|

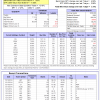

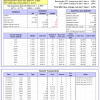

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 0 days, and showing 0.36% return to 12/22/2014. Over the previous week the market value of Best(SPY-SH) gained -3.91% at a time when SPY gained 4.56%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $363,662 which includes $174 cash and excludes $112,136 spent on fees and slippage. |

|

|

The iM-Combo3 portfolio currently holds SPY, XLV, and TLT so far held for an average period of 109 days, and showing a 7.56% return to 12/22/2014. Over the previous week the market value of iM-Combo3 gained -0.55% at a time when SPY gained 4.56%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $117,873 which includes $563 in cash and excludes $932 in fees and slippage. |

|

|

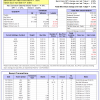

The iM-Best(Short) portfolio currently has 3 short positions. Over the previous week the market value of Best(Short) gained 0.10% at a time when SPY gained 4.56%. Over the period 1/2/2009 to 12/22/2014 the starting capital of $100,000 would have grown to $110,571 which is net of $16,450 fees and slippage. |

|

|

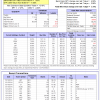

iM-Best10(S&P 1500) portfolio currently holds 10 stocks, 6 of them winners, so far held for an average period of 34 days, and showing combined 0.08% average return to 12/22/2014. Over the previous week the market value of iM-Best10(S&P 1500) gained 7.68% at a time when SPY gained 4.56%. A starting capital of $100,000 at inception of 1/2/2009 would have grown to $845,457 which includes $1478 cash and excludes $59,126 spent on fees and slippage. |

|

|

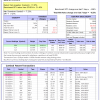

The iM-Best12(USMV)-July-2014 Currently the portfolio holds 12 stocks, 11 of them winners, so far held for an average period of 175 days and showing combined 22.49% average return to 12/22/2014. Since inception, on 6/30/2014, the model gained 22.88% while the benchmark SPY gained 7.03% and the ETF USMV gained 11.00% over the same period. Over the previous week the market value of iM-Best12(USMV)-July gained 3.06% at a time when SPY gained 4.56%. A starting capital of $100,000 at inception on 6/30/2014 has grown to $122,885 which includes $107 cash and $100 for fees and slippage. |

|

|

The iM-Best12(USMV)-October-2014 Currently the portfolio holds 12 stocks, 12 of them winners, so far held for an average period of 84 days, and showing combined 12.89% average return to 12/22/2014. Since inception, on 9/29/2014, the model gained 12.99% while the benchmark SPY gained 5.60% and the ETF USMV gained 9.47% over the same period. Over the previous week the market value of iM-Best12(USMV)-October gained 2.22% at a time when SPY gained 4.56%. A starting capital of $100,000 at inception on 9/29/2014 has grown to $112,987 which includes $133 cash and $100 for fees and slippage. |

,

|

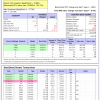

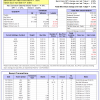

The iM-Best12(USMV)-Trader Currently the portfolio holds 12 stocks, 11 of them winners, so far held for an average period of 69 days, and showing combined 7.11% average return to 12/22/2014. Since inception, on 6/30/2014, the model gained 24.27% while the benchmark SPY gained 7.03% and the ETF USMV gained 11.00% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 3.73% at a time when SPY gained 4.56%. A starting capital of $100,000 at inception on 6/30/2014 has grown to $124,269 which includes $251 cash and $578 for fees and slippage. |

,

|

The iM-Best10(VDIGX)-Trader Currently the portfolio holds 10 stocks, 8 of them winners, so far held for an average period of 143 days, and showing combined 10.55% average return to 12/22/2014. Since inception, on 6/30/2014, the model gained 15.72% while the benchmark SPY gained 7.03% and the VDIGX gained 5.65% over the same period. Over the previous week the market value of iM-Best10(VDIGX)-Trader gained 3.51% at a time when SPY gained 4.56%. A starting capital of $100,000 at inception on 6/30/2014 has grown to $115,717 which includes $16 cash and $255 for fees and slippage. |

Leave a Reply

You must be logged in to post a comment.