Market Signals Summary:

The IBH stock market model is out of the market. The MAC stock market model is invested, The recession indicator COMP is lower than last week’s revised level, and iM-BCIg is down from last week’s level. MAC-AU is again invested in the stock market. The bond market model avoids high beta (long) bonds, the yield curve has long-term steepening trend, both the gold and silver model are invested.

Stock-markets:

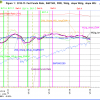

The IBH-model is out of the market as shown in Fig. 1. A Sell A signal was generated 27 weeks ago. The IBH-model is described here and the latest rules can be found here .

The IBH-model is out of the market as shown in Fig. 1. A Sell A signal was generated 27 weeks ago. The IBH-model is described here and the latest rules can be found here .

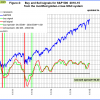

The MAC-US model stays invested. MAC-US Fig 2 shows the spreads of the moving averages. The sell-spread is up from last week’s level. A sell signals is not imminent. The sell spread (red graph) has to move below the zero line for a sell signal.

The MAC-US model stays invested. MAC-US Fig 2 shows the spreads of the moving averages. The sell-spread is up from last week’s level. A sell signals is not imminent. The sell spread (red graph) has to move below the zero line for a sell signal.

The MAC-AU model is again in the market. A buy signal was generated this week. The buy-spread is higher than last week’s level and above zero. A sell signal will only be generated when the sell-spread (red graph) moves from above to below zero.

The MAC-AU model is again in the market. A buy signal was generated this week. The buy-spread is higher than last week’s level and above zero. A sell signal will only be generated when the sell-spread (red graph) moves from above to below zero.

This model and its application is described in MAC-Australia: A Moving Average Crossover System for Superannuation Asset Allocations.

Recession:

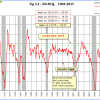

In Fig. 3 one can see that COMP is down from last week’s level, and far away from signaling recession. COMP can be used for stock market exit timing as discussed in this article The Use of Recession Indicators in Stock Market Timing.

Fig. 3.1 shows our recession indicator iM-BCIg, is down from last week’s revised level. A recession is not imminent as one can clearly see.

Fig. 3.1 shows our recession indicator iM-BCIg, is down from last week’s revised level. A recession is not imminent as one can clearly see.

Please also refer to the BCI page

Leave a Reply

You must be logged in to post a comment.