|

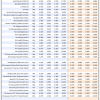

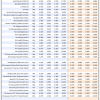

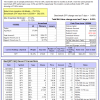

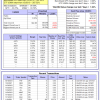

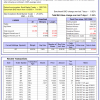

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

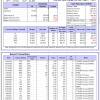

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 0.2%, and for the last 12 months is 18.3%. Over the same period the benchmark E60B40 performance was 0.1% and 15.8% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.05% at a time when SPY gained -0.27%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $163,225 which includes $1,351 cash and excludes $1,786 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 0.3%, and for the last 12 months is 20.3%. Over the same period the benchmark E60B40 performance was 0.1% and 15.8% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -0.04% at a time when SPY gained -0.27%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $168,698 which includes $819 cash and excludes $1,921 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 0.4%, and for the last 12 months is 22.3%. Over the same period the benchmark E60B40 performance was 0.1% and 15.8% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.02% at a time when SPY gained -0.27%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $174,016 which includes $517 cash and excludes $2,048 spent on fees and slippage. |

|

|

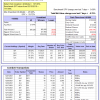

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 447.68% while the benchmark SPY gained 161.52% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -1.56% at a time when SPY gained 0.09%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $136,920 which includes $3,579 cash and excludes $1,565 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 368.58% while the benchmark SPY gained 161.52% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -1.55% at a time when SPY gained 0.09%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $117,145 which includes -$2 cash and excludes $985 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 626.31% while the benchmark SPY gained 161.52% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -0.43% at a time when SPY gained 0.09%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $726,313 which includes $796 cash and excludes $8,372 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 137.91% while the benchmark SPY gained 161.52% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 0.13% at a time when SPY gained 0.09%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $237,915 which includes $3,184 cash and excludes $7,161 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 287.84% while the benchmark SPY gained 161.52% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 0.38% at a time when SPY gained 0.09%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $387,842 which includes $2,616 cash and excludes $4,141 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 552.81% while the benchmark SPY gained 161.52% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 0.28% at a time when SPY gained 0.09%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $653,621 which includes $2,401 cash and excludes $1,675 spent on fees and slippage. |

|

|

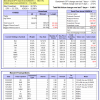

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 202.20% while the benchmark SPY gained 161.52% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 1.86% at a time when SPY gained 0.09%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $302,198 which includes $1,342 cash and excludes $1,529 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 407.43% while the benchmark SPY gained 161.52% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained -0.10% at a time when SPY gained 0.09%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $507,435 which includes -$2,314 cash and excludes $6,129 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 119.98% while the benchmark SPY gained 161.52% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 2.22% at a time when SPY gained 0.09%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $219,979 which includes $351 cash and excludes $8,367 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 253.55% while the benchmark SPY gained 161.52% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 1.65% at a time when SPY gained 0.09%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $353,551 which includes $633 cash and excludes $3,385 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 28.47% while the benchmark SPY gained 35.76% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 0.48% at a time when SPY gained 0.09%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $128,469 which includes $2,377 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 0.7%, and for the last 12 months is 19.8%. Over the same period the benchmark SPY performance was 0.6% and 29.5% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 1.07% at a time when SPY gained 0.09%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $405,720 which includes $2,560 cash and excludes $7,395 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is -4.3%, and for the last 12 months is 10.1%. Over the same period the benchmark SPY performance was 0.6% and 29.5% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -0.30% at a time when SPY gained 0.09%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $06 which includes $73,732 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -0.9%, and for the last 12 months is 12.6%. Over the same period the benchmark SPY performance was 0.6% and 29.5% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -1.22% at a time when SPY gained 0.09%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $291,402 which includes $4,526 cash and excludes $862 spent on fees and slippage. |

|

|

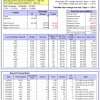

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 0.6%, and for the last 12 months is 29.2%. Over the same period the benchmark SPY performance was 0.6% and 29.5% respectively. Over the previous week the market value of Best(SPY-SH) gained 0.09% at a time when SPY gained 0.09%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $855,639 which includes $13,437 cash and excludes $25,118 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 0.2%, and for the last 12 months is 22.8%. Over the same period the benchmark SPY performance was 0.6% and 29.5% respectively. Over the previous week the market value of iM-Combo3.R1 gained -0.57% at a time when SPY gained 0.09%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $210,941 which includes $6,604 cash and excludes $7,312 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is 0.4%, and for the last 12 months is 28.3%. Over the same period the benchmark SPY performance was 0.6% and 29.5% respectively. Over the previous week the market value of iM-Combo5 gained -0.76% at a time when SPY gained 0.09%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $227,954 which includes $2,597 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -0.6%, and for the last 12 months is 17.6%. Over the same period the benchmark SPY performance was 0.6% and 29.5% respectively. Since inception, on 7/1/2014, the model gained 218.34% while the benchmark SPY gained 180.73% and VDIGX gained 150.29% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -0.40% at a time when SPY gained 0.09%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $318,337 which includes $1,271 cash and excludes $4,175 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is -0.1%, and for the last 12 months is 15.4%. Over the same period the benchmark SPY performance was 0.6% and 29.5% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 0.91% at a time when SPY gained 0.09%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $217,138 which includes $2,496 cash and excludes $1,899 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 1.1%, and for the last 12 months is 18.2%. Over the same period the benchmark SPY performance was 0.6% and 29.5% respectively. Since inception, on 6/30/2014, the model gained 165.08% while the benchmark SPY gained 180.73% and the ETF USMV gained 149.81% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.97% at a time when SPY gained 0.09%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $265,224 which includes $1,695 cash and excludes $7,422 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 0.9%, and for the last 12 months is 28.4%. Over the same period the benchmark SPY performance was 0.6% and 29.5% respectively. Since inception, on 1/3/2013, the model gained 479.71% while the benchmark SPY gained 287.52% and the ETF USMV gained 287.52% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 1.54% at a time when SPY gained 0.09%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $579,708 which includes $4,031 cash and excludes $5,028 spent on fees and slippage. |

|

|

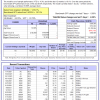

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -0.9%, and for the last 12 months is 1.2%. Over the same period the benchmark BND performance was -0.7% and -2.5% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -1.24% at a time when BND gained -0.82%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $150,496 which includes $564 cash and excludes $2,147 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -0.9%, and for the last 12 months is 12.6%. Over the same period the benchmark SPY performance was 0.6% and 29.5% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -1.22% at a time when SPY gained 0.09%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $291,402 which includes $4,526 cash and excludes $862 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -0.3%, and for the last 12 months is 18.2%. Over the same period the benchmark SPY performance was 0.6% and 29.5% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 0.55% at a time when SPY gained 0.09%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $155,168 which includes $4,209 cash and excludes $1,386 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -0.4%, and for the last 12 months is 24.8%. Over the same period the benchmark SPY performance was 0.6% and 29.5% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 1.07% at a time when SPY gained 0.09%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $167,741 which includes $6,089 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 0.6%, and for the last 12 months is 29.1%. Over the same period the benchmark SPY performance was 0.6% and 29.5% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 0.09% at a time when SPY gained 0.09%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $202,366 which includes $3,639 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 0.6%, and for the last 12 months is 8.1%. Over the same period the benchmark SPY performance was 0.6% and 29.5% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 0.24% at a time when SPY gained 0.09%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $179,739 which includes $3,185 cash and excludes $8,212 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.