|

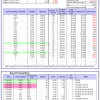

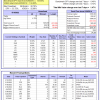

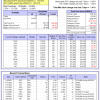

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

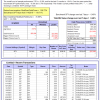

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -9.7%, and for the last 12 months is -0.5%. Over the same period the benchmark E60B40 performance was -13.0% and -4.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.62% at a time when SPY gained 0.55%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $147,107 which includes $1,611 cash and excludes $2,097 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -10.1%, and for the last 12 months is -0.3%. Over the same period the benchmark E60B40 performance was -13.0% and -4.7% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 0.62% at a time when SPY gained 0.55%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $151,232 which includes $1,759 cash and excludes $2,238 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -10.4%, and for the last 12 months is 0.0%. Over the same period the benchmark E60B40 performance was -13.0% and -4.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.61% at a time when SPY gained 0.55%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $155,179 which includes $1,846 cash and excludes $2,374 spent on fees and slippage. |

|

|

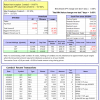

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 298.46% while the benchmark SPY gained 119.71% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 0.22% at a time when SPY gained 0.48%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $99,616 which includes -$1,181 cash and excludes $1,653 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 184.95% while the benchmark SPY gained 119.71% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -0.10% at a time when SPY gained 0.48%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $69,504 which includes -$1,475 cash and excludes $1,059 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 456.46% while the benchmark SPY gained 119.71% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 2.81% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $556,461 which includes -$5,740 cash and excludes $8,673 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 187.35% while the benchmark SPY gained 119.71% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 1.87% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $287,353 which includes $4,250 cash and excludes $8,132 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 264.58% while the benchmark SPY gained 119.71% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -0.97% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $364,580 which includes $1,542 cash and excludes $4,981 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 426.10% while the benchmark SPY gained 119.71% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 1.61% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $526,101 which includes $3,047 cash and excludes $1,706 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 185.78% while the benchmark SPY gained 119.71% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 0.47% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $285,779 which includes $769 cash and excludes $1,550 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 366.34% while the benchmark SPY gained 119.71% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 3.29% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $466,336 which includes -$6,442 cash and excludes $6,856 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 129.46% while the benchmark SPY gained 119.71% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 0.00% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $229,455 which includes $1,027 cash and excludes $9,338 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 166.11% while the benchmark SPY gained 119.71% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -3.21% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $266,349 which includes $106 cash and excludes $4,315 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 21.99% while the benchmark SPY gained 14.05% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 1.02% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $121,993 which includes -$129 cash and excludes $00 spent on fees and slippage. |

|

|

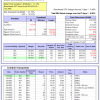

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is -6.5%, and for the last 12 months is -9.3%. Over the same period the benchmark SPY performance was -15.5% and -2.7% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -0.94% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $376,383 which includes $1,814 cash and excludes $7,957 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is -2.7%, and for the last 12 months is -7.9%. Over the same period the benchmark SPY performance was -15.5% and -2.7% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -1.44% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $30,728 which includes $104,216 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -12.0%, and for the last 12 months is -10.4%. Over the same period the benchmark SPY performance was -15.5% and -2.7% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.48% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $258,722 which includes $264 cash and excludes $950 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -15.4%, and for the last 12 months is -2.7%. Over the same period the benchmark SPY performance was -15.5% and -2.7% respectively. Over the previous week the market value of Best(SPY-SH) gained 0.48% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $720,132 which includes $370 cash and excludes $25,134 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -12.6%, and for the last 12 months is 2.3%. Over the same period the benchmark SPY performance was -15.5% and -2.7% respectively. Over the previous week the market value of iM-Combo3.R1 gained 0.66% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $184,069 which includes -$821 cash and excludes $7,776 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -24.7%, and for the last 12 months is -11.0%. Over the same period the benchmark SPY performance was -15.5% and -2.7% respectively. Over the previous week the market value of iM-Combo5 gained 0.59% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $171,138 which includes -$513 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -13.1%, and for the last 12 months is -7.2%. Over the same period the benchmark SPY performance was -15.5% and -2.7% respectively. Since inception, on 7/1/2014, the model gained 178.30% while the benchmark SPY gained 135.85% and VDIGX gained 134.82% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 1.47% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $278,301 which includes $505 cash and excludes $4,336 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 4.8%, and for the last 12 months is 4.3%. Over the same period the benchmark SPY performance was -15.5% and -2.7% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -0.28% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $227,768 which includes $1,808 cash and excludes $2,349 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -1.8%, and for the last 12 months is 1.5%. Over the same period the benchmark SPY performance was -15.5% and -2.7% respectively. Since inception, on 6/30/2014, the model gained 157.66% while the benchmark SPY gained 135.85% and the ETF USMV gained 125.07% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 1.41% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $257,661 which includes $1,829 cash and excludes $7,509 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 7.3%, and for the last 12 months is 11.2%. Over the same period the benchmark SPY performance was -15.5% and -2.7% respectively. Since inception, on 1/3/2013, the model gained 516.67% while the benchmark SPY gained 225.57% and the ETF USMV gained 225.57% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 0.99% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $616,665 which includes $6,976 cash and excludes $6,351 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -10.1%, and for the last 12 months is -9.3%. Over the same period the benchmark BND performance was -9.6% and -8.6% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -0.09% at a time when BND gained 0.62%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $136,593 which includes -$10 cash and excludes $2,263 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -12.0%, and for the last 12 months is -10.4%. Over the same period the benchmark SPY performance was -15.5% and -2.7% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.48% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $258,722 which includes $264 cash and excludes $950 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -4.8%, and for the last 12 months is 6.0%. Over the same period the benchmark SPY performance was -15.5% and -2.7% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 1.00% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $148,174 which includes $344 cash and excludes $1,394 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -7.0%, and for the last 12 months is 3.9%. Over the same period the benchmark SPY performance was -15.5% and -2.7% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.45% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $156,619 which includes $404 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -11.9%, and for the last 12 months is 1.2%. Over the same period the benchmark SPY performance was -15.5% and -2.7% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 1.17% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $177,273 which includes $1,693 cash and excludes $4,331 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -1.9%, and for the last 12 months is 0.4%. Over the same period the benchmark SPY performance was -15.5% and -2.7% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -1.45% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $175,257 which includes $63 cash and excludes $8,560 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.