Market Signals Summary:

The MAC-US model is invested. The “3-mo Hi-Lo Index of the S&P500” generated a buy signal on 6/12/2018 and is invested in the markets. The monthly updated S&P500 Coppock indicator is also invested. The MAC-AU is also invested. The recession indicators COMP and iM-BCIg do not signal a recession. The bond market model avoids high beta (long) bonds, and the yield curve is flattening and signaled buy FLAT end March 2018. Both the gold and silver Coppock models are invested. Also, the iM-Gold Timer is in gold since 7/10/2017.

Stock-markets:

The MAC-US model generated a buy-signal 4/5/2016 and thus is invested in the stock-markets. The sell-spread (red graph) is above last week’s level and has to fall below zero to signal a sell.

The MAC-US model generated a buy-signal 4/5/2016 and thus is invested in the stock-markets. The sell-spread (red graph) is above last week’s level and has to fall below zero to signal a sell.

The 3-mo Hi-Lo Index of the S&P500 is above last week’s level at 7.71% (last week 7.51%), generating a buy signal, and is invested in the market since 6/12/2018.

The 3-mo Hi-Lo Index of the S&P500 is above last week’s level at 7.71% (last week 7.51%), generating a buy signal, and is invested in the market since 6/12/2018.

The MAC-AU model is invested in the markets after it generated a buy signal on March 21, 2016. The sell-spread is remains near last week’s level and has to fall below zero to signal a sell.

The MAC-AU model is invested in the markets after it generated a buy signal on March 21, 2016. The sell-spread is remains near last week’s level and has to fall below zero to signal a sell.

This model and its application is described in MAC-Australia: A Moving Average Crossover System for Superannuation Asset Allocations.

Recession:

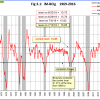

Figure 3 shows the COMP below last week’s downward revised level. No recession is indicated. COMP can be used for stock market exit timing as discussed in this article The Use of Recession Indicators in Stock Market Timing.

Figure 3 shows the COMP below last week’s downward revised level. No recession is indicated. COMP can be used for stock market exit timing as discussed in this article The Use of Recession Indicators in Stock Market Timing.

Figure 3.1 shows the recession indicator iM-BCIg at last week’s level. An imminent recession is not signaled .

Figure 3.1 shows the recession indicator iM-BCIg at last week’s level. An imminent recession is not signaled .

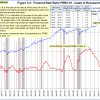

Please also refer to the BCI page

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) is down from last week’s level and is not signaling a recession. The FRR2-10 general trend is downwards.

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) is down from last week’s level and is not signaling a recession. The FRR2-10 general trend is downwards.

A description of this indicator can be found here.

Leave a Reply

You must be logged in to post a comment.