Market Signals Summary:

The S&P 500 Coppock Indicator, MAC-US and the iM-Google Trend is disinvested from the markets, whereas the MAC-US, the 3-month Hi-Lo Index, and CAPE-Cycle-ID is invested The BCIg does not signal a recession as does the growth of the Conference Board’s Leading Economic Indicator. The Forward Rate Ratio between the 2 and 10 is no longer inverted and the curve is steepening. The iM-Gold Coppock and the iM-Gold Timer are invested in gold. The iM-Silver Coppock is invested in silver.

Stock-markets:

The MAC-US model is invested since mid June 2025,

The MAC-US model is invested since mid June 2025,

.

The 3-mo Hi-Lo Index Index of the S&P500 is at 6.6% (last week 9.0%) and entered the markets mid June, 2025.

The 3-mo Hi-Lo Index Index of the S&P500 is at 6.6% (last week 9.0%) and entered the markets mid June, 2025.

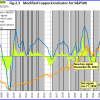

The Coppock indicator for the S&P500 invested the the US stock markets mid August 2024. This indicator is described here.

The Coppock indicator for the S&P500 invested the the US stock markets mid August 2024. This indicator is described here.

The MAC-AU model is dis-invested from the Australian stock market sine end April 2025.

The MAC-AU model is dis-invested from the Australian stock market sine end April 2025.

This model and its application is described in MAC-Australia: A Moving Average Crossover System for Superannuation Asset Allocations.

Recession:

BCIg is not signaling a recession.

BCIg is not signaling a recession.

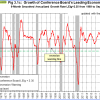

The growth of the Conference Board’s Leading Economic Indicator does not signal a recession.

The growth of the Conference Board’s Leading Economic Indicator does not signal a recession.

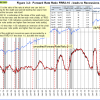

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) is no longer inverted and the curve is steepening.

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) is no longer inverted and the curve is steepening.

A description of this indicator can be found here.

The iM-Low Frequency Timer switched to bonds on 9/26/2022.

The iM-Low Frequency Timer switched to bonds on 9/26/2022.

A description of this indicator can be found here.