Market Signals Summary:

The MAC-US model generated a buy signal last week, thus the model is invested in the markets. However, this buy signal should be evaluated together with our other indicators. The MAC-AU remains out of the markets. The recession indicators COMP and iM-BCIg do not signal a recession. The bond market model avoids high beta (long) bonds, the trend of the yield spread is indeterminate. Both the gold and silver model are invested.

Stock-markets:

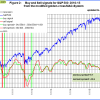

The MAC-US model generated a buy-signal last week when the buy-spread became positive. The sell-spread is increasing however it remains negative and thus the model will not generate a sell signal should there be a significant down turn in the market.

The MAC-US model generated a buy-signal last week when the buy-spread became positive. The sell-spread is increasing however it remains negative and thus the model will not generate a sell signal should there be a significant down turn in the market.

The 3-mo Hi-Lo Index of the S&P500 signaled an exit from the stock market at the end of April 2015. For a buy signal to emerge the 40-day moving average (MA40) of the index must move from below to above 5.0%. The upward trend of MA40 continued strongly this week and it may generate a buy signal next week.

The 3-mo Hi-Lo Index of the S&P500 signaled an exit from the stock market at the end of April 2015. For a buy signal to emerge the 40-day moving average (MA40) of the index must move from below to above 5.0%. The upward trend of MA40 continued strongly this week and it may generate a buy signal next week.

The MAC-AU model generated a sell signal end of August and thus in cash. The buy-spread is higher than last week’s level. The next buy signal will emerge once the buy spread (green graph) moves above the zero line.

The MAC-AU model generated a sell signal end of August and thus in cash. The buy-spread is higher than last week’s level. The next buy signal will emerge once the buy spread (green graph) moves above the zero line.

This model and its application is described in MAC-Australia: A Moving Average Crossover System for Superannuation Asset Allocations.

Recession:

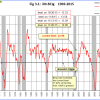

Figure 3 shows the COMP is near last week’s downward revised level, and far away from signaling recession. COMP can be used for stock market exit timing as discussed in this article The Use of Recession Indicators in Stock Market Timing.

Figure 3 shows the COMP is near last week’s downward revised level, and far away from signaling recession. COMP can be used for stock market exit timing as discussed in this article The Use of Recession Indicators in Stock Market Timing.

Figure 3.1 shows the recession indicator iM-BCIg is down from last week’s level. An imminent recession is not signaled .

Figure 3.1 shows the recession indicator iM-BCIg is down from last week’s level. An imminent recession is not signaled .

Please also refer to the BCI page

Leave a Reply

You must be logged in to post a comment.