Bond-market:

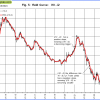

The BVR-model favors high beta bonds (long-bonds) and intermediate duration bonds when the BVR rises. The Bond Value Ratio as shown in Fig 4 is near last week’s value, and according to the model, only when BVR turns upward after having been lower than the lower offset-line should one consider long bonds again.

The BVR-model favors high beta bonds (long-bonds) and intermediate duration bonds when the BVR rises. The Bond Value Ratio as shown in Fig 4 is near last week’s value, and according to the model, only when BVR turns upward after having been lower than the lower offset-line should one consider long bonds again.

The Yield Curve:

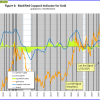

The yield curve model indicates the trend of the 10-year and 2-year Treasuries yield spread. Figure 5 charts (i10 – i2), the yield curve is inverted and is near last weeks value. This model confirms the direction of the BVR.

The yield curve model indicates the trend of the 10-year and 2-year Treasuries yield spread. Figure 5 charts (i10 – i2), the yield curve is inverted and is near last weeks value. This model confirms the direction of the BVR.

Gold:

The modified Coppock Gold indicator, shown in Fig 6, generated a buy signal beginning March 2022 and is invested in gold.

The modified Coppock Gold indicator, shown in Fig 6, generated a buy signal beginning March 2022 and is invested in gold.

This indicator is described in Is it Time to Buy Gold Again? – Wait for the buy signal …….

The iM GOLD-TIMER Rev-1 This model generated a new a buy signal mid August 2021 after being in cash for two weeks and thus invested in gold.

The iM GOLD-TIMER Rev-1 This model generated a new a buy signal mid August 2021 after being in cash for two weeks and thus invested in gold.

Silver:

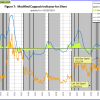

The modified Coppock Silver indicator shown in Fig 7. A week after exiting silver, iM-coppock model generated a buy signal end December 2022 and is invested in Silver.

The modified Coppock Silver indicator shown in Fig 7. A week after exiting silver, iM-coppock model generated a buy signal end December 2022 and is invested in Silver.

This indicator is described in Silver – Better Than Gold: A Modified Coppock Indicator for Silver.

Leave a Reply

You must be logged in to post a comment.