Market Signals Summary:

The Hi-Lo Index of the S&P 500, the iM-Google Trend Timer and the CAPE-Cycle-ID are out of the stock markets. The bond market model begins to favor high beta (long) bonds. However, the MAC-US as well as the S&P 500 Coppock Indicator are invested the Stock Market since the first week of February 2023. All our recession indicators are signalling a recession: BCIg is signalling a recession since March 16, 2023; the Forward Rate Ratio between the 2 and 10 year rates inverted beginning August 2022 thus signalling a recession; and the growth of the Conference Board’s Leading Economic Indicator is signalling a recession since November 2022. The Gold Coppock is invested in gold, so is the iM-Gold Timer. The Silver Coppock model generated a buy signal and is invested in silver.

Stock-markets:

The MAC-US model invested the US stock markets in first week of February 2023.

The MAC-US model invested the US stock markets in first week of February 2023.

The 3-mo Hi-Lo Index Index of the S&P500 is at -4.43% (last week -4.66%), and exited the stock markets March 7, 2023.

The 3-mo Hi-Lo Index Index of the S&P500 is at -4.43% (last week -4.66%), and exited the stock markets March 7, 2023.

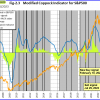

The Coppock indicator for the S&P500 entered the the US stock markets in the first week February 2023. This indicator is described here.

The Coppock indicator for the S&P500 entered the the US stock markets in the first week February 2023. This indicator is described here.

The MAC-AU model generated a buy signal end August 2022, and is invested the Australian stock market.

The MAC-AU model generated a buy signal end August 2022, and is invested the Australian stock market.

This model and its application is described in MAC-Australia: A Moving Average Crossover System for Superannuation Asset Allocations.

Recession:

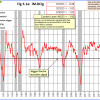

After the DOL backward revised its data (more here), BCIg signals a recession since March 16, 2023

After the DOL backward revised its data (more here), BCIg signals a recession since March 16, 2023

The growth of the Conference Board’s Leading Economic Indicator after the August 18 update signals a recession. The November 18 update of the Leading Economic Indicator is signaling that the US economy is/will soon be in a recession.

The growth of the Conference Board’s Leading Economic Indicator after the August 18 update signals a recession. The November 18 update of the Leading Economic Indicator is signaling that the US economy is/will soon be in a recession.

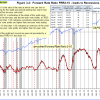

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) inverted beginning August 2022 and is signalling a recession — the average lead time of this signal is 14 months.

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) inverted beginning August 2022 and is signalling a recession — the average lead time of this signal is 14 months.

A description of this indicator can be found here.

The iM-Low Frequency Timer switched to bonds on 9/26/2023.

The iM-Low Frequency Timer switched to bonds on 9/26/2023.

A description of this indicator can be found here.