- The Trade Weighted US Dollar Index has been growing since Q4 2011. Its growth increasing over the last nine months.

- The annual rise in CPI is below 2%, and the US economy remains relatively weak.

- The US Market is attracting foreign capital that is fleeing their local currency devaluation.

- There is no reason for the Fed to increase interest rates under these conditions.

- Interest rates will probably rise only once the dollar reverses its gains.

In our January 10th article we argued that with a strengthening US dollar the Fed would not increase interest rate soon. Three weeks later, both Warren Buffet and Jack Welsh made the same call.

Now three months later the Fed has removed the word “patience” from their statements, fueling speculation that interest may rise sooner rather than later. However, the economic reality is that the dollar continues to strengthen, the annual growth of the Consumer Price Index is near zero percent, and growth in employment is slowing. We believe these all speak against an early interest rate hike.

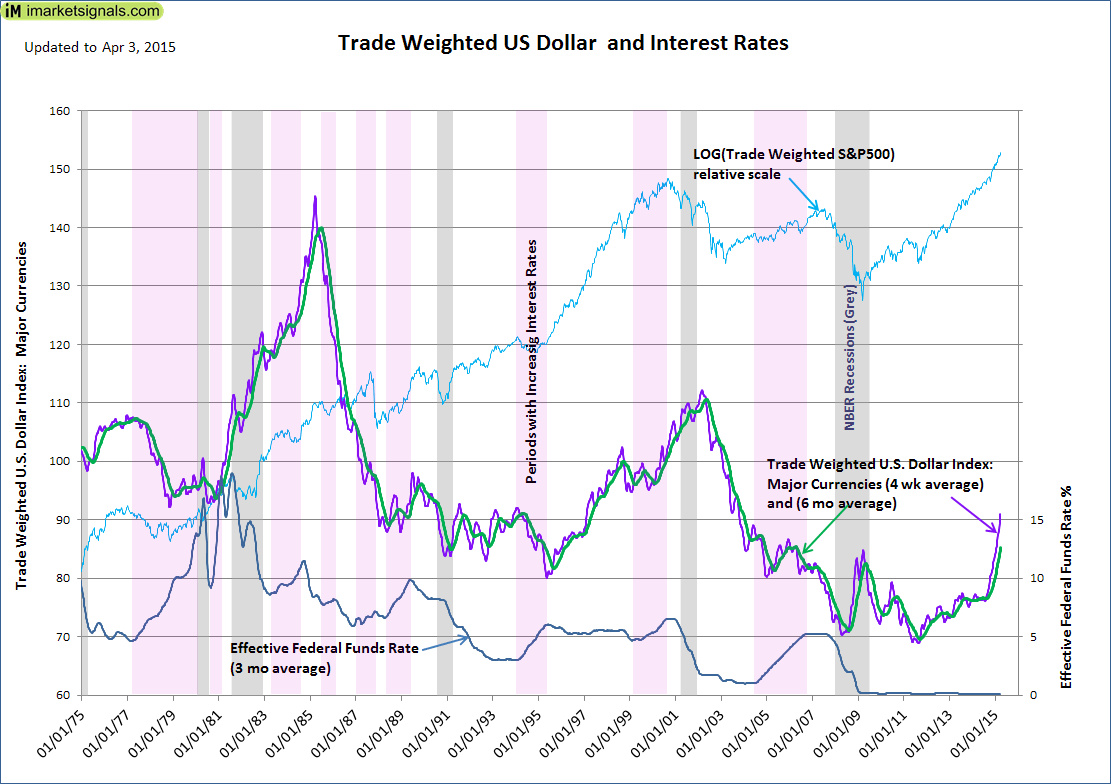

Below we chart the Trade Weighted U.S. Dollar Index for the major currencies and the 3-Month Treasury Bill rate. In the last forty years one can identify eight periods of prolonged interest rate hikes. One also notes that seven of the eight periods occurred when the Dollar Index was stagnant or declining, the period 1983 to 85 being the exception.

The present cycle of weakening major world currencies relative to the US dollar started end of 2011, with a marked acceleration during the last nine months that is seemingly set to continue.

The US stock market measured in trade weighted US dollars, that is as a foreign investor would see it, has performed well and only recently passed its 2000 peak. Thus, the US dollar has become desirable to foreign investors who are fleeing their local currency and are looking for safer havens in US Treasuries and large-cap stocks. Therefore, foreign capital appears to be providing the liquidity fueling the current bull market in large-cap stocks and Treasuries.

So why would the Fed increase interest rates and slow the economy when the annual growth of the Consumer Price Index is below 2%, with the latest February figure near zero percent. According to Fed’s website “The Federal Open Market Committee (FOMC) judges that inflation at the rate of 2 percent ………… is most consistent over the longer run with the Federal Reserve’s mandate for price stability and maximum employment.”

Under the prevailing economic conditions it would only make sense to raise the interest rates to support the US dollar against rising foreign currencies. Once the Trade Weighted Dollar Index begins to flatten or fall, as was the case during 7 of the 8 prolonged periods of rising rates in the last forty years, then interest rates may increase.

It is the relationship between GDP growth and the change in unemployment and how that has completely changed since the baby-boomer retirement wave started in 2011. The last couple of months have clearly shown that the unemployment rate will fall even in a weak economy. As a result the unemployment rate should decrease further even as growth disappoints. Unemployment could be down to 4% in late 2016! How should the FED react if growth stays weak at the same time? I guess the FED will start hiking rates sooner or later, just because they are afraid of the low unemployment rate and its assumed impact on inflation. (Funny to remember that not long ago the FED actually expected to hike rates once unemployment fell below 6.5%.) With the slack now gone the discussion about potential growth will define the economic research in coming years. Current information suggests that annual GDP growth could fall below 1% and still unemployment would fall. Thus, my bet is that the FED raises rates in late 2015 and continues to raise rates in 2016 until the yield curve inverts leading to a recession and then the FED will take short term rates back down to 0.5% or lower.