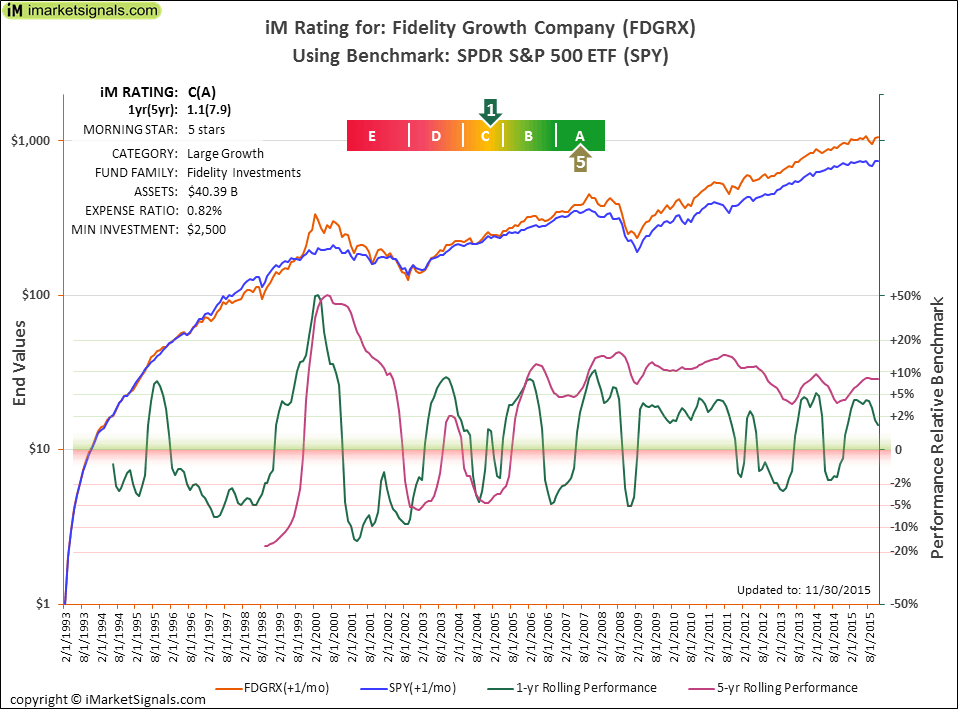

Of the many actively managed stock funds we investigated only a few funds have produced better returns than the benchmark SPY, and are likely to continue to outperform SPY. These funds are characterized with 1yr and 5yr ratings better than ‘C’, and would have had positive 5-yr Rolling Performance over longer periods. The charts and iM-Ratings for three such large-cap stock funds, JGASX, FDGRX and GTLLX are provided in the Appendix.

Please visit our dedicated webpage on imarketsignals.com for a listing of stock funds investigated with performance charts and iM-Ratings. If you are interested in the iM-Rating and chart for a particular fund not listed, please leave fund symbol and appropriate benchmark fund in the comment box at the bottom of the webpage so we can add the fund.

Appendix

Special terms and abbreviations

Terminal Value (TV): The sum of all contributions including all gains or losses from a specified starting date to the present or to a specified past date.

PRGFX(+1/mo), QCSTRX(+1/mo), SPY(+1/mo): Terminal values from all past consecutive monthly $1.00 contributions made in PRGFX, QCSTRX, and SPY.

1-yr Rolling Performance: The percentage difference between the terminal values from the past 12 consecutive rolling monthly $1.00 investments made in a fund and the benchmark, calculated as (TV12 (fund) – TV12 (bench) ) / TV12 (bench).

5-yr Rolling Performance: The percentage difference between the terminal values from the past 60 consecutive rolling monthly $1.00 investments made in a fund and the benchmark, calculated as (TV60 (fund) – TV60 (bench) ) / TV60 (bench).

iM-Rating Criteria

The Rating criteria are based on the most recent past 1-yr and 5-yr Rolling Performances with the thresholds as listed below.

| Performance Rating Thresholds | |

| Rating | Thresholds |

| A | above 6% |

| B | 2% to 6% |

| C | -1% to 2% |

| D | -5% to -1% |

| E | below -5% |

Other Funds likely to outperform SPY

JPMorgan Growth Advantage Sel (JGASX) with iM-Rating C(A). The funds VHIAX, JGACX, JGVRX, JGVVX are of the same class family and all enjoy the same rating.

Fidelity Growth Company (FDGRX) and FDEBX of the same class, both have an iM-Rating of C(A)

Glenmede Large Cap Growth (GTLLX) with IM-Rating C(A)

Very helpful.

Can you run the Nicholas fund through this analysis? NICSX. It has a good long term track record but this last year it didn’t beat SPY.

Also PRNHX is a smaller cap but has some solid returns. So that might be interesting.

Thanks.

Changed my mind on these two. Your three are much better. I also like TRBCX.