|

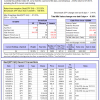

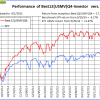

The iM-Best(SPY-SH) model currently holds SH, so far held for a period of 84 days, and showing a -2.84% return to 6/1/2015. Over the previous week the market value of Best(SPY-SH) gained -0.38% at a time when SPY gained 0.41%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $353,018 which includes $19 and excludes $12,862 spent on fees and slippage. |

| The iM-Combo3 model currently holds SH, TLT, and XLV, so far held for a period of 214 days, and showing a 6.68% return to 6/1/2015. Over the previous week the market value of iM-Combo3 gained -0.04% at a time when SPY gained 0.41%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $122,106 which includes $3,492 and excludes $1,231 spent on fees and slippage. | |

| The iM-Best(Short) model currently holds 0 position(s). Over the previous week the market value of iM-Best(Short) gained 0.45% at a time when SPY gained 0.41%. Over the period 1/2/2009 to 6/1/2015 the starting capital of $100,000 would have grown to $106,876 which includes $106,876 and excludes $18,424 spent on fees and slippage. | |

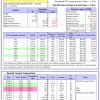

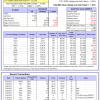

| The iM-Best10(S&P 1500) model currently holds 10 stocks, 7 of them winners, so far held for a period of 29 days, and showing a 3.14% return to 6/1/2015. Over the previous week the market value of iM-Best10 gained 2.44% at a time when SPY gained 0.41%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $843,366 which includes -$1,303 and excludes $67,521 spent on fees and slippage. | |

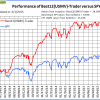

| The iM-Best12(USMV)Q1-Investor model currently holds 12 stocks, 8 of them winners, so far held for a period of 142 days, and showing a 5.30% return to 6/1/2015. Since inception, on 1/5/2015, the model gained 6.21% while the benchmark SPY gained 5.36% and the ETF USMV gained 3.99% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 0.43% at a time when SPY gained 0.41%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $106,209 which includes $658 and excludes $134 spent on fees and slippage. | |

| The iM-Best12(USMV)Q2-Investor model currently holds 12 stocks, 6 of them winners, so far held for a period of 63 days, and showing a -0.91% return to 6/1/2015. Since inception, on 1/5/2015, the model gained -0.68% while the benchmark SPY gained 1.59% and the ETF USMV gained 0.43% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 0.60% at a time when SPY gained 0.41%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $99,318 which includes $645 and excludes $99 spent on fees and slippage. | |

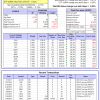

| The iM-Best12(USMV)Q3-Investor model currently holds 12 stocks, 12 of them winners, so far held for a period of 318 days, and showing a 25.80% return to 6/1/2015. Since inception, on 7/1/2014, the model gained 25.54% while the benchmark SPY gained 9.63% and the ETF USMV gained 13.23% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 1.47% at a time when SPY gained 0.41%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $125,543 which includes $28 and excludes $129 spent on fees and slippage. | |

| The iM-Best12(USMV)Q4-Investor model currently holds 12 stocks, 11 of them winners, so far held for a period of 225 days, and showing a 18.08% return to 6/1/2015. Since inception, on 9/30/2014, the model gained 17.34% while the benchmark SPY gained 8.17% and the ETF USMV gained 11.67% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 0.88% at a time when SPY gained 0.41%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $117,337 which includes $03 and excludes $132 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 18.51% over SPY. (see iM-USMV Investor Portfolio) | |

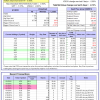

| The iM-Best12(USMV)-Trader model currently holds 12 stocks, 7 of them winners, so far held for a period of 100 days, and showing a 6.64% return to 6/1/2015. Since inception, on 7/1/2014, the model gained 28.10% while the benchmark SPY gained 9.63% and the ETF USMV gained 13.23% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 1.03% at a time when SPY gained 0.41%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $128,097 which includes $335 and excludes $1,000 spent on fees and slippage. | |

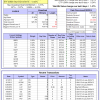

| The iM-Best10(VDIGX)-Trader model currently holds 10 stocks, 7 of them winners, so far held for a period of 196 days, and showing a 7.15% return to 6/1/2015. Since inception, on 7/1/2014, the model gained 16.49% while the benchmark SPY gained 9.63% and the ETF VDIGX gained 8.56% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -0.13% at a time when SPY gained 0.41%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $116,487 which includes -$113 and excludes $372 spent on fees and slippage. |

test

Posted in edit

Leave a Reply

You must be logged in to post a comment.