- The BestogaX universe of the Russell1000 consists of the so called “Vice” stocks (excluding Gaming stocks), plus the stocks from the GICS-sub-industries: Restaurants, Soft Drinks, and Internet Retail.

- A discussion on the merits of investing in the stocks of the BestogaX universe is available here.

- The iM-BestogaX5-System is a combination of the partially hedged BestogaX-5 Investor and Trader models, each of which periodically select five of the highest ranked stocks from the Russell1000 BestogaX universe.

- No market timing in the stock buy- and sell rules. During adverse market conditions it is hedged short SSO, with hedge ratios varying from 20% to 50% of current holdings.

- This system has a low turnover, because the specified minimum holding periods are one year, and three months for the Investor and Trader component models, respectively.

Simulated performance of component models

Please refer to the relevant model descriptions for performance curves of the two equal weight component models BestogaX-5 Investor partially hedged and BestogaX-5 Trader partially hedged.

Historic simulated performance of the iM-BestogaX-5 System

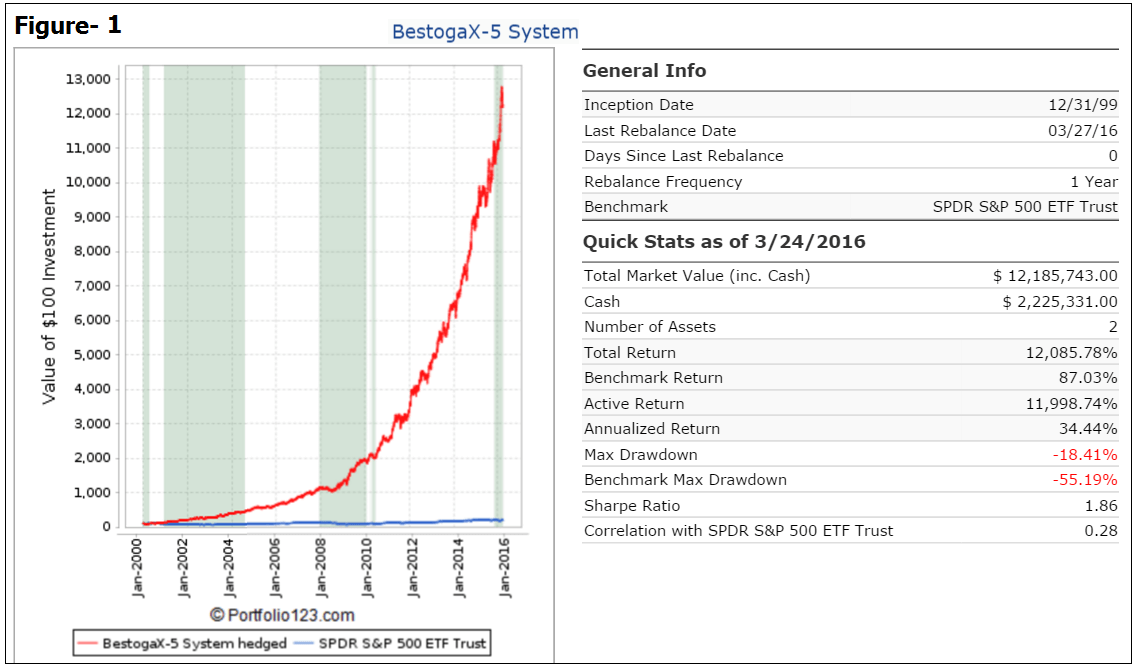

In the Figure-1 below, the red graph represents the simulated performance of the model and the blue graph shows the performance of the benchmark SPY.

- This combination model shows a simulated annualized return of 34.4% from January 2000 to March 2016, and maximum drawdowns would have been -18% in the year 2000.

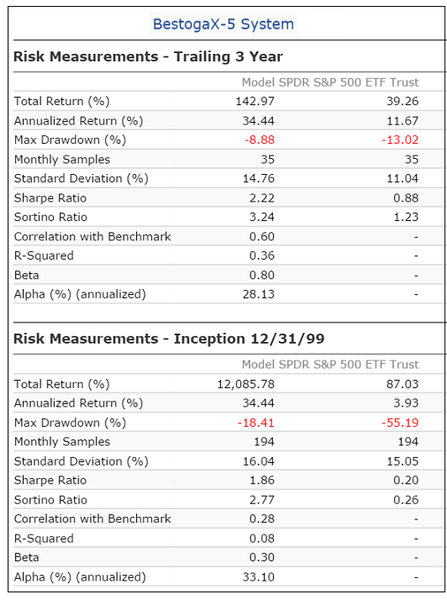

Return and risk figures for this combination model are shown in the table below.

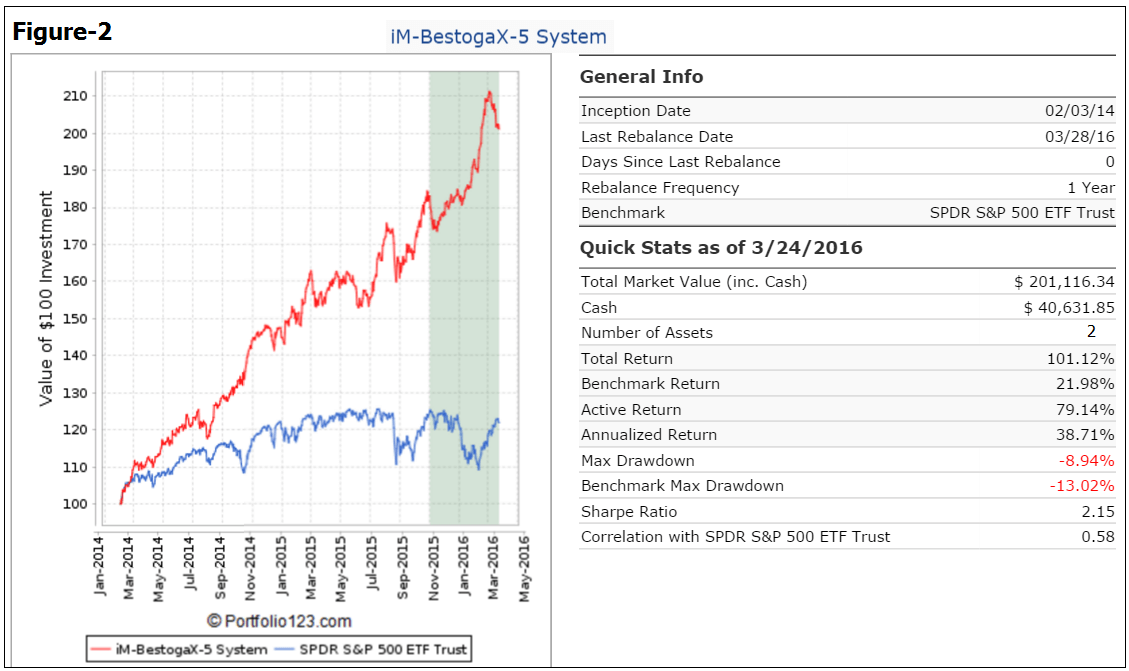

The simulated trading performance of the system from Feb-2014 to Mar-2016 is shown in Figure-2 below. The total return would have been 101% with maximum drawdown of -9.0%. It is apparent that the model continued to perform well during the period when returns for the general market were stagnant, or lower.

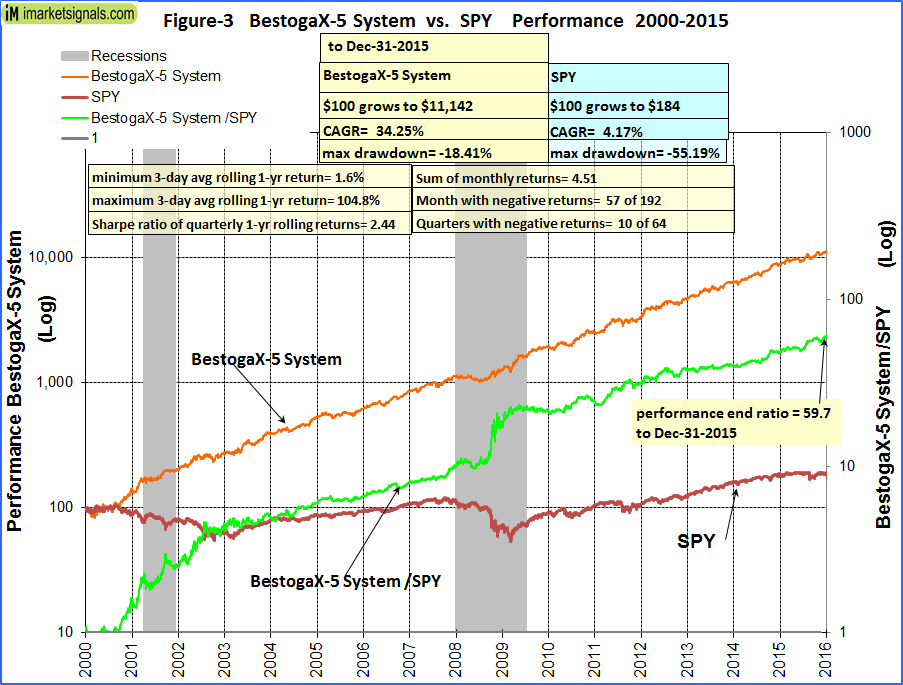

Figure-3 shows performance from Jan-2000 to Dec-2015. The green graph is the performance ratio of the BestogaX5-System to SPY. A rising slope of this graph indicates when it outperformed SPY; it produced about 60 times the value to December 2015 which one would have had from a buy-and-hold investment in SPY over the same period.

Annual Returns

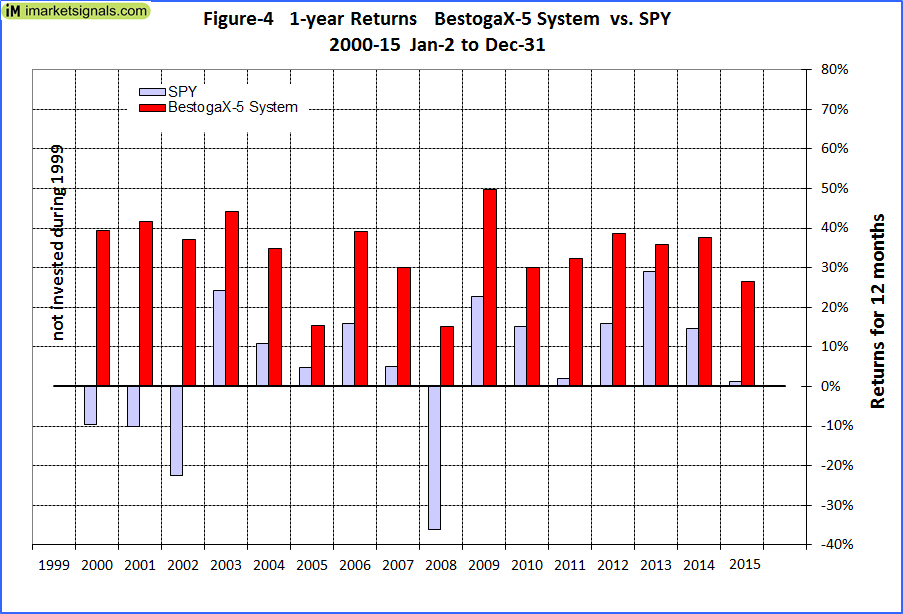

Calendar year performance shown in Figure-4 ranged from a maximum of 50% for 2009 to a minimum of 15% for 2005 and 2008. There would never have been a loss over any calendar year. All annual returns exceeded those of the benchmark SPY. Annual returns were relatively uniform, with none of the years showing excessive returns.

Rolling 1-year returns

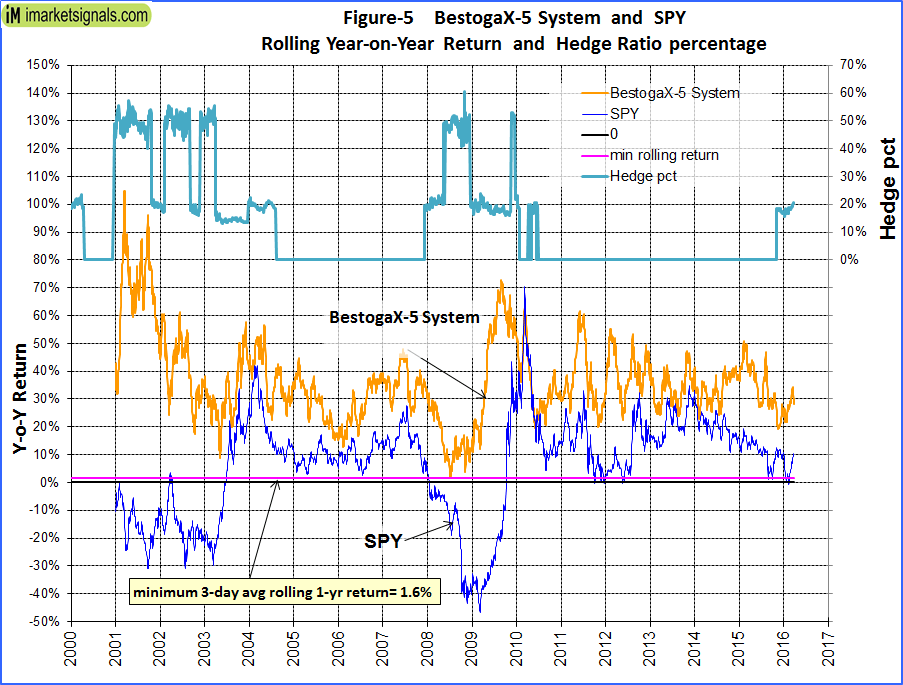

Figure 5 shows the rolling 1-year returns starting each trading day from 2000. The minimum return over 12 months would have been about 2% and the maximum about 70%. Also shown is the hedge ratio which varied from about 20% to 50% of current long holdings when the model was hedged.

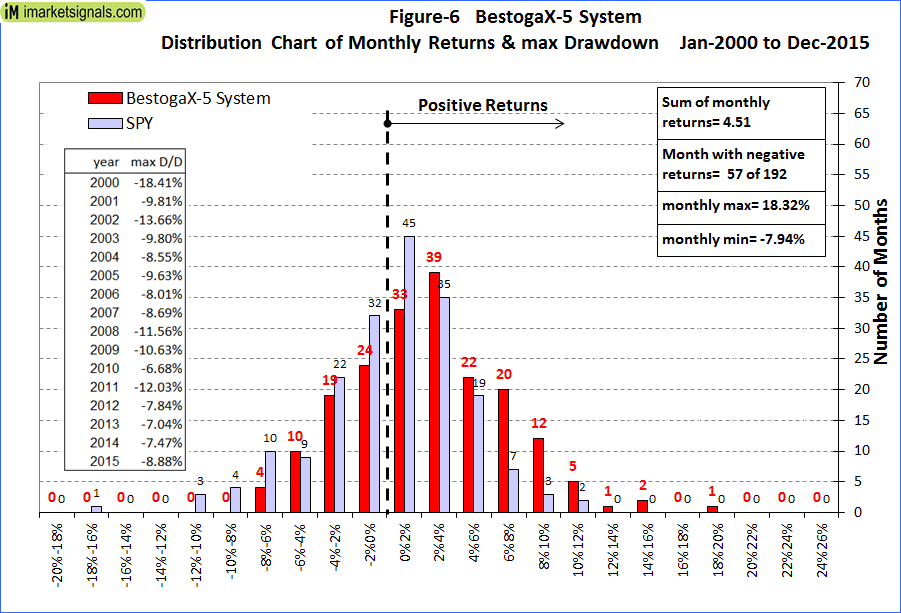

Distribution of Monthly Returns

Figure 6 shows the distribution of monthly returns. There were a total of 192 months in the period under consideration. The BestogaX5-System produced positive returns during 135 months and only 57 months had negative returns. SPY had 81 months of negative returns.

Also shown are the maximum drawdowns during each calendar year. The highest D/D of -18.4% occurred in the year 2000.

Following the Model

Detailed weekly performance updates, and trading signals, for the iM-BestogaX5-System will be available at iMarketSignals. (Gold subscription)

APPENDIX A

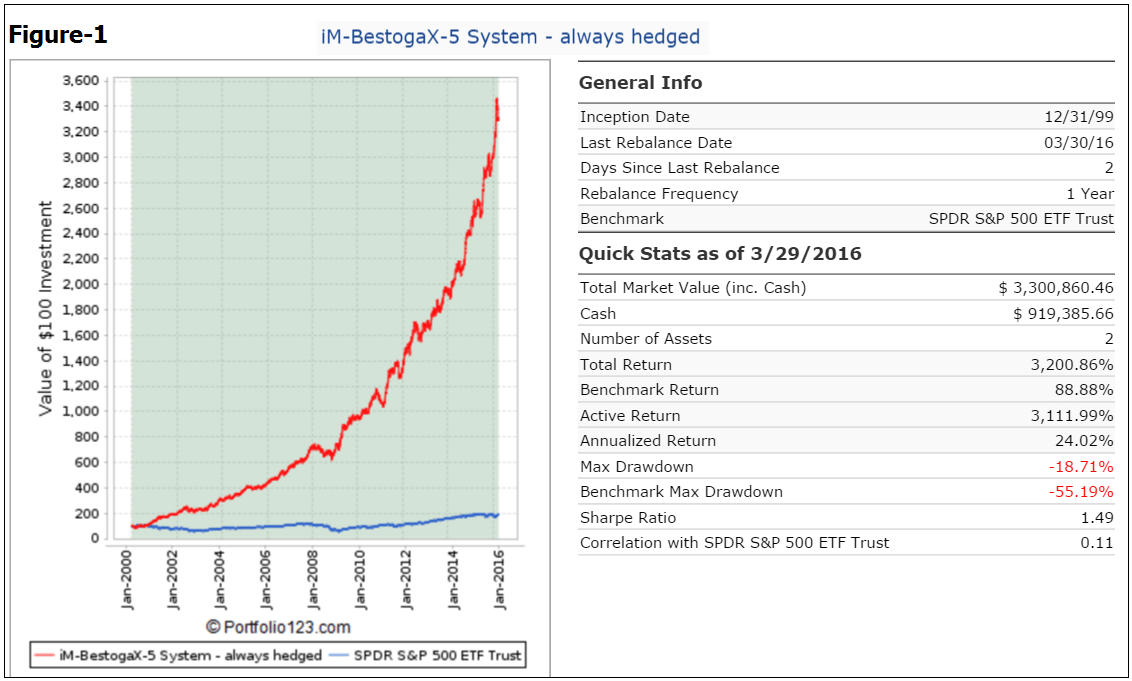

iM-BestogaX5-System – Always Hedged

The “iM-BestogaX5-System – Always Hedged” is a combination of the always hedged BestogaX-5 Investor and Trader models, each of which periodically select five of the highest ranked stocks from the Russell1000 BestogaX universe, and is always hedged short SSO, with a hedge ratio of 30% of current long holdings.

This model should be of interest to investors wanting to protect against “black swan events” and are prepared to accept lower returns due to the permanent hedge.

This combination model shows a simulated annualized return of 24.0% from January 2000 to March 2016, and maximum drawdown would have been -18.7%, as seen in Figure-1 below.

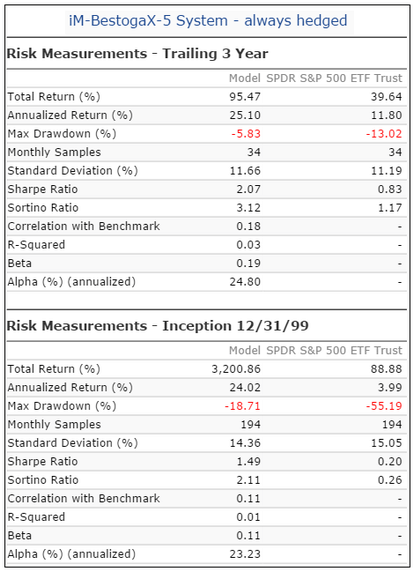

Return and risk figures for this combination model are shown in the table below.

Following the Model

Trading signals will not be provided, because stock holdings for this model are similar to the iM-BestogaX5-System, the only difference being that it is permanently hedged.

APPENDIX B

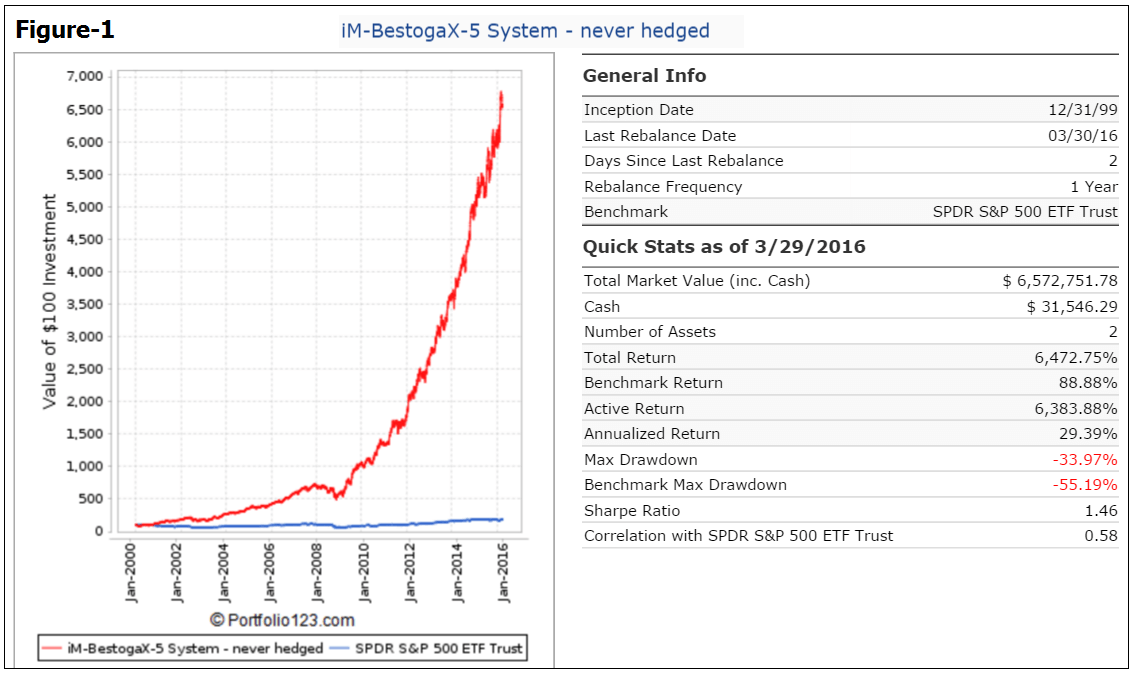

iM-BestogaX5-System – Never Hedged

The “iM-BestogaX5-System – Never Hedged” is a combination of the never hedged BestogaX-5 Investor and Trader models, each of which periodically select five of the highest ranked stocks from the Russell1000 BestogaX universe.

This model should be of interest to investors wanting to maximize returns during up-markets, and to those who provide their own hedging protection.

This combination model shows a simulated annualized return of 29.4% from January 2000 to March 2016, and maximum drawdown would have been -34.0%, as seen in Figure-1 below.

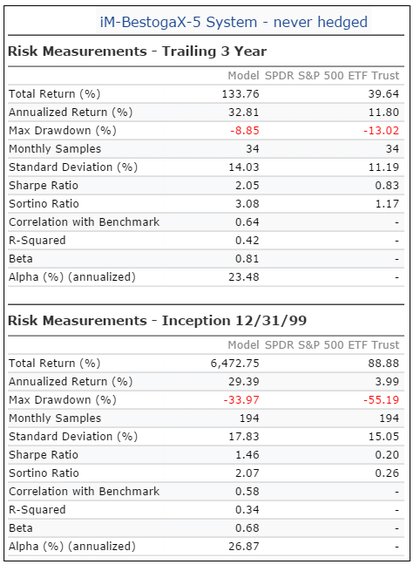

Return and risk figures for this combination model are shown in the table below

Following the Model

Trading signals will not be provided, because stock holdings for this model are similar to the iM-BestogaX5-System, the only difference being that it is never hedged.

Disclaimer

All results are presented for informational and educational purposes only and shall not be construed as advice to invest in any assets. Backtesting results should be interpreted in light of differences between simulated performance and actual trading, and an understanding that past performance is no guarantee of future results. All Systems should make investment choices based upon their own analysis of the asset, its expected returns and risks, or consult a financial adviser. The designer of this model is not a registered investment adviser.

Georg & Anton,

Have you thought of a NEW Combo6 where this system (Partially hedged BestogaX-5) replaces Bestoga3 (Sin stocks)as the 6th component?

You knew I would at least ask for a back-test of this new combo and request that you consider rolling it out, right? :-)

There are numerous combination possibilities for our models, and we cannot explore them all. Nothing is preventing you from using the BestogaX-5 System instead of Bestoga3 in a combination.

Georg,

Do you have any plans to develop software that will allow subscribers to combine all of these models into a book? Only a small amount of the great work that you offer is available on P123.

I would have a lot more confidence using your latest models if I knew how they were interacting with what I already have going on.

Thanks,

Jon

Unfortunately we have no such software. We use P123 for all our combos. However we are planning to demonstrate how to use the X5 models in combination with some of our Combo5 models.

Could all of your models be published on P123 so we could do this work ourselves?

Also we can’t publish them on P123, because we may not offer the same models simultaneously at iM and P123, except for the old Combo3 models for which we have a separate agreement.

Great system gentlemen. A couple of questions:

Does this system have 10 stocks total? 5 Investor & 5 Trader?

Will the stocks be listed as Investor or Trader in case one wants to follow either the Investor or Trader model by itself?

Thanks!

The System is a combo of two models, each of which holds 5 stocks from the same universe. Theoretically it can hold 10 different stocks, but this is not very likely.

Stock holdings for the Investor and Trader are reported separately.

For what it’s worth, SSO is on the hard to borrow list at TS.

For very similar results one can hedge the Trader with 100% short SPY, and the Investor with 80% short SPY of current holdings (excluding cash).

We are planning to have a X5 System hedged with long SDS for very similar returns.

1. I presume you can be long SDS rather than short SSO.

2. When you say 25% short SSO this means you are 50% hedged.

3. Can you explain why the two ports have different holdings and how they were selected.

Thanx

1. You can also hedge with long SDS and selling sufficient stock positions to pay for it. Hedge percentages remain for the Trader 60% long SDS, and for the Investor 40% long SDS.

2. correct

3. The two ports have different min holding periods (3-mo for the Trader, 12-mo for the Investor), so they select the new stocks at different times.

When the system is hedged with long SDS then weight of stock positions will be different than for the system with a short hedge. So, one cannot just take the holdings from the short hedged system and reduce them proportionally to pay for the long hedge.

Could you use margin to be long SDS to get similar results as using margin to be short SSO? That way no reduction in the stock positions would be required to fund the long SDS hedge %.

Yes, one can buy a long SDS hedge on margin and get very much the same results as selling short SSO. But this is actually not necessary.

The backtest results with SDS bought from funds when proportionally reducing stocks are:

Investor:

AR = 30.5%

D/D = -15.6%

Trader:

AR = 37.5%

D/D = -21.7%

Combo:

AR = 34.4%

D/D = -15.1%

So the Combo is the one, that the system provides signals for to Gold subscribers, right?

It appears by buying SDS (instead of shorting SSO), the CAGR remains the same at 34.4%, while the Max. Drawdown goes down from 18.41% to 15.1%.

Can you please confirm that I am interpreting this correctly i.e., it may be better to buy SDS than short SSO.

Thanks a bunch.

Georg,

Can you, or have you, published the returns using SDS hedge on margin, no selling of stock to pay for the hedge? I think the tax advantage would outweigh the cost of margin, all else being equal.

Jon

mmtdoc

The returns for the system with SDS bought on margin are similar to the returns with SSO. One would have to keep the hedge percentages for SDS the same as for SSO.

RV

Please see the description for for the System hedged with SDS.

https://imarketsignals.com/2016/im-bestogax-5sds-system-long-hedging-strategy/

Same question as above. Does using long SDS rather than short SSO have similar results?

Short SSO may be difficult due to low daily share volume and difficulty finding short shares.

Can you provide the results if SH was used in lieu of short SSO (or SDS). (Using the same hedge percent.) Return, drawdown and standard deviation would be very helpful.

Thank you.

Or if its easier, use short SPY with the stated short SSO hedge percent.

SPY short provides half protection of SSO short.

For very similar results one can hedge the Trader with 100% short SPY, and the Investor with 80% short SPY of current holdings (excluding cash).

I am very interested in understanding the impact of “half protection” of using short SPY vs SSO.

Thanks.

A system with Trader short hedged 60%SPY and Investor short hedged 40%SPY, providing “half protection”, increases max D/D and reduces return and Sharpe.:

Annualized Return 30.39%

Max Drawdown -24.14%

Sharpe Ratio 1.63

How do you determine how much to hedge 20% to 50%?

Seems like the hedge for both should be on. 50% in total.

Standard market timer is hedged so the investor 40% hedge should be on (20% since that model is 50% of the total).

And for the Trader, the Standard market timer is on and the 50 Day MA of the S&P 500 Index is lower than the 500 Day MA so the 60% hedge should be on (30% since this model is the other 50% of the total).

Am I missing something?

For the Std Market Timer there is an entry rule and an exit rule. So the Timer stays hedged from the date when the entry rule is fulfilled to the date when the exit rule is fulfilled. Currently the entry rule is no longer fulfilled, but the exit rule has not yet been triggered.

The entry rule for the hedge of the X5-Trader requires the entry rule for the Timer and for SMA50 to be less than the SMA500 of the S&P500 to be in place at the same time. The SMA condition came into being on 2/8/2016. At that time the Timer’s entry rule was no longer valid.

Therefor, the Trader is not hedged now, because both entry rules were not in place on 2/8/2016 or anytime thereafter.

Still have a couple of questions on the iM-BestogaX-5 System. Sorry to be pedantic but I want to make sure I have it right. Let’s assume that based on the current names MO and Sam have an initial cost of $20k each and the others cost $10k each for a grand total of $100k. What is the $ value of the short position of the SSO needed to hedge the position according to the system rules. If instead you buy SDS what is the dollar value of that you need to hedge the position.

Also in your calculation of the % long term gains of the system does your arithmetic take into account the cash received from the short sales?

BestogaX-5 System’s value of the short position is currently 20% of the value of all the long positions.

I one wants to hedge with long SDS then as per table at the end of the model description

https://imarketsignals.com/2016/im-bestogax-5sds-system-long-hedging-strategy/

one has to reduce the Investor long positions to 60% of what is shown, so that they amount to 30%.

All return figures include gains or losses of the short positions, including margin carry cost and any dividends payable for the borrowed SSO position.

Currently the BestogaX-5 System has 8 long positions and 1 short position SSO as per table below:

Ticker… Weight… Shares… Value

1 MO … 19.55% … 318 … $19,614.24

2 SAM … 19.54% … 109 … $19,599.29

3 CMG … 10.29% … 22 … $10,324.38

4 DPS … 9.61% … 109 … $9,638.87

5 PCLN … 10.62% … 8 … $10,655.20

6 DPZ … 10.36% … 75 … $10,396.50

7 EAT … 10.12% … 215 … $10,156.60

8 PM … 10.18% … 102 … $10,211.22

Total Long Positions $100,596.30

9 SSO … -20.11% … -310 … ($20,171.70)

Hi Georg

I am currently following the Combo 5 and bestoga X-5 systems. The current allocation for the former is 40% IEF, 40% SH and 20% QLD. Whilst not exact QLD is an almost opposing position to SH. So is there much point in having the SH and QLD positions (I understand the systems are independent of each other).

Regards

SK

QLD is not an opposing position to SH. QLD seeks daily investment results that correspond to two times (2x) the daily performance of the NASDAQ-100 Index.

So 2xSH would be an opposing position (approximately) to 1xQLD.

Thanks, perhaps I didnt make myself clear.

The combo5 current allocation is 40% SH and 20% QLD, so effectively an opposing position, so would one stay in cash ?

QLD neutralizes 2xSH. So effectively Combo5 (currently 5-11-2016) allocation is 40% IEF and 60% Cash.

Many thanks

Georg,

If the standard market timer now says no hedge, and 50/500 SMA condition

is met why is this model still showing 20% hedge?

The hedging rules are not identical for the two models.

Georg

Wondering about simplified approach to hedge using composite SPY/IEF as hedge trigger maybe 35% short SSO?

You are referring to the Composite Market Timer Stocks/Bonds (SPY-IEF) and using the periods when this model is in IEF as the hedge periods.

One could do this, but the problem with this strategy is that from 2000 to 2017 there were 36 periods when the Timer was in IEF.

A backtest for the BestogaX5 Trader shows improved return from 25.7% to 32.3%, and improved max D/D from -39.9% to -21.7%, for the un-hedged vs the model hedged short 35% SSO.

Hi –

I am unclear about asset allocation with regards to the hedge (in a partially hedged Bestoga system).

Do I hold a certain percentage of the portfolio in cash in case a hedge becomes necessary? Would I sell a certain percentage of the stocks to raise funds for the hedge?

thank you

The models assume you would sell a certain percentage of the stocks to raise funds for the hedge. The Investor model sells 40% of current holdings, and the Trader model sells 60% of current holdings.