|

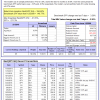

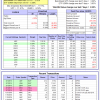

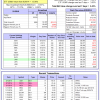

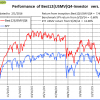

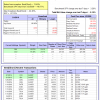

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

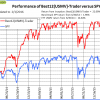

| iM-Best(SPY-SH): The model’s out of sample performance YTD is 5.0%, and for the last 12 months is 30.6%. Over the same period the benchmark SPY performance was -5.0% and -0.9% respectively. Over the previous week the market value of Best(SPY-SH) gained -3.20% at a time when SPY gained -3.20%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $456,623 which includes -$2,391 cash and excludes $14,503 spent on fees and slippage. | |

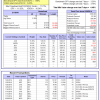

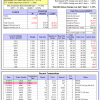

| iM-Combo3: The model’s out of sample performance YTD is -8.5%, and for the last 12 months is 3.0%. Over the same period the benchmark SPY performance was -5.0% and -0.9% respectively. Over the previous week the market value of iM-Combo-3 gained -1.96% at a time when SPY gained 3.20%[/iM]. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $121,087 which includes -$380 cash and excludes $2,340 spent on fees and slippage. | |

| The iM-Best8(S&P500 Min Vol)Tax-Efficient The model’s out of sample performance YTD is -1.4%, and for the last 12 months is 12.9%. Over the same period the benchmark SPY performance was -5.0% and -0.9% respectively. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained 3.95% at a time when SPY gained 3.20%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $439,133 which includes $6,524 cash and excludes $6,003 spent on fees and slippage. | |

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -2.5%, and for the last 12 months is 11.2%. Over the same period the benchmark SPY performance was -5.0% and -0.9% respectively. Since inception, on 7/1/2014, the model gained 22.86% while the benchmark SPY gained 1.96% and the ETF VDIGX gained 6.62% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 4.48% at a time when SPY gained 3.20%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $122,857 which includes -$2 cash and excludes $892 spent on fees and slippage. | |

| iM-BESTOGA-3: The model’s out of sample performance YTD is 1.5%, and for the last 12 months is 31.6%. Over the same period the benchmark SPY performance was -5.0% and -0.9% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 3.93% at a time when SPY gained 3.20%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $186,428 which includes $16,053 cash and excludes $767 spent on fees and slippage. | |

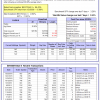

| iM-Best3x4(S&P 500 Min Vol): The model’s out of sample performance YTD is -3.4%, and since inception -0.8%. Over the same period the benchmark SPY performance was -5.0% and -7.1% respectively. Over the previous week the market value of iM-Best3x4 gained 1.79% at a time when SPY gained 3.20%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $99,230 which includes $854 cash and excludes $860 spent on fees and slippage. | |

| iM-Best2x4(S&P 500 Min Vol): The model’s out of sample performance YTD is -2.8%, and since inception -4.0%. Over the same period the benchmark SPY performance was -5.0% and -7.0% respectively. Over the previous week the market value of iM-Best2x4 gained 1.77% at a time when SPY gained 3.20%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $95,999 which includes -$602 cash and excludes $602 spent on fees and slippage. | |

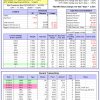

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -4.3%, and for the last 12 months is 2.6%. Over the same period the benchmark SPY performance was -5.0% and -0.9% respectively. Since inception, on 7/1/2014, the model gained 22.09% while the benchmark SPY gained 1.96% and the ETF USMV gained 14.64% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 2.52% at a time when SPY gained 3.20%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $122,087 which includes -$106 cash and excludes $1,571 spent on fees and slippage. | |

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is -3.8%, and for the last 12 months is 0.4%. Over the same period the benchmark SPY performance was -5.0% and -0.9% respectively. Since inception, on 1/5/2015, the model gained 0.35% while the benchmark SPY gained -2.02% and the ETF USMV gained 5.28% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 2.05% at a time when SPY gained 3.20%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $100,348 which includes -$69 cash and excludes $371 spent on fees and slippage. | |

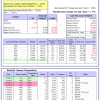

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is -3.2%, and since inception -3.7%. Over the same period the benchmark SPY performance was -5.0% and -4.4% respectively. Since inception, on 3/31/2015, the model gained -3.70% while the benchmark SPY gained -5.51% and the ETF USMV gained 1.69% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 3.16% at a time when SPY gained 3.20%. A starting capital of $100,000 at inception on 3/31/2015 would have grown to $96,302 which includes $43 cash and excludes $211 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is -4.0%, and for the last 12 months is -7.0%. Over the same period the benchmark SPY performance was -5.0% and -0.9% respectively. Since inception, on 7/1/2014, the model gained 12.55% while the benchmark SPY gained 1.96% and the ETF USMV gained 14.64% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 2.52% at a time when SPY gained 3.20%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $112,545 which includes -$10 cash and excludes $547 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/30/2014, the model gained 7.48% while the benchmark SPY gained 0.60% and the ETF USMV gained 13.06% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 2.42% at a time when SPY gained 3.20%. A starting capital of $100,000 at inception on 9/30/2014 would have grown to $107,483 which includes -$117 cash and excludes $468 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 16.17% over SPY. (see iM-USMV Investor Portfolio) | |

| iM-Best(Short): The model’s out of sample performance YTD is 8.4%, and for the last 12 months is 1.0%. Over the same period the benchmark SPY performance was -5.0% and -0.9% respectively. Over the previous week the market value of iM-Best(Short) gained -0.15% at a time when SPY gained 3.20%. Over the period 1/2/2009 to 2/1/2016 the starting capital of $100,000 would have grown to $113,488 which includes $157,941 cash and excludes $17,908 spent on fees and slippage. |

iM-Best Reports – 2/1/2016

Posted in pmp SPY-SH

Leave a Reply

You must be logged in to post a comment.