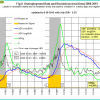

Unemployment

The unemployment rate recession model (article link), has been updated with the July UER of 5.3%. Based on the historic patterns of the unemployment rate indicators prior to recessions one can reasonably conclude that the U.S. economy is not likely to go into recession anytime soon

The unemployment rate recession model (article link), has been updated with the July UER of 5.3%. Based on the historic patterns of the unemployment rate indicators prior to recessions one can reasonably conclude that the U.S. economy is not likely to go into recession anytime soon

Here is the link to the full update.

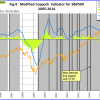

Coppock Indicator for the S&P500

The Coppock indicator for the S&P500 generated the last interim buy signal on January 31, 2014 and a sell signal early in January 2015. This model is now out of the market. This indicator is described here.

The Coppock indicator for the S&P500 generated the last interim buy signal on January 31, 2014 and a sell signal early in January 2015. This model is now out of the market. This indicator is described here.

Trade Weighted USD

A downward trend of the Trade Weighted USD (TW$) could signal the start of possible increases in federal fund rates. The TW$ after an interim decline is recovering and the 6 month moving average trend remains upward. Please see our article and Buffett and Welch comment

A downward trend of the Trade Weighted USD (TW$) could signal the start of possible increases in federal fund rates. The TW$ after an interim decline is recovering and the 6 month moving average trend remains upward. Please see our article and Buffett and Welch comment

TIAA Real Estate Account

As of end of July 2015 the 1-year rolling return is 11.24%. The Vanguard REIT Index Fund seemingly is retreating from the all-time high; however, the good positive returns of TIAA Real Estate Account are expected to continue. A sell signal is not imminent.

As of end of July 2015 the 1-year rolling return is 11.24%. The Vanguard REIT Index Fund seemingly is retreating from the all-time high; however, the good positive returns of TIAA Real Estate Account are expected to continue. A sell signal is not imminent.

Leave a Reply

You must be logged in to post a comment.