|

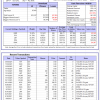

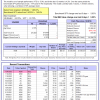

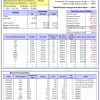

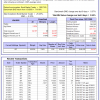

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

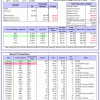

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -5.9%, and for the last 12 months is 8.8%. Over the same period the benchmark E60B40 performance was -5.2% and 8.6% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -2.03% at a time when SPY gained -1.97%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $153,190 which includes $1,351 cash and excludes $1,786 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -6.4%, and for the last 12 months is 9.7%. Over the same period the benchmark E60B40 performance was -5.2% and 8.6% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -2.41% at a time when SPY gained -1.97%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $157,306 which includes $819 cash and excludes $1,921 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -6.9%, and for the last 12 months is 10.5%. Over the same period the benchmark E60B40 performance was -5.2% and 8.6% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -2.77% at a time when SPY gained -1.97%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $161,275 which includes $517 cash and excludes $2,048 spent on fees and slippage. |

|

|

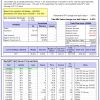

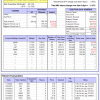

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 376.04% while the benchmark SPY gained 140.79% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -4.03% at a time when SPY gained -3.65%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $119,010 which includes -$3,271 cash and excludes $1,577 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 290.54% while the benchmark SPY gained 140.79% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -6.59% at a time when SPY gained -3.65%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $97,634 which includes $79 cash and excludes $998 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 546.43% while the benchmark SPY gained 140.79% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -5.82% at a time when SPY gained -3.65%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $646,426 which includes $796 cash and excludes $8,372 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 129.98% while the benchmark SPY gained 140.79% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -6.29% at a time when SPY gained -3.65%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $229,980 which includes $719 cash and excludes $7,276 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 287.58% while the benchmark SPY gained 140.79% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -2.80% at a time when SPY gained -3.65%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $387,580 which includes $2,616 cash and excludes $4,141 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 499.88% while the benchmark SPY gained 140.79% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained -5.88% at a time when SPY gained -3.65%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $599,877 which includes $3,059 cash and excludes $1,675 spent on fees and slippage. |

|

|

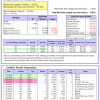

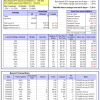

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 196.51% while the benchmark SPY gained 140.79% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -1.28% at a time when SPY gained -3.65%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $296,513 which includes $2,114 cash and excludes $1,529 spent on fees and slippage. |

|

|

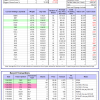

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 383.68% while the benchmark SPY gained 140.79% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained -1.14% at a time when SPY gained -3.65%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $483,678 which includes $10,843 cash and excludes $6,369 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 112.88% while the benchmark SPY gained 140.79% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained -0.61% at a time when SPY gained -3.65%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $212,883 which includes $35 cash and excludes $8,476 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 221.12% while the benchmark SPY gained 140.79% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -1.03% at a time when SPY gained -3.65%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $321,120 which includes $6,637 cash and excludes $3,525 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 23.06% while the benchmark SPY gained 24.99% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained -2.76% at a time when SPY gained -3.65%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $123,057 which includes $3,175 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is -0.8%, and for the last 12 months is 14.6%. Over the same period the benchmark SPY performance was -7.4% and 16.4% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -3.40% at a time when SPY gained -3.65%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $399,290 which includes $3,140 cash and excludes $7,395 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is -5.0%, and for the last 12 months is 4.2%. Over the same period the benchmark SPY performance was -7.4% and 16.4% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 3.02% at a time when SPY gained -3.65%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to -$165 which includes $77,643 cash and excludes Gain to date spent on fees and slippage. |

|

|

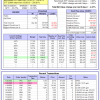

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -1.9%, and for the last 12 months is 8.9%. Over the same period the benchmark SPY performance was -7.4% and 16.4% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.93% at a time when SPY gained -3.65%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $288,531 which includes $4,526 cash and excludes $862 spent on fees and slippage. |

|

|

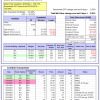

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -7.3%, and for the last 12 months is 16.3%. Over the same period the benchmark SPY performance was -7.4% and 16.4% respectively. Over the previous week the market value of Best(SPY-SH) gained -3.58% at a time when SPY gained -3.65%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $788,975 which includes $2,981 cash and excludes $25,129 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -7.2%, and for the last 12 months is 10.5%. Over the same period the benchmark SPY performance was -7.4% and 16.4% respectively. Over the previous week the market value of iM-Combo3.R1 gained -2.89% at a time when SPY gained -3.65%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $195,459 which includes $4,878 cash and excludes $7,447 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -9.1%, and for the last 12 months is 12.3%. Over the same period the benchmark SPY performance was -7.4% and 16.4% respectively. Over the previous week the market value of iM-Combo5 gained -3.28% at a time when SPY gained -3.65%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $206,531 which includes $4,332 cash and excludes $0 spent on fees and slippage. |

|

|

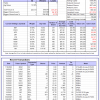

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -8.1%, and for the last 12 months is 10.4%. Over the same period the benchmark SPY performance was -7.4% and 16.4% respectively. Since inception, on 7/1/2014, the model gained 194.38% while the benchmark SPY gained 158.48% and VDIGX gained 148.57% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -3.04% at a time when SPY gained -3.65%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $294,376 which includes $1,271 cash and excludes $4,175 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 0.2%, and for the last 12 months is 15.6%. Over the same period the benchmark SPY performance was -7.4% and 16.4% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -1.93% at a time when SPY gained -3.65%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $217,912 which includes $2,728 cash and excludes $1,899 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -0.7%, and for the last 12 months is 15.3%. Over the same period the benchmark SPY performance was -7.4% and 16.4% respectively. Since inception, on 6/30/2014, the model gained 160.56% while the benchmark SPY gained 158.48% and the ETF USMV gained 134.66% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -2.01% at a time when SPY gained -3.65%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $260,561 which includes $1,765 cash and excludes $7,422 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 0.7%, and for the last 12 months is 29.3%. Over the same period the benchmark SPY performance was -7.4% and 16.4% respectively. Since inception, on 1/3/2013, the model gained 478.33% while the benchmark SPY gained 256.81% and the ETF USMV gained 256.81% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -2.47% at a time when SPY gained -3.65%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $578,330 which includes $25 cash and excludes $5,308 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -1.9%, and for the last 12 months is 0.2%. Over the same period the benchmark BND performance was -1.8% and -2.7% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 0.95% at a time when BND gained 0.57%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $148,995 which includes $564 cash and excludes $2,147 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -1.9%, and for the last 12 months is 8.9%. Over the same period the benchmark SPY performance was -7.4% and 16.4% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.93% at a time when SPY gained -3.65%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $288,531 which includes $4,526 cash and excludes $862 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -4.2%, and for the last 12 months is 15.8%. Over the same period the benchmark SPY performance was -7.4% and 16.4% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -0.93% at a time when SPY gained -3.65%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $149,168 which includes $4,209 cash and excludes $1,386 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -4.8%, and for the last 12 months is 18.7%. Over the same period the benchmark SPY performance was -7.4% and 16.4% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -1.88% at a time when SPY gained -3.65%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $160,313 which includes $6,089 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -7.3%, and for the last 12 months is 16.2%. Over the same period the benchmark SPY performance was -7.4% and 16.4% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -3.58% at a time when SPY gained -3.65%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $186,612 which includes $3,639 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -1.0%, and for the last 12 months is 8.8%. Over the same period the benchmark SPY performance was -7.4% and 16.4% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 1.54% at a time when SPY gained -3.65%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $176,879 which includes -$1,992 cash and excludes $8,558 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.