|

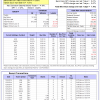

The iM-Best(SPY-SH) model currently holds SH, so far held for a period of 49 days, and showing -8.61% return to 12/8/2014. Over the previous week the market value of Best(SPY-SH) gained -0.43% at a time when SPY gained 0.41%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $365,736 which includes $3 cash and excludes $11,411 spent on fees and slippage. |

|

|

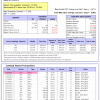

The iM-Combo3 portfolio currently holds SH, XLV, and SSO so far held for an average period of 137 days, and showing a 10.32% return to 12/8/2014. Over the previous week the market value of iM-Combo3 gained 0.86% at a time when SPY gained 0.41%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $121,051 which includes $3,027 in cash and excludes $805 in fees and slippage. |

|

|

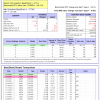

The iM-Best(Short) portfolio currently has 1 short positions. Over the previous week the market value of Best(Short) gained 0.42% at a time when SPY gained 0.41%. Over the period 1/2/2009 to 12/8/2014 the starting capital of $100,000 would have grown to $108,127 which is net of $16,315 fees and slippage. |

|

|

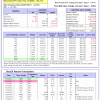

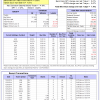

iM-Best10(S&P 1500) portfolio currently holds 10 stocks, 5 of them winners, so far held for an average period of 52 days, and showing combined -0.29% average return to 12/8/2014. Over the previous week the market value of iM-Best10(S&P 1500) gained 0.90% at a time when SPY gained 0.41%. A starting capital of $100,000 at inception of 1/2/2009 would have grown to $822,114 which includes $657 cash and excludes $58,725 spent on fees and slippage. |

|

|

The iM-Best12(USMV)-July-2014 Currently the portfolio holds 12 stocks, 11 of them winners, so far held for an average period of 161 days and showing combined 20.36% average return to 12/8/2014. Since inception, on 6/30/2014, the model gained 20.75% while the benchmark SPY gained 6.00% and the ETF USMV gained 9.65% over the same period. Over the previous week the market value of iM-Best12(USMV)-July gained 1.20% at a time when SPY gained 0.41%. A starting capital of $100,000 at inception on 6/30/2014 has grown to $120,747 which includes $107 cash and $100 for fees and slippage. |

|

|

The iM-Best12(USMV)-October-2014 Currently the portfolio holds 12 stocks, 12 of them winners, so far held for an average period of 70 days, and showing combined 12.31% average return to 12/8/2014. Since inception, on 9/29/2014, the model gained 12.36% while the benchmark SPY gained 4.59% and the ETF USMV gained 8.14% over the same period. Over the previous week the market value of iM-Best12(USMV)-October gained 1.85% at a time when SPY gained 0.41%. A starting capital of $100,000 at inception on 9/29/2014 has grown to $112,358 which includes $82 cash and $100 for fees and slippage. |

,

|

The iM-Best12(USMV)-Trader Currently the portfolio holds 12 stocks, 8 of them winners, so far held for an average period of 61 days, and showing combined 5.55% average return to 12/8/2014. Since inception, on 6/30/2014, the model gained 21.80% while the benchmark SPY gained 6.00% and the ETF USMV gained 9.65% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 1.68% at a time when SPY gained 0.41%. A starting capital of $100,000 at inception on 6/30/2014 has grown to $121,803 which includes $163 cash and $537 for fees and slippage. |

,

|

The iM-Best10(VDIGX)-Trader Currently the portfolio holds 10 stocks, 8 of them winners, so far held for an average period of 129 days, and showing combined 10.16% average return to 12/8/2014. Since inception, on 6/30/2014, the model gained 15.25% while the benchmark SPY gained 6.00% and the VDIGX gained 7.01% over the same period. Over the previous week the market value of iM-Best10(VDIGX)-Trader gained 1.70% at a time when SPY gained 0.41%. A starting capital of $100,000 at inception on 6/30/2014 has grown to $115,245 which includes $631 cash and $254 for fees and slippage. |

Leave a Reply

You must be logged in to post a comment.