Market Signals Summary:

The MAC US reentered the market end March 2022, also the iM-GT Timer, the S&P 500 Coppock Indicator and the MAC-AU are invested in the stock markets. The Hi -Lo Index Index of the S&P500 remains in cash although it is near to entering the markets. The bond market model avoids high beta (long) bonds. The Gold Coppock is invested in gold, so is the iM-Gold Timer. The Silver Coppock model is also invested in silver.

Stock-markets:

The MAC-US model is invested in the US stock markets since end March 2022.

The MAC-US model is invested in the US stock markets since end March 2022.

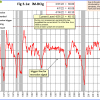

The 3-mo Hi-Lo Index Index of the S&P500 is at +4.83% (last week +0.89%), and has exited the stock market on 1/20/22.

The 3-mo Hi-Lo Index Index of the S&P500 is at +4.83% (last week +0.89%), and has exited the stock market on 1/20/22.

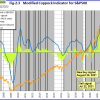

The Coppock indicator for the S&P500 generated a buy signal end August 2021 and is invested in stocks. This indicator is described here.

The Coppock indicator for the S&P500 generated a buy signal end August 2021 and is invested in stocks. This indicator is described here.

The MAC-AU model is invested the Australian stock market end March 2022.

The MAC-AU model is invested the Australian stock market end March 2022.

This model and its application is described in MAC-Australia: A Moving Average Crossover System for Superannuation Asset Allocations.

Recession:

BCIg signals economic recovery.

BCIg signals economic recovery.

The growth of the Conference Board’s Leading Economic Indicator signals economic recovery.

The growth of the Conference Board’s Leading Economic Indicator signals economic recovery.

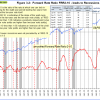

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) is below last week’s level.

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) is below last week’s level.

A description of this indicator can be found here.

The iM-Low Frequency Timer switched into stocks on 6/15/2020.

The iM-Low Frequency Timer switched into stocks on 6/15/2020.

A description of this indicator can be found here.