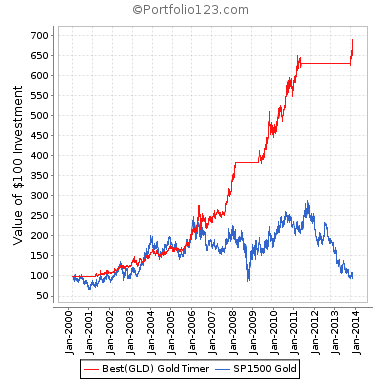

Using the Portfolio123 platform the iM-Best Gold Timer (click for more details) was backtested from Jan-2-2000, as this was the first full year when the algorithm had access to all the required economic indicators from the database of the web-based simulation platform where the backtest was performed.

The timing algorithm is partly based on my research reported in this article. The model uses the SPDR® Gold Shares ETF: GLD, and the economic indicators Federal Funds Rate, 10-year Treasury Note yield, and the S&P500 Estimated Earnings Yield. The benchmark is the Specialty Index SP1500 Gold, representing the gold miners in the S&P1500. The ETF GLD has already gained about 10% since the date of the buy signal to the middle of February-2014.

There were three buy signals: 2/20/2001, 5/11/2009 and 12/30/2013. An interesting observation is that the three buy signals always occurred shortly after the normalized benchmark index (blue graph) bottomed near 100, as can be seen from the chart above.

Hi,

Is this model active or discontinued. I came across it by googling.

Thanks!

This model has been discontinued because the available backtest period is too short.