|

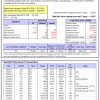

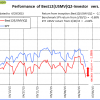

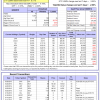

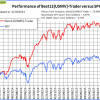

The iM-Best(SPY-SH) model currently holds SH, so far held for a period of 112 days, and showing a -0.56% return to 6/29/2015. Over the previous week the market value of Best(SPY-SH) gained 3.09% at a time when SPY gained -3.05%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $361,298 which includes $19 and excludes $12,862 spent on fees and slippage. |

| The iM-Combo3 model currently holds SH, TLT, and XLV, so far held for an average period of 242 days, and showing a 6.10% return to 6/29/2015. Over the previous week the market value of iM-Combo3 gained 0.64% at a time when SPY gained -3.05%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $121,759 which includes $2,528 and excludes $1,242 spent on fees and slippage. | |

| The iM-Best(Short) model currently holds 2 position(s). Over the previous week the market value of iM-Best(Short) gained 1.26% at a time when SPY gained -3.05%. Over the period 1/2/2009 to 6/29/2015 the starting capital of $100,000 would have grown to $106,993 which includes $149,530 and excludes $18,735 spent on fees and slippage. | |

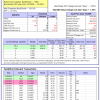

| The iM-Best10(S&P 1500) model currently holds 10 stocks, 1 of them winners, so far held for an average period of 48 days, and showing a -7.63% return to 6/29/2015. Over the previous week the market value of iM-Best10 gained -7.52% at a time when SPY gained -3.05%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $765,550 which includes $419 and excludes $67,993 spent on fees and slippage. | |

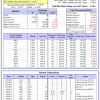

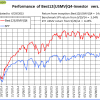

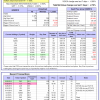

| The iM-Best12(USMV)Q1-Investor model currently holds 12 stocks, 6 of them winners, so far held for an average period of 170 days, and showing a 3.20% return to 6/29/2015. Since inception, on 1/5/2015, the model gained 4.36% while the benchmark SPY gained 2.79% and the ETF USMV gained 0.81% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -3.06% at a time when SPY gained -3.05%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $104,362 which includes $914 and excludes $134 spent on fees and slippage. | |

| The iM-Best12(USMV)Q2-Investor model currently holds 12 stocks, 6 of them winners, so far held for an average period of 91 days, and showing a -3.05% return to 6/29/2015. Since inception, on 3/31/2015, the model gained -2.74% while the benchmark SPY gained -0.88% and the ETF USMV gained -2.63% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained -3.64% at a time when SPY gained -3.05%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $97,261 which includes $727 and excludes $99 spent on fees and slippage. | |

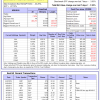

| The iM-Best12(USMV)Q3-Investor model currently holds 12 stocks, 10 of them winners, so far held for an average period of 317 days, and showing a 18.30% return to 6/29/2015. Since inception, on 7/1/2014, the model gained 21.73% while the benchmark SPY gained 6.97% and the ETF USMV gained 9.77% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained -3.19% at a time when SPY gained -3.05%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $121,734 which includes -$70 and excludes $152 spent on fees and slippage. | |

| The iM-Best12(USMV)Q4-Investor model currently holds 12 stocks, 10 of them winners, so far held for an average period of 232 days, and showing a 14.40% return to 6/29/2015. Since inception, on 9/30/2014, the model gained 14.61% while the benchmark SPY gained 5.54% and the ETF USMV gained 8.25% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained -3.20% at a time when SPY gained -3.05%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $114,606 which includes -$39 and excludes $151 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 18.11% over SPY. (see iM-USMV Investor Portfolio) | |

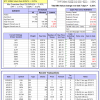

| The iM-Best12(USMV)-Trader model currently holds 12 stocks, 6 of them winners, so far held for an average period of 77 days, and showing a 1.05% return to 6/29/2015. Since inception, on 7/1/2014, the model gained 25.06% while the benchmark SPY gained 6.97% and the ETF USMV gained 9.77% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -2.96% at a time when SPY gained -3.05%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $125,055 which includes $161 and excludes $1,063 spent on fees and slippage. | |

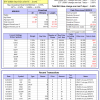

| The iM-Best10(VDIGX)-Trader model currently holds 10 stocks, 5 of them winners, so far held for an average period of 189 days, and showing a 4.42% return to 6/29/2015. Since inception, on 7/1/2014, the model gained 16.31% while the benchmark SPY gained 6.97% and the ETF VDIGX gained 7.42% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -2.79% at a time when SPY gained -3.05%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $116,312 which includes $20 and excludes $397 spent on fees and slippage. |

iM-Best Reports – 6/29/2015

Posted in pmp SPY-SH

Leave a Reply

You must be logged in to post a comment.