- The Trade Weighted US Dollar Index has been growing since Q4 2011. Its growth rate increasing over the last six months.

- The annual rise in CPI is below 2%, and the US economy remains relatively weak.

- The US Market is attracting foreign capital that is fleeing their local currency devaluation, fueling the US bull market.

- There is no reason for the Fed to increase interest rates under these conditions.

- Interest rates will probably rise once the dollar reverses its gains.

In October 2014 the Fed announced that QE has ended and that it is keeping record low interest rates for “a considerable time”. The question arises “When will the Fed increase interest rates?” Some analysts are speculating for rate hikes in April or May this year. We believe that history may provide better guidance.

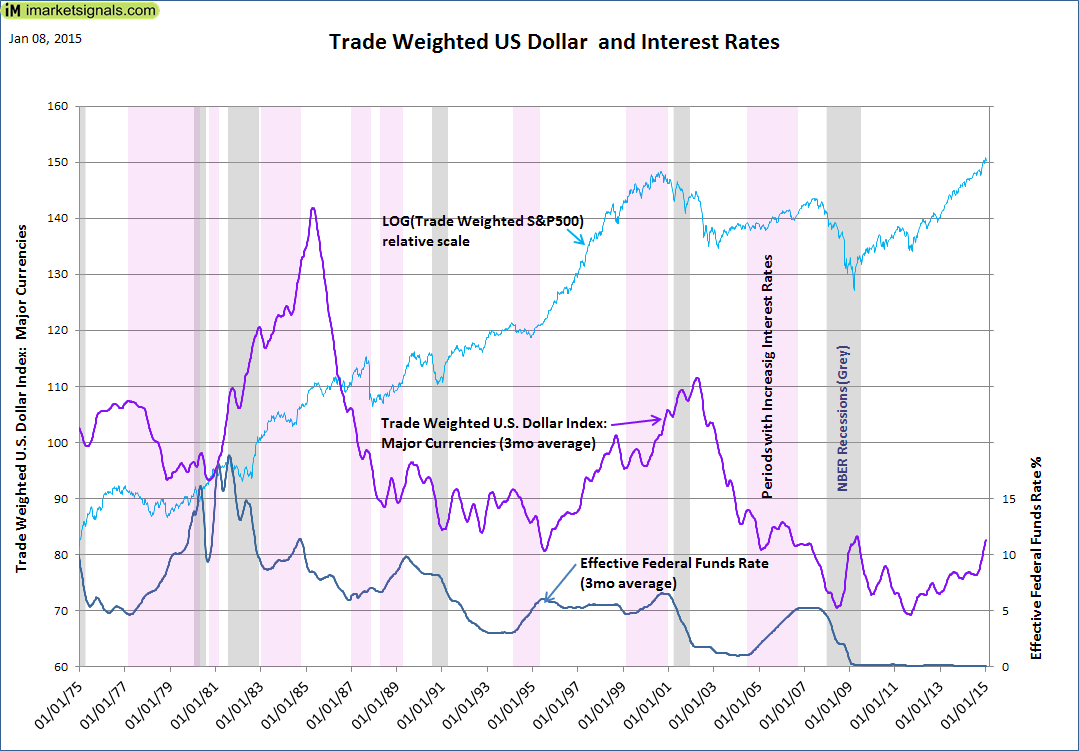

Below we chart the Trade Weighted U.S. Dollar Index for the major currencies and the Effective Federal Funds Rate, both smoothed by three months moving averages. In the last forty years one can identify eight periods of prolonged interest rate hikes. One also notes that seven of the eight periods occurred when the Dollar Index was stagnant or declining, the period 1983 to 85 is the exception.

The present cycle of weakening major world currencies relative to the US dollar started end of 2011, with a marked acceleration during the last six months that is seemingly set to continue.

The US stock market measured in trade weighted US dollars, that is how a foreign investor would see it, has performed well and only recently passed its 2000 peak. Thus, the US dollar has become desirable to foreign investors who are fleeing their local currency and are looking for safer havens in US Treasuries and large-cap stocks. Therefore, foreign capital appears to be providing the liquidity fueling the current bull market in large-cap stocks and Treasuries.

So why would the Fed increase interest rates and slow the economy when the annual growth of the Consumer Price Index is below 2%, with the latest November figure at 1.32%. According to Fed’s website “The Federal Open Market Committee (FOMC) judges that inflation at the rate of 2 percent ………… is most consistent over the longer run with the Federal Reserve’s mandate for price stability and maximum employment.”

Under the prevailing economic conditions it would only make sense to raise the interest rates to support the US dollar against rising foreign currencies. Once the Trade Weighted Dollar Index starts to flatten or fall, as was the case during 7 of the 8 prolonged periods of rising rates in the last forty years, then interest rates may go up.

Leave a Reply

You must be logged in to post a comment.