|

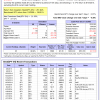

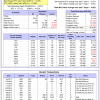

The iM-Best(SPY-SH) model currently holds SH, so far held for a period of 154 days, and showing a -3.17% return to 8/10/2015. Over the previous week the market value of Best(SPY-SH) gained -0.38% at a time when SPY gained 0.37%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $351,835 which includes $19 cash and excludes $12,862 spent on fees and slippage. |

| The iM-Combo3 model currently holds SH, TLT, and XLV, so far held for an average period of 284 days, and showing a 7.61% return to 8/10/2015. Over the previous week the market value of iM-Combo3 gained -0.51% at a time when SPY gained 0.37%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $123,313 which includes $3,931 cash and excludes $1,243 spent on fees and slippage. | |

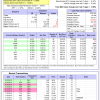

| The iM-Best8(S&P500 Min Vol)Tax-Efficient model currently holds 8 stocks, 6 of them winners, so far held for an average period of 238 days, and showing a 15.79% return to 8/10/2015. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained 1.52% at a time when SPY gained 0.37%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $470,636 which includes $953 cash and excludes $4,683 spent on fees and slippage. | |

| The iM-Best10(VDIGX)-Trader model currently holds 10 stocks, 9 of them winners, so far held for an average period of 158 days, and showing a 8.70% return to 8/10/2015. Since inception, on 7/1/2014, the model gained 25.77% while the benchmark SPY gained 9.65% and the ETF VDIGX gained 10.03% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 0.99% at a time when SPY gained 0.37%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $125,775 which includes -$429 cash and excludes $527 spent on fees and slippage. | |

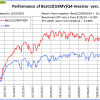

| The iM-Best10(S&P 1500) model currently holds 10 stocks, 3 of them winners, so far held for an average period of 5 days, and showing a -1.08% return to 8/10/2015. Over the previous week the market value of iM-Best10 gained 2.91% at a time when SPY gained 0.37%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $806,586 which includes -$8,174 cash and excludes $74,308 spent on fees and slippage. | |

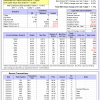

| The iM-Best3x4(S&P 500 Min Vol) model currently holds 8 stocks, 5 of them winners, so far held for an average period of 20 days, and showing a 0.41% return to 8/10/2015. Over the previous week the market value of iM-Best3x4 gained 0.63% at a time when SPY gained 0.37%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $100,997 which includes $157 cash and excludes $75 spent on fees and slippage. | |

| The iM-Best2x4(S&P 500 Min Vol) model currently holds 4 stocks, 2 of them winners, so far held for an average period of 25 days, and showing a 0.79% return to 8/10/2015. Over the previous week the market value of iM-Best2x4 gained 1.22% at a time when SPY gained 0.37%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $100,625 which includes $17 cash and excludes $29 spent on fees and slippage. | |

| The iM-Best12(USMV)-Trader model currently holds 12 stocks, 9 of them winners, so far held for an average period of 80 days, and showing a 0.13% return to 8/10/2015. Since inception, on 7/1/2014, the model gained 28.60% while the benchmark SPY gained 9.65% and the ETF USMV gained 15.59% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 1.11% at a time when SPY gained 0.37%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $128,596 which includes $259 cash and excludes $1,196 spent on fees and slippage. | |

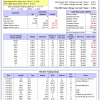

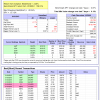

| The iM-Best12(USMV)Q1-Investor model currently holds 12 stocks, 9 of them winners, so far held for an average period of 163 days, and showing a 1.92% return to 8/10/2015. Since inception, on 1/5/2015, the model gained 7.91% while the benchmark SPY gained 5.37% and the ETF USMV gained 6.15% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 0.38% at a time when SPY gained 0.37%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $107,910 which includes $55 cash and excludes $190 spent on fees and slippage. | |

| The iM-Best12(USMV)Q2-Investor model currently holds 13 stocks, 8 of them winners, so far held for an average period of 123 days, and showing a -4.24% return to 8/10/2015. Since inception, on 3/31/2015, the model gained 2.23% while the benchmark SPY gained 1.61% and the ETF USMV gained 2.53% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained -0.28% at a time when SPY gained 0.37%. A starting capital of $100,000 at inception on 3/31/2015 would have grown to $102,228 which includes $7,277 cash and excludes $106 spent on fees and slippage. | |

| The iM-Best12(USMV)Q3-Investor model currently holds 12 stocks, 6 of them winners, so far held for an average period of 44 days, and showing a -2.21% return to 8/10/2015. Since inception, on 7/1/2014, the model gained 22.83% while the benchmark SPY gained 9.65% and the ETF USMV gained 15.59% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 0.16% at a time when SPY gained 0.37%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $122,825 which includes -$11 cash and excludes $388 spent on fees and slippage. | |

| The iM-Best12(USMV)Q4-Investor model currently holds 12 stocks, 9 of them winners, so far held for an average period of 274 days, and showing a 8.84% return to 8/10/2015. Since inception, on 9/30/2014, the model gained 16.37% while the benchmark SPY gained 8.18% and the ETF USMV gained 13.99% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 0.82% at a time when SPY gained 0.37%. A starting capital of $100,000 at inception on 9/30/2014 would have grown to $116,367 which includes $228 cash and excludes $157 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 18.05% over SPY. (see iM-USMV Investor Portfolio) | |

| The iM-Best(Short) model currently holds 4 position(s). Over the previous week the market value of iM-Best(Short) gained 0.13% at a time when SPY gained 0.37%. Over the period 1/2/2009 to 8/10/2015 the starting capital of $100,000 would have grown to $102,131 which includes $183,736 cash and excludes $19,611 spent on fees and slippage. |

iM-Best Reports – 8/10/2015

Posted in pmp SPY-SH

Leave a Reply

You must be logged in to post a comment.