Portfolio123 data changes can affect more recent model performance. We monitor our models to see whether there are any negative effects from data revisions.

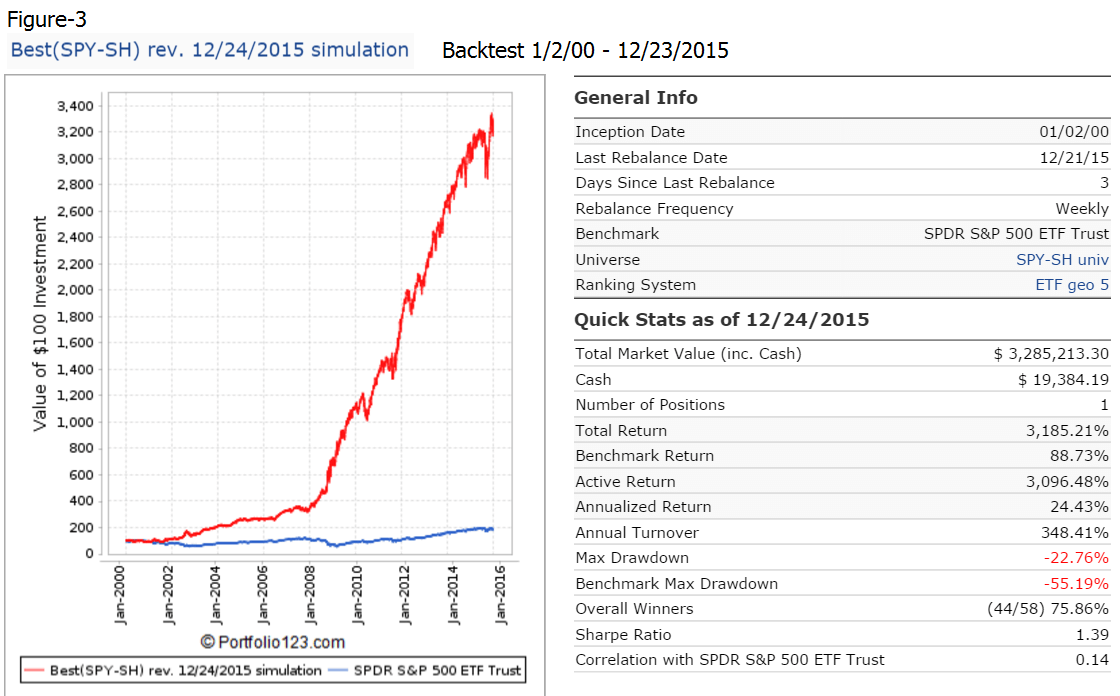

This Dec-24-2015 change constitutes a minor revision to the moving average cross-over system for the SPY sell rules. The effect is a reduction in volatility. Also over the backtest period from Jan-2000 to Dec-2015 the maximum drawdown is reduced to -23%, and there would have been fewer trades as well.

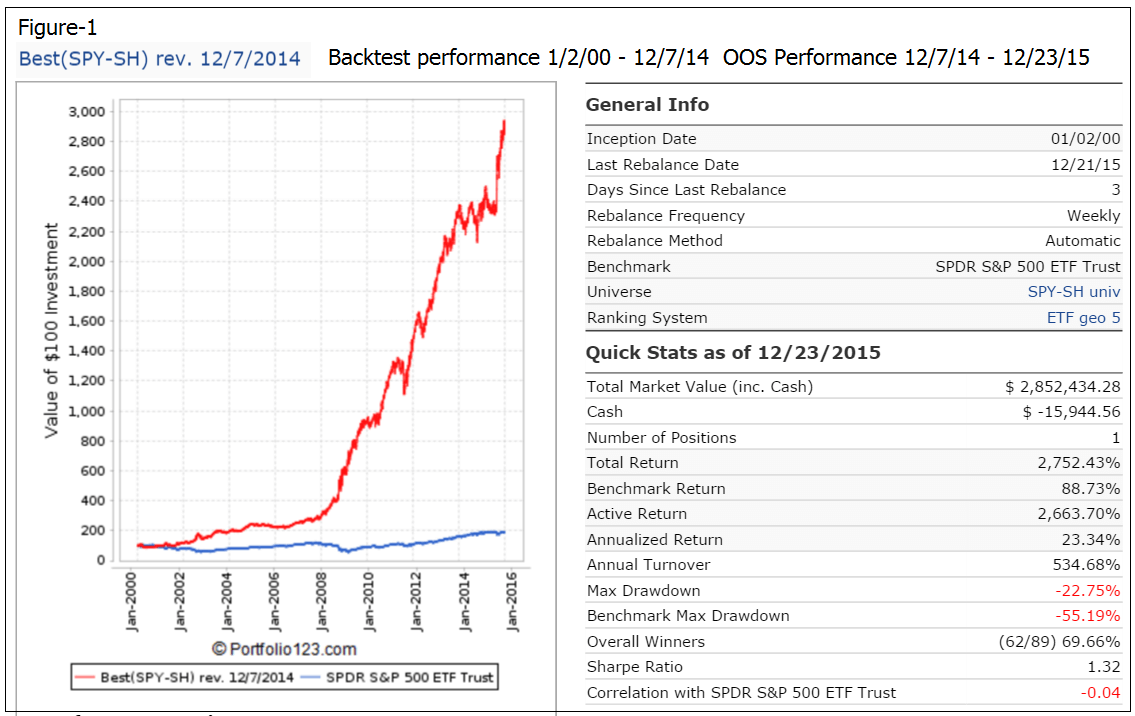

Figure-1 shows the performance after the first change made on 12/7/2014. The performance from Jan-2000 to 12/7/2014 is the backtest. From 12/7/2014 – 12/23/2015 it is out-of-sample performance.

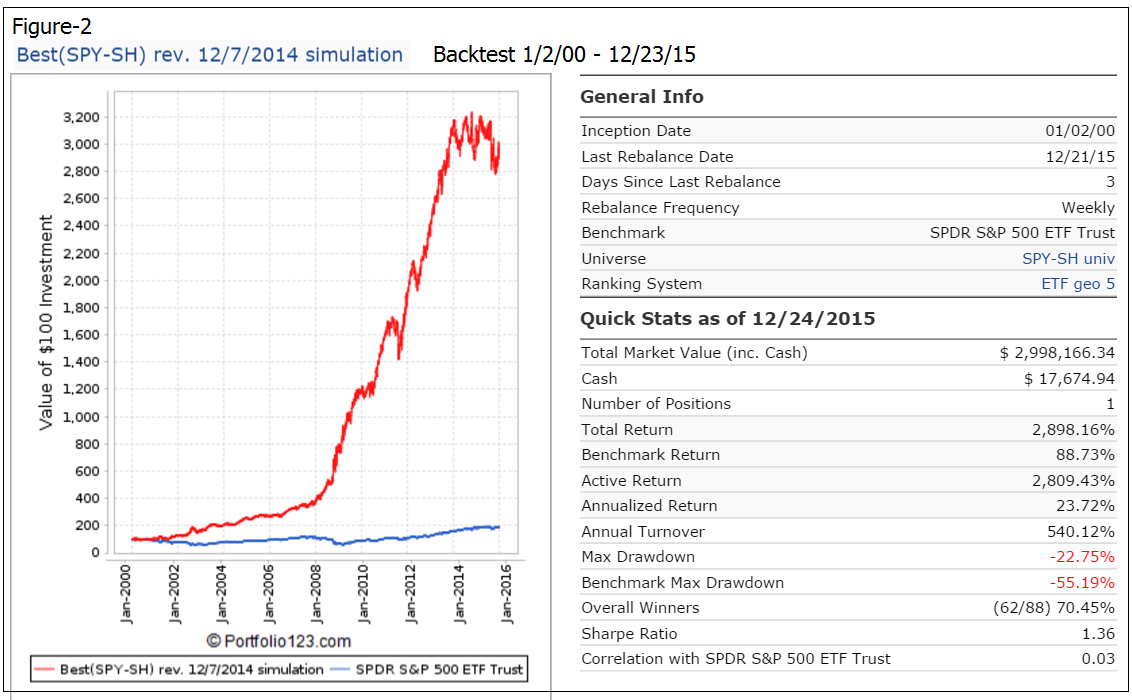

Figure-2 shows the simulated performance from Jan-2000 to 12/23/2015 with the algorithm as of 12/7/2014. Note the difference of the equity curve between Figure-1 and Figure-2, especially the deteriorating performance from 2015 onward. If all P123 data had remained unchanged from 12/7/14 onward, then Figure-2 would have had to be identical to Figure-1.

Figure-3 shows the simulated performance from Jan-2000 to 12/23/2015 with the algorithm that incorporates the revision of 12/24/2015. Annualized return remains about the same, but turnover is reduced from 540% to 350%, and the winners are up from 70% to 75%. The more recent performance is improved when compared to Figure-2.

Leave a Reply

You must be logged in to post a comment.