|

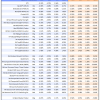

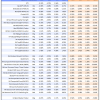

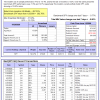

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

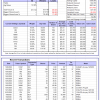

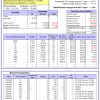

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -1.5%, and for the last 12 months is 3.0%. Over the same period the benchmark E60B40 performance was 8.2% and 12.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.50% at a time when SPY gained -0.53%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $127,525 which includes $448 cash and excludes $1,783 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -3.3%, and for the last 12 months is 1.8%. Over the same period the benchmark E60B40 performance was 8.2% and 12.7% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -0.57% at a time when SPY gained -0.53%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $128,263 which includes $333 cash and excludes $1,918 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -5.1%, and for the last 12 months is 0.6%. Over the same period the benchmark E60B40 performance was 8.2% and 12.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.64% at a time when SPY gained -0.53%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $128,914 which includes $509 cash and excludes $2,045 spent on fees and slippage. |

|

|

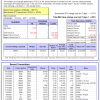

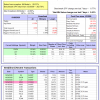

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 343.31% while the benchmark SPY gained 82.57% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -4.74% at a time when SPY gained -0.77%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $110,828 which includes $7,543 cash and excludes $1,082 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 320.69% while the benchmark SPY gained 82.57% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -1.74% at a time when SPY gained -0.77%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $105,172 which includes $490 cash and excludes $667 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 179.39% while the benchmark SPY gained 82.57% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -3.50% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $279,390 which includes $129 cash and excludes $2,970 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/8/2016, the model gained 289.30% while the benchmark SPY gained 82.57% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained -3.50% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 1/8/2016 would have grown to $389,301 which includes $1,982 cash and excludes $1,472 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 152.68% while the benchmark SPY gained 82.57% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -4.31% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $252,677 which includes $563 cash and excludes $1,014 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 225.47% while the benchmark SPY gained 82.57% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 1.40% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $325,467 which includes $4,265 cash and excludes $4,700 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 104.00% while the benchmark SPY gained 82.57% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 2.80% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $203,997 which includes $16 cash and excludes $6,266 spent on fees and slippage. |

|

|

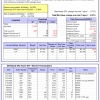

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 19.1%, and for the last 12 months is 21.8%. Over the same period the benchmark SPY performance was 7.0% and 14.7% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -1.75% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $300,110 which includes $1,391 cash and excludes $5,574 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 31.4%, and for the last 12 months is 63.4%. Over the same period the benchmark SPY performance was 7.0% and 14.7% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 4.05% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $26,793 which includes $65,955 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -15.4%, and for the last 12 months is -9.2%. Over the same period the benchmark SPY performance was 7.0% and 14.7% respectively. Over the previous week the market value of Best(SPY-SH) gained -0.80% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $599,721 which includes -$26,793 cash and excludes $25,091 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -12.5%, and for the last 12 months is -10.2%. Over the same period the benchmark SPY performance was 7.0% and 14.7% respectively. Over the previous week the market value of iM-Combo3.R1 gained -1.15% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $155,017 which includes $4,703 cash and excludes $6,570 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is 1.4%, and for the last 12 months is 6.7%. Over the same period the benchmark SPY performance was 7.0% and 14.7% respectively. Over the previous week the market value of iM-Combo5 gained -1.33% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $156,317 which includes $3,215 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 2.4%, and for the last 12 months is 13.3%. Over the same period the benchmark SPY performance was 7.0% and 14.7% respectively. Since inception, on 7/1/2014, the model gained 150.71% while the benchmark SPY gained 95.99% and VDIGX gained 89.97% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -1.10% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $250,714 which includes $1,243 cash and excludes $3,635 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is -2.0%, and for the last 12 months is 4.8%. Over the same period the benchmark SPY performance was 7.0% and 14.7% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -0.87% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $174,205 which includes $121 cash and excludes $1,556 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -11.0%, and for the last 12 months is -3.4%. Over the same period the benchmark SPY performance was 7.0% and 14.7% respectively. Since inception, on 6/30/2014, the model gained 109.08% while the benchmark SPY gained 95.99% and the ETF USMV gained 95.44% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -1.79% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $209,080 which includes $2,363 cash and excludes $7,084 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 7.5%, and for the last 12 months is 10.6%. Over the same period the benchmark SPY performance was 7.0% and 14.7% respectively. Since inception, on 1/3/2013, the model gained 291.54% while the benchmark SPY gained 170.54% and the ETF USMV gained 153.94% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 1.13% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $391,539 which includes $4,759 cash and excludes $3,495 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -36.6%, and for the last 12 months is -32.3%. Over the same period the benchmark SPY performance was 3.0% and 11.7% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -0.24% at a time when BND gained -0.18%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $141,691 which includes $2,304 cash and excludes $2,087 spent on fees and slippage. |

|

|

iM-Best(Short): The model’s out of sample performance YTD is -11.0%, and for the last 12 months is -14.6%. Over the same period the benchmark SPY performance was 7.0% and 14.7% respectively. Over the previous week the market value of iM-Best(Short) gained 0.53% at a time when SPY gained -0.77%. Over the period 1/2/2009 to 10/26/2020 the starting capital of $100,000 would have grown to $71,632 which includes $113,608 cash and excludes $28,836 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -1.4%, and for the last 12 months is 2.5%. Over the same period the benchmark SPY performance was 7.0% and 14.7% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -0.87% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $123,998 which includes $715 cash and excludes $1,386 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -2.8%, and for the last 12 months is -1.0%. Over the same period the benchmark SPY performance was 7.0% and 14.7% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.20% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $126,095 which includes $1,053 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -13.2%, and for the last 12 months is -7.0%. Over the same period the benchmark SPY performance was 7.0% and 14.7% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -0.76% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $141,789 which includes $603 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 15.6%, and for the last 12 months is 19.4%. Over the same period the benchmark SPY performance was 7.0% and 14.7% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -0.95% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $150,546 which includes -$662 cash and excludes $5,636 spent on fees and slippage. |

|

|

iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is -8.8%, and for the last 12 months is -5.7%. Over the same period the benchmark SPY performance was 7.0% and 14.7% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained -0.26% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $102,700 which includes $1,318 cash and excludes $2,151 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.