|

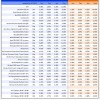

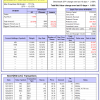

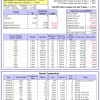

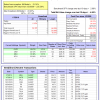

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

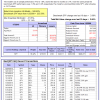

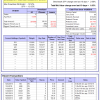

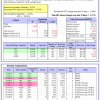

| iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 0.3%, and for the last 12 months is -2.4%. Over the same period the benchmark SPY performance was 1.2% and -2.6% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.63% at a time when SPY gained 1.78%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $112,255 which includes $412 cash and excludes $497 spent on fees and slippage. | |

| iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 0.3%, and for the last 12 months is -2.5%. Over the same period the benchmark SPY performance was 1.2% and -2.6% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 0.62% at a time when SPY gained 1.78%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $114,246 which includes $375 cash and excludes $563 spent on fees and slippage. | |

| iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 0.2%, and for the last 12 months is -2.5%. Over the same period the benchmark SPY performance was 1.2% and -2.6% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.60% at a time when SPY gained 1.78%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $116,228 which includes $465 cash and excludes $629 spent on fees and slippage. | |

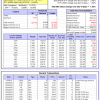

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 1.8%, and for the last 12 months is 5.7%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Over the previous week the market value of Best(SPY-SH) gained 2.66% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $612,020 which includes $3,543 cash and excludes $20,123 spent on fees and slippage. | |

| iM-Combo3.R1: The model’s out of sample performance YTD is 0.5%, and for the last 12 months is -4.8%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Over the previous week the market value of iM-Combo3.R1 gained 1.35% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $155,788 which includes $54,428 cash and excludes $4,602 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance YTD is 0.6%, and for the last 12 months is -4.0%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Over the previous week the market value of iM-Combo5 gained 1.36% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $128,064 which includes $28,570 cash and excludes $1,326 spent on fees and slippage. | |

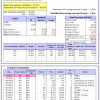

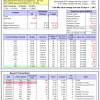

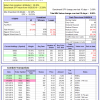

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 0.4%, and for the last 12 months is 2.1%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Since inception, on 7/1/2014, the model gained 84.24% while the benchmark SPY gained 42.13% and VDIGX gained 41.32% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 1.55% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $184,242 which includes $55 cash and excludes $2,421 spent on fees and slippage. | |

| iM-Best7(HiD-LoV): The model’s out of sample performance YTD is 1.3%, and for the last 12 months is -3.2%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 1.68% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $110,722 which includes $645 cash and excludes $2,681 spent on fees and slippage. | |

| iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 0.7%, and for the last 12 months is -0.4%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 1.65% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $151,727 which includes $2,018 cash and excludes $790 spent on fees and slippage. | |

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 0.5%, and for the last 12 months is -1.0%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Since inception, on 6/30/2014, the model gained 72.34% while the benchmark SPY gained 42.13% and the ETF USMV gained 54.56% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 1.26% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $172,340 which includes $464 cash and excludes $4,942 spent on fees and slippage. | |

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is -0.1%, and for the last 12 months is -0.8%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Since inception, on 1/5/2015, the model gained 64.22% while the benchmark SPY gained 36.58% and the ETF USMV gained 41.94% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 0.86% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $164,220 which includes $1,521 cash and excludes $1,393 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is 0.7%, and for the last 12 months is 0.5%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Since inception, on 3/30/2015, the model gained 39.88% while the benchmark SPY gained 31.70% and the ETF USMV gained 37.09% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 1.31% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 3/30/2015 would have grown to $139,880 which includes $6,784 cash and excludes $1,288 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is 0.9%, and for the last 12 months is -6.9%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Since inception, on 7/1/2014, the model gained 68.17% while the benchmark SPY gained 42.13% and the ETF USMV gained 54.56% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 1.55% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $168,174 which includes $4,156 cash and excludes $1,840 spent on fees and slippage. | |

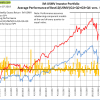

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/29/2014, the model gained 76.48% while the benchmark SPY gained 39.98% and the ETF USMV gained 52.43% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 1.34% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 9/29/2014 would have grown to $176,478 which includes -$1,878 cash and excludes $1,696 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 40.26% over SPY. (see iM-USMV Investor Portfolio) | |

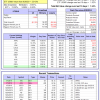

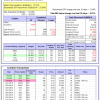

| iM-Best(Short): The model’s out of sample performance YTD is -4.7%, and for the last 12 months is -6.6%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Over the previous week the market value of iM-Best(Short) gained -4.85% at a time when SPY gained 2.68%. Over the period 1/2/2009 to 1/7/2019 the starting capital of $100,000 would have grown to $84,865 which includes $157,520 cash and excludes $25,124 spent on fees and slippage. | |

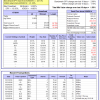

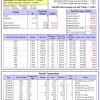

| iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 1.1%, and for the last 12 months is -5.1%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 1.45% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $107,288 which includes -$241 cash and excludes $336 spent on fees and slippage. | |

| iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 0.4%, and for the last 12 months is -1.4%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.71% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $108,508 which includes -$197 cash and excludes $00 spent on fees and slippage. | |

| iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is 2.3%, and for the last 12 months is -7.3%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained 3.14% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $122,953 which includes $4,511 cash and excludes $513 spent on fees and slippage. | |

| iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -0.1%, and for the last 12 months is 3.3%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 0.59% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $141,118 which includes -$55 cash and excludes $1,920 spent on fees and slippage. | |

| iM-VIX Timer with ZIV: The model’s out of sample performance YTD is 3.9%, and for the last 12 months is 2.4%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained 5.53% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $187,826 which includes $3,551 cash and excludes $4,760 spent on fees and slippage. | |

| iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 0.1%, and for the last 12 months is -15.8%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 0.31% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $109,848 which includes -$760 cash and excludes $2,428 spent on fees and slippage. | |

| iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is 1.2%, and for the last 12 months is -9.8%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 1.89% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $97,481 which includes $291 cash and excludes $407 spent on fees and slippage. | |

| iM-Min Drawdown Combo: The model’s out of sample performance YTD is 1.6%, and for the last 12 months is -5.0%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Over the previous week the market value of the iM-Min Drawdown Combo gained 2.28% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $103,589 which includes $3,402 cash and excludes $722 spent on fees and slippage. | |

| iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is 0.0%, and for the last 12 months is -18.5%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained 0.88% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $138,491 which includes $334 cash and excludes $1,440 spent on fees and slippage. | |

| iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is 0.4%, and for the last 12 months is -8.2%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained 0.87% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $117,751 which includes $298 cash and excludes $1,364 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.