- This is a copycat trading strategy based on the quarterly 13F filings of 10 large hedge funds with assets under management (AUM) greater than $3.5-Billion.

- The algorithm looks at the top 20 largest holdings from each of the 10 filers and then picks the 15 most frequently held stocks among all of the filers.

- The model selects 12 of the 15 consensus picks from this hedge fund group with a ranking system based on quality.

- Changes in the holdings occur only every three months, about 45 days after the end of a quarter when 13F filings become public information, February, May, August, and November.

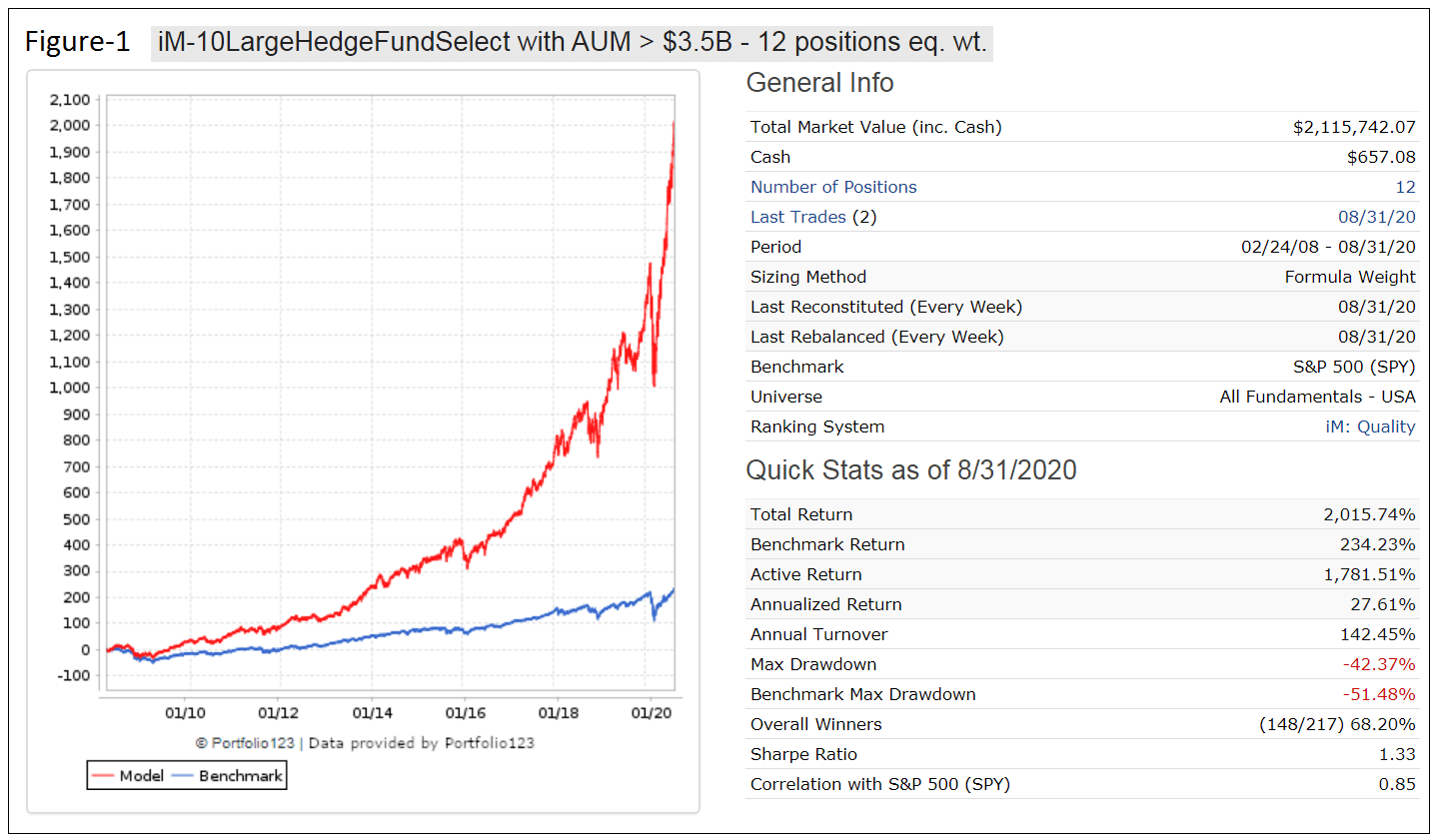

- From Feb-2008 to Aug-2020 this strategy would have produced an annualized return (CAGR) of 27.6%, significantly more than the 10.1% CAGR of the S&P 500 ETF (SPY) over this period.

Rational for a Copycat Strategy

Research from Barclay and Novus published in October 2019 found that a stock selection copycat strategy that combines conviction and consensus of fund managers that have longer-term views outperformed the S&P 500 by 3.80% on average annually from Q1 2004 to Q2 2019.

Similarly our weekly published Best10(VDIGX) trading model, which selects the 10 highest ranked stocks from the holdings of the of the Vanguard Dividend Growth Fund (VDIGX) outperformed the fund and SPY since July 2014 on average by about 5.4% annually.

Therefore, relying on the stock picking expertise of professional fund managers should provide superior returns than a “do-it-yourself” strategy for an average investor.

Stock Selection from the Fund Manager Group

This model only considers hedge funds with AUM greater than $3.5-Billion. This is because of the recent SEC proposal to dramatically raise the required reporting threshold for 13F filings from $100-million to $3,500-million, despite numerous objections from the public.

Stocks come from the quarterly 13F filings, point in time, approximately 45 days after the end of month filing date of each quarter, typically by the middle of February, May, August and November. Thus, the model is reconstituted with an approximate 45-day lag after the quarter-end, with positions occasionally rebalanced to equally weight more often.

Hedge Fund Filers (AUM as of 3/31/2020):

- AKRE CAPITAL MANAGEMENT (10.9 B)

- ALTIMETER CAPITAL MANAGEMENT (4.5 B)

- COATUE MANAGEMENT (12.6 B)

- ECHO STREET CAPITAL MANAGEMENT (6.5 B)

- LOOMIS SAYLES & COMPANY L P (58.8 B)

- PERCEPTIVE ADVISORS (3.8 B)

- RENAISSANCE TECHNOLOGIES (130.1 B)

- RIVERBRIDGE PARTNERS (4.8 B)

- TCI FUND MANAGEMENT LTD (22.6 B)

- WHALE ROCK CAPITAL MANAGEMENT (5.9 B)

The top 15 consensus picks from the group are selected by looking at each fund’s top 20 holdings and counting the number of times a stock is found in all of the funds. Stocks with the highest count are picked first.

The model then ranks the consensus picks with a ranking system based on quality to hold 12 positions.

The Ranking System

This ranking systems focuses on a single well-recognized investing style, it identifies shares of the highest “quality” companies.

The factors and weights used in this ranking system are

1. Profit Margins: 20%

2. Turnover: 20%

3. Returns on Capital: 40%

4. Financial Strength: 20%

Returns on Capital are the primary indicators of management accomplishment. Margin and Turnover are components of Return on Capital. And Financial Strength is a measure of business risk.

Historic Performance

Figure-1 shows the performance of this strategy since Feb-2008 backtested on the on-line portfolio simulation platform Portfolio 123. It would have produced an annualized return of 27.6% with low 1.4-times annual turnover, with trading costs of about 0.12% of each trade amount taken into account. The total return is almost 9-times that of SPY and the average holding period for a position would have been 220 days.

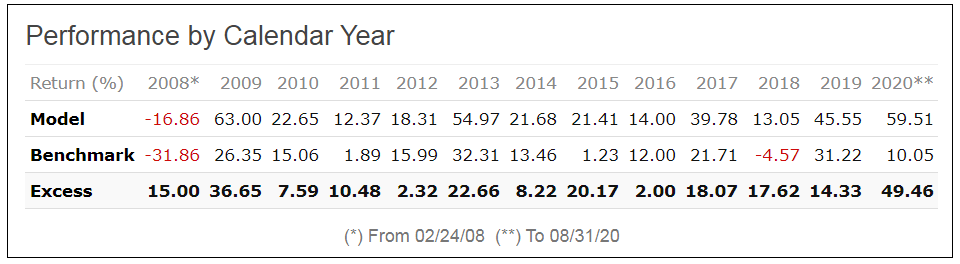

The model outperformed the benchmark SPY every calendar year, as can be seen from the table below.

Conclusion:

The analysis shows that a hedge fund copycat strategy would have produced excellent returns and should be preferable to a buy-and-hold investment strategy of index funds. Minimum trading is required, only four times per year. The current holdings are listed in the appendix.

Gold members at iMarketSignals can follow this strategy; buy/sell signals and performance are updated weekly. The next holdings update will be middle of November 2020, but the holdings’ weights should be periodically rebalanced to equal weight.

Appendix

Current Holdings (as of 8/31/2020)

| Ticker | Name | MktCap | Days Held | Sector |

| ADSK | Autodesk Inc. | 54 B | 14 | Technology |

| AMZN | Amazon.com Inc | 1,729 B | 1924 | Consumer Non-Cyclicals |

| BA | Boeing Co | 97 B | 14 | Industrials |

| CSGP | CoStar Group Inc | 33 B | 189 | Technology |

| DIS | Walt Disney Co (The) | 235 B | 14 | Consumer Services |

| FB | Facebook Inc | 836 B | 2471 | Technology |

| GOOGL | Alphabet Inc | 1,110 B | 1743 | Technology |

| MSFT | Microsoft Corp | 1,707 B | 923 | Technology |

| PYPL | PayPal Holdings Inc | 239 B | 105 | Finance |

| SPGI | S&P Global Inc | 88 B | 105 | Technology |

| TSLA | Tesla Inc | 463 B | 105 | Consumer Cyclicals |

| VRSK | Verisk Analytics Inc | 30 B | 1106 | Business Services |

Re. updates this week: what is difference between “5-Hedge Fund Select”, and “10-Hedge Fund Select”?

Thanks,

Tom C

Georg,

as usual great work!

1. How did you pick THESE Hedge Funds (and not some others) ?

2. A 42% drawdown is nerve wrecking, have you found better combinations with less drawdown?

Thanks.

This is an all stock portfolio model, if it is too risky for you just move on and pick a different model

Georg,

did any of your timers improve results (drawdown)?

Have you tested a smaller number of holdings? For example, 6 stocks instead of 12?

Thanks,

Jeff

Can you post the trades that were made for this approach since the beginning of the back test period in 2008?

Georg,

It seems that this iM-10LargeHedgeFundSelect portfolio is a bit different than the one you publish on SeekingAlpha as iM-Top10(of 40 Large Hedge Funds). The one on SeekingAlpha seems to have a better short term performance. Can you comment on the difference? I am trying to see which one to follow.

James