There is no bell ringing when the market peaks before recessions, but indicators such as iMarketSignals’ Business Cycle Index (BCI) are useful in identifying recession starts well in advance. By exiting the stock market at the time of BCI’s recession signals, investors would still have avoided about 60% of the market declines from pre-recession peaks to inter-recession troughs on average.

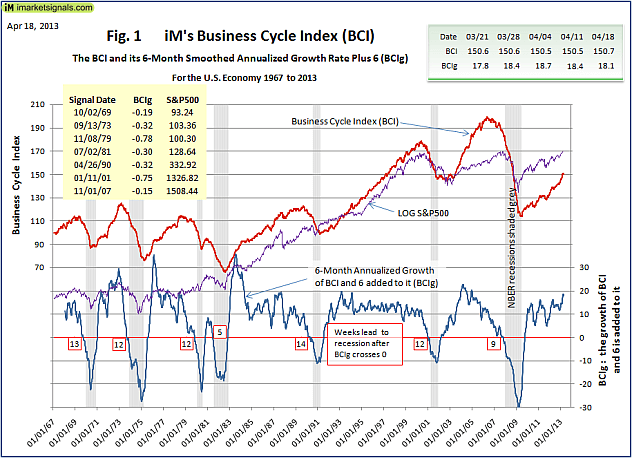

The BCI, its growth BCIg, signal dates and the S&P500 are shown in Figure 1.

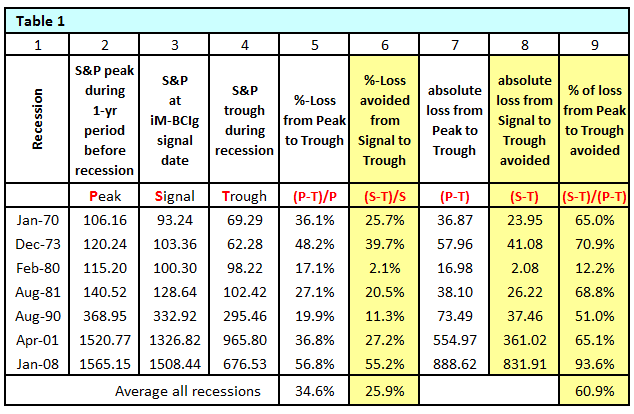

In Table 1 below we record for each recession the pre-recession peak of the S&P500, the value on the day of the BCIg signal, and the subsequent lowest value of the inter-recession trough. From these we calculate the loss avoided by exiting the market on the day of the BCIg signal.

Following the signals from our recession indicator one would have avoided on average about 61% of the total market decline from pre-recession peaks to inter-recession troughs as indicated in the last column of Table 1. One can see in column 6 that exiting the market at the signal dates would have avoided losses averaging about 26%. Had one known the market peak, one could have avoided the 35% average decline as shown in column 5. Prior to the last recession the exit signal from BCIg occurred almost when the market peaked.

The BCI was developed for reliable recession prediction, thus re-entry signals into the market are provided by other models.

Georg,

Do you currently have a model to re-enter the market, or are you working on one?

Thanks

Hi Georg,

I’d also be interested in a model to re-enter the market based on the BCI if you have one.

Thanks

James