Market Signals Summary:

The MAC-US and the 3-mo Hi-Lo are invested in the stock market. The bond market model avoids high beta (long) bonds. The Gold Coppock remains in gold, but the iM-Gold Timer is not invested in gold since 03/15/2021. The Silver Coppock model is also invested in silver.

The Yield Curve continues to steepened strongly, and consequently the Bond Value Ratio is falling.

The iM-GT Timer, based on Google Search Trends volume is invested in the stock market since 7/1/2020.

The TIAA Real Estate Account model reinvested in QREARX on 3/2/2021

Stock-markets:

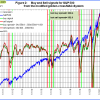

The MAC-US model is invested in the stock market.

The MAC-US model is invested in the stock market.

The 3-mo Hi-Lo Index Index of the S&P500 at +9.44% is near last week’s +9.54%, and is in the market since 11/10/2020..

The 3-mo Hi-Lo Index Index of the S&P500 at +9.44% is near last week’s +9.54%, and is in the market since 11/10/2020..

The Coppock indicator for the S&P500 entered the market on 5/9/2019 and is invested and generated a new buy signal on 8/20/20. This indicator is described here.

The Coppock indicator for the S&P500 entered the market on 5/9/2019 and is invested and generated a new buy signal on 8/20/20. This indicator is described here.

The MAC-AU model is invested in the Australian stock market since mid July 2020.

The MAC-AU model is invested in the Australian stock market since mid July 2020.

This model and its application is described in MAC-Australia: A Moving Average Crossover System for Superannuation Asset Allocations.

Recession:

BCIg Temporarily withdrawn

BCIg Temporarily withdrawn

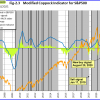

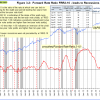

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) is near last week’s level.

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) is near last week’s level.

A description of this indicator can be found here.

The iM-Low Frequency Timer switched into stocks on 6/15/2020.

The iM-Low Frequency Timer switched into stocks on 6/15/2020.

A description of this indicator can be found here.