|

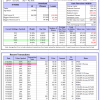

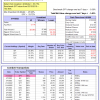

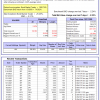

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

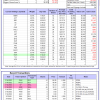

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -8.9%, and for the last 12 months is 4.0%. Over the same period the benchmark E60B40 performance was -9.6% and 2.9% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.82% at a time when SPY gained -1.24%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $148,320 which includes $93 cash and excludes $1,787 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -10.0%, and for the last 12 months is 3.7%. Over the same period the benchmark E60B40 performance was -9.6% and 2.9% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -0.77% at a time when SPY gained -1.24%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $151,366 which includes $1,038 cash and excludes $1,921 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -11.0%, and for the last 12 months is 3.3%. Over the same period the benchmark E60B40 performance was -9.6% and 2.9% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.73% at a time when SPY gained -1.24%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $154,242 which includes $670 cash and excludes $2,048 spent on fees and slippage. |

|

|

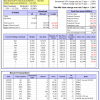

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 342.69% while the benchmark SPY gained 128.29% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -0.85% at a time when SPY gained -0.58%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $110,673 which includes -$1,965 cash and excludes $1,641 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 224.65% while the benchmark SPY gained 128.29% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -0.20% at a time when SPY gained -0.58%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $81,163 which includes $298 cash and excludes $1,052 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 458.37% while the benchmark SPY gained 128.29% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -1.30% at a time when SPY gained -0.58%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $558,715 which includes $1,147 cash and excludes $8,416 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 162.94% while the benchmark SPY gained 128.29% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 3.23% at a time when SPY gained -0.58%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $262,939 which includes -$103 cash and excludes $7,630 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 281.65% while the benchmark SPY gained 128.29% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -0.67% at a time when SPY gained -0.58%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $381,650 which includes $61 cash and excludes $4,515 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 468.08% while the benchmark SPY gained 128.29% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 0.62% at a time when SPY gained -0.58%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $568,419 which includes $1,350 cash and excludes $1,706 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 159.23% while the benchmark SPY gained 128.29% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -3.99% at a time when SPY gained -0.58%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $259,229 which includes $350 cash and excludes $1,532 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 365.51% while the benchmark SPY gained 128.29% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained -2.52% at a time when SPY gained -0.58%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $465,505 which includes $1,229 cash and excludes $6,430 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 119.00% while the benchmark SPY gained 128.29% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained -1.34% at a time when SPY gained -0.58%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $218,999 which includes $409 cash and excludes $8,970 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 182.78% while the benchmark SPY gained 128.29% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -1.94% at a time when SPY gained -0.58%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $282,784 which includes $2,137 cash and excludes $3,948 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 21.89% while the benchmark SPY gained 18.50% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained -0.45% at a time when SPY gained -0.58%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $121,892 which includes $2,712 cash and excludes $00 spent on fees and slippage. |

|

|

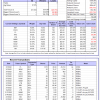

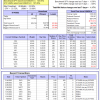

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is -3.0%, and for the last 12 months is 1.5%. Over the same period the benchmark SPY performance was -12.2% and 7.2% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -0.45% at a time when SPY gained -0.58%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $390,764 which includes $2,108 cash and excludes $7,640 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 19.4%, and for the last 12 months is 20.4%. Over the same period the benchmark SPY performance was -12.2% and 7.2% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -4.67% at a time when SPY gained -0.58%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $31,569 which includes $90,795 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -8.6%, and for the last 12 months is -1.4%. Over the same period the benchmark SPY performance was -12.2% and 7.2% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.58% at a time when SPY gained -0.58%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $268,763 which includes -$619 cash and excludes $950 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -12.1%, and for the last 12 months is 7.2%. Over the same period the benchmark SPY performance was -12.2% and 7.2% respectively. Over the previous week the market value of Best(SPY-SH) gained -0.58% at a time when SPY gained -0.58%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $748,079 which includes $398 cash and excludes $25,132 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -16.0%, and for the last 12 months is 2.1%. Over the same period the benchmark SPY performance was -12.2% and 7.2% respectively. Over the previous week the market value of iM-Combo3.R1 gained -1.24% at a time when SPY gained -0.58%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $176,779 which includes $4,874 cash and excludes $7,707 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -19.1%, and for the last 12 months is -0.1%. Over the same period the benchmark SPY performance was -12.2% and 7.2% respectively. Over the previous week the market value of iM-Combo5 gained -1.48% at a time when SPY gained -0.58%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $183,743 which includes $3,311 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -11.9%, and for the last 12 months is 3.8%. Over the same period the benchmark SPY performance was -12.2% and 7.2% respectively. Since inception, on 7/1/2014, the model gained 182.02% while the benchmark SPY gained 145.05% and VDIGX gained 142.23% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 2.24% at a time when SPY gained -0.58%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $282,018 which includes -$225 cash and excludes $4,274 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is -1.7%, and for the last 12 months is 8.9%. Over the same period the benchmark SPY performance was -12.2% and 7.2% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -2.21% at a time when SPY gained -0.58%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $213,626 which includes $2,040 cash and excludes $2,171 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -4.0%, and for the last 12 months is 4.2%. Over the same period the benchmark SPY performance was -12.2% and 7.2% respectively. Since inception, on 6/30/2014, the model gained 151.86% while the benchmark SPY gained 145.05% and the ETF USMV gained 127.28% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -1.17% at a time when SPY gained -0.58%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $251,859 which includes $563 cash and excludes $7,436 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 0.8%, and for the last 12 months is 14.5%. Over the same period the benchmark SPY performance was -12.2% and 7.2% respectively. Since inception, on 1/3/2013, the model gained 479.29% while the benchmark SPY gained 238.27% and the ETF USMV gained 238.27% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -1.22% at a time when SPY gained -0.58%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $579,293 which includes $1,653 cash and excludes $5,469 spent on fees and slippage. |

|

|

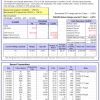

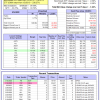

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -6.7%, and for the last 12 months is -4.5%. Over the same period the benchmark BND performance was -5.7% and -3.9% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -2.22% at a time when BND gained -2.24%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $141,749 which includes -$81 cash and excludes $2,203 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -8.6%, and for the last 12 months is -1.4%. Over the same period the benchmark SPY performance was -12.2% and 7.2% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.58% at a time when SPY gained -0.58%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $268,763 which includes -$619 cash and excludes $950 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -8.1%, and for the last 12 months is 9.8%. Over the same period the benchmark SPY performance was -12.2% and 7.2% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -2.42% at a time when SPY gained -0.58%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $143,052 which includes $56 cash and excludes $1,393 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -6.4%, and for the last 12 months is 10.8%. Over the same period the benchmark SPY performance was -12.2% and 7.2% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -1.25% at a time when SPY gained -0.58%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $157,634 which includes -$549 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -12.0%, and for the last 12 months is 7.2%. Over the same period the benchmark SPY performance was -12.2% and 7.2% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -0.57% at a time when SPY gained -0.58%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $177,111 which includes $3,639 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 5.0%, and for the last 12 months is 19.1%. Over the same period the benchmark SPY performance was -12.2% and 7.2% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -2.23% at a time when SPY gained -0.58%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $187,583 which includes -$1,992 cash and excludes $8,558 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.