In continuation of our previous article “How Good are Vanguard’s LifeStrategy Funds? Much Better Returns From Vanguard Funds with iM’s (MAC-Vang)20/80” we show that exceptionally high returns can be obtained from Vanguard funds, when a dynamic asset allocation strategy is employed, and actively managed funds instead of index funds are used. Using a combination of bond-, stock-, and sector-funds in the model, and switching asset allocation according to stock-market climate, provided an annualized average return of over 15% for the backtest period Jan-2000 to Jul-2014.

The strategy requires some stock-market timing:

Investment during up-market periods: 80% stocks and 20% bonds.

The bond fund combination consists of three Vanguard funds:

- 6% Intermediate-Term Investment-Grade Fund (VFICX)

- 8% Long-Term Invest-Grade Fund (VWESX)

- 6% Long-Term Treasury Fund (VUSTX)

The stock fund combination consists of three Vanguard funds:

- 25% Selected Value Fund (VASVX)

- 33% Energy Fund (VGENX)

- 22% Health Care Fund (VGHCX)

Investment during down-market periods: 80% bonds and 20% stocks.

The bond fund combination consists of the same three bond funds:

- 24% Intermediate-Term Investment-Grade Fund (VFICX)

- 32% Long-Term Invest-Grade Fund (VWESX)

- 24% Long-Term Treasury Fund (VUSTX)

Only one of the three stock funds is used:

- 20% Selected Value Fund (VASVX)

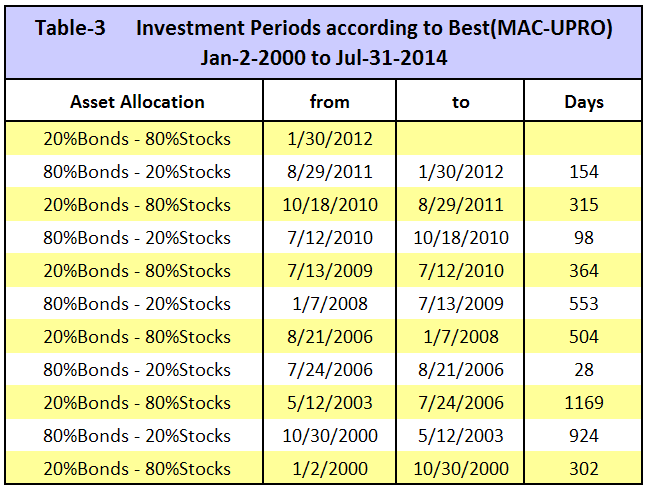

The up- and down-market periods come from the MAC-US (backtested over 65 years), or alternatively the Best(MAC-UPRO) will provide nearly the same signal dates: up-market periods are indicated when the model is invested in UPRO. From 2000 to 2014 the models signaled only 5 down-market periods and 6 up-market periods, including the current up-market period; they are listed in Table-3 in the Appendix.

Performance of iM(MAC-Vang)20/80managed versus Vanguard Total Stock Market Index Fund VTSMX

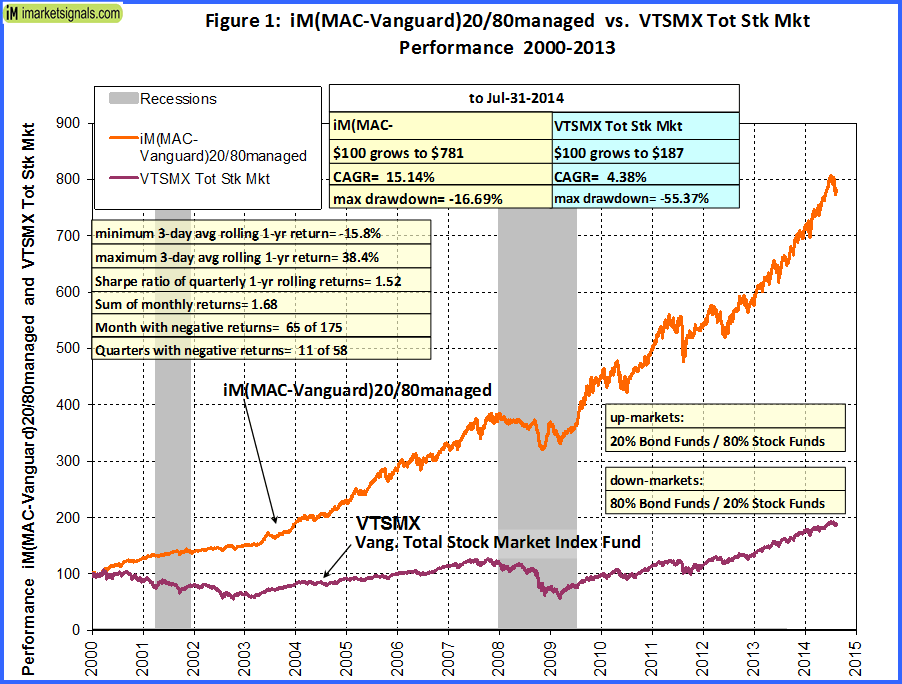

The backtest for (MAC-Vang)managed, from the beginning of 2000 to end of end of July 2014, shows an annualized growth rate of 15.1% with a maximum drawdown of only -16.7%. Risk measurements of monthly returns were Sharpe Ratio= 1.47 and Sortino Ratio= 2.29.

Figure-1 graphs the performance of a $100 initial investment over time.

Figure-1 graphs the performance of a $100 initial investment over time.

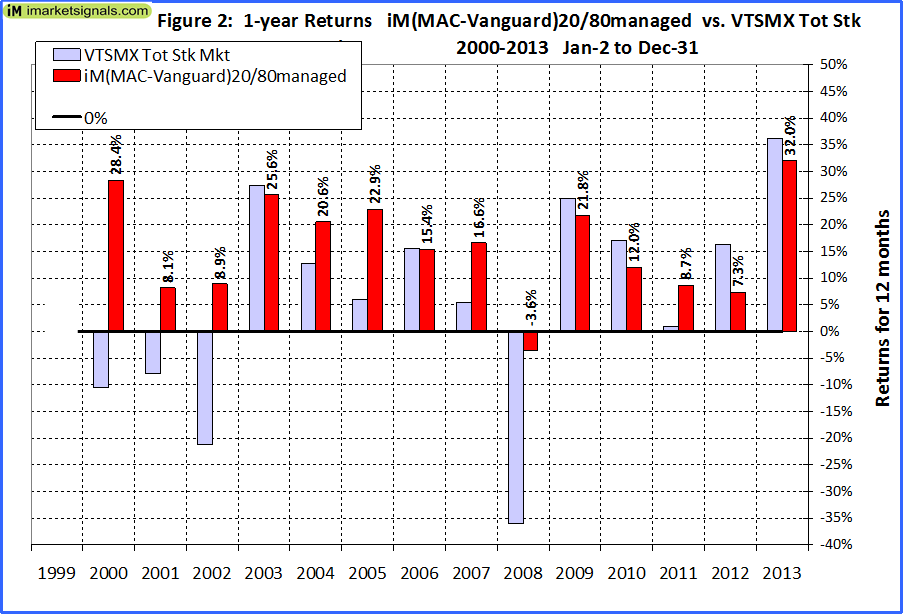

Figure-2 compares the 1-year returns of (MAC-Vang)20/80managed to those of the Total Stock Market Index Fund. There was only one year (2008) when (MAC-Vang)managed showed a small negative return of -3.6%, but it was only a tenth of the 36% loss of the index fund for the same year.

Figure-2 compares the 1-year returns of (MAC-Vang)20/80managed to those of the Total Stock Market Index Fund. There was only one year (2008) when (MAC-Vang)managed showed a small negative return of -3.6%, but it was only a tenth of the 36% loss of the index fund for the same year.

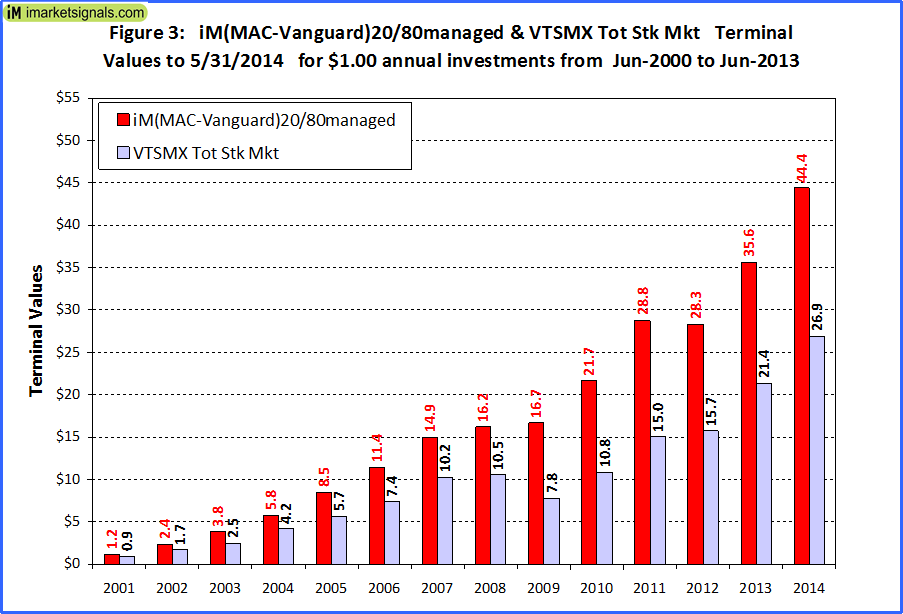

Figure-3 shows the results of investing $1.00 each year from 2000 to 2013 in (MAC-Vang)20/80managed and VTSMX. One would have invested a total of $14.00 cumulatively by the end. This simulates saving for retirement. It shows that the terminal values of (MAC-Vang)20/80managed were higher for every year than those of the Vanguard Total Stock Market Index Fund. The $14.00 invested in the index fund would at the end only have had a value of $26.92, whereas the terminal value from (MAC-Vang)20/80managed would have been 65% higher at $44.42.

Figure-3 shows the results of investing $1.00 each year from 2000 to 2013 in (MAC-Vang)20/80managed and VTSMX. One would have invested a total of $14.00 cumulatively by the end. This simulates saving for retirement. It shows that the terminal values of (MAC-Vang)20/80managed were higher for every year than those of the Vanguard Total Stock Market Index Fund. The $14.00 invested in the index fund would at the end only have had a value of $26.92, whereas the terminal value from (MAC-Vang)20/80managed would have been 65% higher at $44.42.

Conclusion

Investors in Vanguard funds can achieve good returns with less risk by following a simple market timing strategy to decide on the asset allocation for their investment. A dynamic asset allocation strategy dependent on stock-market climate is the key to better returns. For highest returns one should invest in actively managed funds and avoid index funds as the comparison between (MAC-Vang)20/80managed and (MAC-Vang)20/80index shows.

Following iM(MAC-Vang)20/80managed

Monthly updates of asset allocation and performance for (MAC-Vang)20/80managed will be posted on our website iMarketSignals.com. The nominal asset allocation is maintained by rebalancing every 12 months, at the end of December. The last rebalance occurred on Dec-31-2013, and the asset allocation as of Aug-15-2014 is:

- 6.07% Intermediate-Term Investment-Grade Fund (VFICX)

- 8.09% Long-Term Invest-Grade Fund (VWESX)

- 6.07% Long-Term Treasury Fund (VUSTX)

- 24.03% Selected Value Fund (VASVX)

- 33.44% Energy Fund (VGENX)

- 22.30% Health Care Fund (VGHCX)

Appendix

Performance of iM(MAC-Vang)20/80managed versus Vanguard Total Stock Market Index Fund VTSMX and iM(MAC-Vang)20/80index

Note: The performance results for iM(MAC-Vang)20/80index, which uses only two Vanguard funds, the Total Bond Market Index Fund (VBMFX) and the Total Stock Market Index Fund (VTSMX), in a 20/80 combination can be found at iMarketSignals.com.

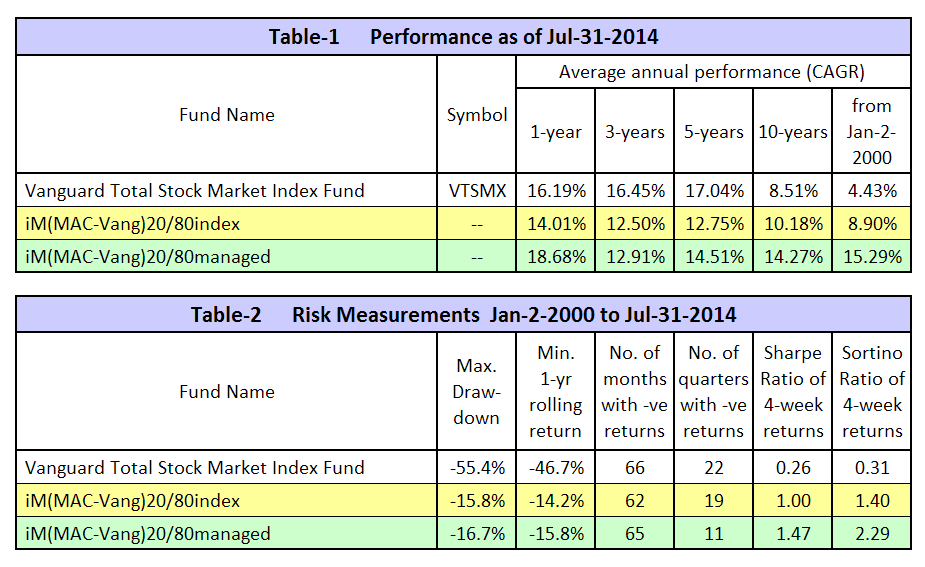

Performance and risk measurements are listed in Tables-1 and -2.

It is evident from the analyses that the 20/80 actively managed fund combination iM(MAC-Vang)20/80managed produced much higher returns than the index fund combination and risk measurements are also better.

Georg –

How would the 20/80 managed strategy look if using the COMP-IBH signals of the BCI signals? Any better than MAC? Thanks

-Joel

COMP-IBH signals with being out of the stock market March 2013 would have produced a CAGR=15.24%. Ignoring the March 2013 sell signal would have produced 16.26% to July 31, 2014.

Georg – It’s my understanding that within the COMP-IBH, the IBH indicator is used as the buy signal to get you back invested after a COMP sell signal. So, the IBH indicator would have gotten one back in the market in early 2009, and with no COMP sell signals since, that composite model would have been invested since early 2009, right? Am I missing something?

Thanks,

Joel

I am very impressed with these results! My retirement funds are in the Vanguard family and I’ve been searching for a timing system.

Can you explain the buy and sell triggers for the managed stock/bond system vs spy/bond system?

Is the buy signal still based on SPY 34ema/200ema >1.001? Or do you track each of the three funds and create a composite trigger that is different from a SPY trigger? Is there ever any consideration for the technical state of the bond funds at the moment of the SPY cross?…or is the switch completely based on the MA’s relationship to the SPY.

Thank you for any further insight!

The buy and sell triggers are based on the MAC-US system which uses the S&P500 for its signals. A buy signal (up-stockmarket) occurs when the 34-day exponential moving average (EMA) of the S&P 500 becomes greater than 1.001 times the 200-day EMA. A sell signal (down-stockmarket) occurs when the 40-day simple moving average (MA) of the S&P 500 crosses below the 200-day MA. It is not critical to do the switches exactly on the day when the signals are generated, because the up- and down-market periods are quite long.

For convenience the signals from the R2G model Best(MAC-UPRO) were used for the analysis, which clone those of the MAC-US. This was done so people could check on the independent P123 platform the signal dates of the closed trades of Best(MAC-UPRO). Investment in IEF signalling down-stockmarket conditions.

It would be prudent to consider the interest rate climate when selecting the bond fund component of the dynamic models, but for the backtest that would have been difficult to do. The BVR model can possibly provide some guidance.

Thank you. This is quite an interesting read. What was the basis for selecting the Energy and Health Care funds as your up-market funds?

We have two models for the Vanguard funds. They are actively managed or index funds allocation models. For the actively managed we found the allocation that would have provided the highest returns in the past. This is not necessarily the optimum allocation going forward.

The message we wanted to convey is that dynamic asset allocation beats static asset allocation, irrespective of whether it is for managed or index funds.

In this post describing your system you document the 20/80 percentages for the 6 Vanguard Managed funds. However, today you when you report on the current stats you also do a 30/70% what are the up and down percentages, and would you drop energy and healthcare as well?

30/70 indicates investment allocation during up-market of 70% stocks and 30% bonds. In the documentation we used the 80/20 allocation as an example to show detailed performance as this model had the highest long term performance. We have not made a similar study for the 30/70 allocation model.

From the current table (Jan-31-2015) one can see that over the last 5 years allocation models using index funds outperformed the models using managed funds. Assuming that this trend continuous then going forward it should be more advantageous to use the index funds in the allocation models.