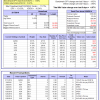

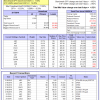

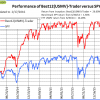

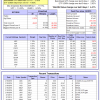

| iM-Best(SPY-SH): The model’s out of sample performance YTD is 5.1%, and for the last 12 months is 24.2%. Over the same period the benchmark SPY performance was -5.4% and -6.2% respectively. Over the previous week the market value of Best(SPY-SH) gained -4.17% at a time when SPY gained 4.02%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $456,833 which includes -$2,391 cash and excludes $14,503 spent on fees and slippage. | |

| iM-Combo3: The model’s out of sample performance YTD is -6.7%, and for the last 12 months is -0.8%. Over the same period the benchmark SPY performance was -5.4% and -6.2% respectively. Over the previous week the market value of iM-Combo-3 gained -2.26% at a time when SPY gained 4.02%[/iM]. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $123,407 which includes -$1,613 cash and excludes $2,449 spent on fees and slippage. | |

| The iM-Best8(S&P500 Min Vol)Tax-Efficient The model’s out of sample performance YTD is -0.3%, and for the last 12 months is 8.4%. Over the same period the benchmark SPY performance was -5.4% and -6.2% respectively. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained 4.23% at a time when SPY gained 4.02%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $443,920 which includes $6,524 cash and excludes $6,003 spent on fees and slippage. | |

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -3.1%, and for the last 12 months is 5.4%. Over the same period the benchmark SPY performance was -5.4% and -6.2% respectively. Since inception, on 7/1/2014, the model gained 22.11% while the benchmark SPY gained 1.56% and the ETF VDIGX gained 6.91% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 4.67% at a time when SPY gained 4.02%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $122,106 which includes -$17 cash and excludes $918 spent on fees and slippage. | |

| iM-BESTOGA-3: The model’s out of sample performance YTD is -0.8%, and for the last 12 months is 22.6%. Over the same period the benchmark SPY performance was -5.4% and -6.2% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 1.55% at a time when SPY gained 4.02%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $182,204 which includes $16,053 cash and excludes $767 spent on fees and slippage. | |

| iM-Best3x4(S&P 500 Min Vol): The model’s out of sample performance YTD is -5.5%, and since inception -3.0%. Over the same period the benchmark SPY performance was -5.4% and -7.4% respectively. Over the previous week the market value of iM-Best3x4 gained 3.00% at a time when SPY gained 4.02%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $97,053 which includes -$328 cash and excludes $897 spent on fees and slippage. | |

| iM-Best2x4(S&P 500 Min Vol): The model’s out of sample performance YTD is -3.5%, and since inception -4.6%. Over the same period the benchmark SPY performance was -5.4% and -7.4% respectively. Over the previous week the market value of iM-Best2x4 gained 2.60% at a time when SPY gained 4.02%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $95,358 which includes -$1,703 cash and excludes $647 spent on fees and slippage. | |

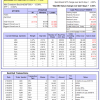

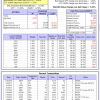

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -0.7%, and for the last 12 months is 1.0%. Over the same period the benchmark SPY performance was -5.4% and -6.2% respectively. Since inception, on 7/1/2014, the model gained 26.60% while the benchmark SPY gained 1.56% and the ETF USMV gained 14.28% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 4.32% at a time when SPY gained 4.02%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $126,599 which includes $45 cash and excludes $1,614 spent on fees and slippage. | |

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is 0.2%, and for the last 12 months is -0.6%. Over the same period the benchmark SPY performance was -5.4% and -6.2% respectively. Since inception, on 1/5/2015, the model gained 4.58% while the benchmark SPY gained -2.40% and the ETF USMV gained 4.95% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 4.41% at a time when SPY gained 4.02%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $104,583 which includes $91 cash and excludes $405 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is 0.8%, and since inception 0.3%. Over the same period the benchmark SPY performance was -5.4% and -4.7% respectively. Since inception, on 3/31/2015, the model gained 0.30% while the benchmark SPY gained -5.89% and the ETF USMV gained 1.37% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 5.22% at a time when SPY gained 4.02%. A starting capital of $100,000 at inception on 3/31/2015 would have grown to $100,299 which includes $20 cash and excludes $211 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is 0.5%, and for the last 12 months is -6.2%. Over the same period the benchmark SPY performance was -5.4% and -6.2% respectively. Since inception, on 7/1/2014, the model gained 17.84% while the benchmark SPY gained 1.56% and the ETF USMV gained 14.28% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 4.14% at a time when SPY gained 4.02%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $117,839 which includes $22 cash and excludes $547 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/30/2014, the model gained 12.08% while the benchmark SPY gained 0.20% and the ETF USMV gained 12.70% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 3.53% at a time when SPY gained 4.02%. A starting capital of $100,000 at inception on 9/30/2014 would have grown to $112,079 which includes $222 cash and excludes $485 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 20.42% over SPY. (see iM-USMV Investor Portfolio) | |

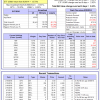

| iM-Best(Short): The model’s out of sample performance YTD is 9.5%, and for the last 12 months is 8.1%. Over the same period the benchmark SPY performance was -5.4% and -6.2% respectively. Over the previous week the market value of iM-Best(Short) gained -0.30% at a time when SPY gained 4.02%. Over the period 1/2/2009 to 2/17/2016 the starting capital of $100,000 would have grown to $114,645 which includes $139,354 cash and excludes $17,978 spent on fees and slippage. |

iM-Best Reports – 2/18/2016

Posted in pmp SPY-SH

Leave a Reply

You must be logged in to post a comment.