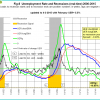

Unemployment

The unemployment rate recession model (article link), has been updated with the February UER of 5.5%. Based on the historic patterns of the unemployment rate indicators prior to recessions one can reasonably conclude that the U.S. economy is not likely to go into recession anytime soon

The unemployment rate recession model (article link), has been updated with the February UER of 5.5%. Based on the historic patterns of the unemployment rate indicators prior to recessions one can reasonably conclude that the U.S. economy is not likely to go into recession anytime soon

Here is the link to latest update.

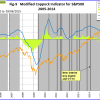

Coppock Indicator for the S&P500

The Coppock indicator for the S&P500 generated the last interim buy signal on January 31, 2014 and a sell signal early in January 2015. This model is now out of the market. This indicator is described here.

The Coppock indicator for the S&P500 generated the last interim buy signal on January 31, 2014 and a sell signal early in January 2015. This model is now out of the market. This indicator is described here.

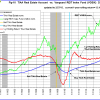

Trade Weighted USD

A downward trend of the Trade Weighted USD (TW$) could signal the start of possible increases in federal fund rates. However, from the graph it is clear that the TW$ has an upward trend. Please see our article and Buffett and Welch comment

A downward trend of the Trade Weighted USD (TW$) could signal the start of possible increases in federal fund rates. However, from the graph it is clear that the TW$ has an upward trend. Please see our article and Buffett and Welch comment

TIAA Real Estate Account

As of end of February 2015 the 1-year rolling return is 12.2%. The Vanguard REIT Index Fund is near an all time high signaling that there is further upside potential for the TIAA Real Estate Account. A sell signal is not imminent.

As of end of February 2015 the 1-year rolling return is 12.2%. The Vanguard REIT Index Fund is near an all time high signaling that there is further upside potential for the TIAA Real Estate Account. A sell signal is not imminent.

Leave a Reply

You must be logged in to post a comment.